The share of online ad revenue going to the duopoly of Google and Meta appears to have gone into decline, according to data from WARC and Insider Intelligence/eMarketer.

But that isn’t good news for publishers. The gains in share and overall ad spend are not going back to news media or other content publishers.

Press Gazette was so concerned about the dominance of Google and Facebook over UK advertising that it launched a campaign in 2017 with the aim of stopping the pair from destroying journalism (see main picture).

But ad spend gains are now going to a “third wave” of “retail media”, such as Amazon and Walmart, and to Tiktok, the data shows. The first two historic waves of ad spend were search (which mostly went to Alphabet’s Google) and then social (dominated by Meta’s Facebook and Instagram), according to Alex Brownsell, head of content at WARC Media.

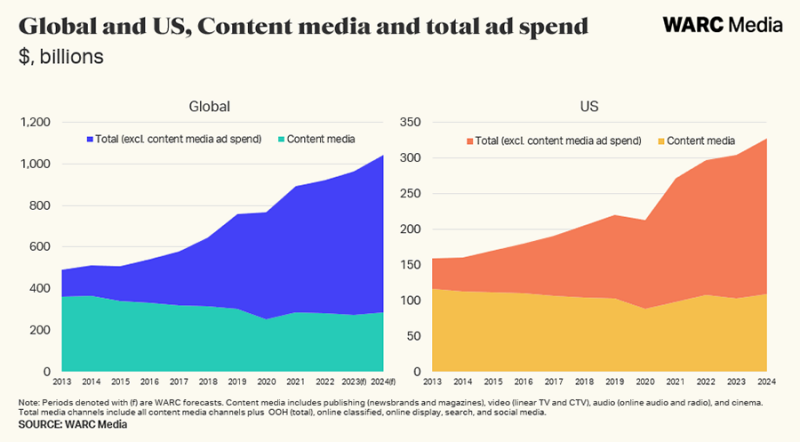

WARC’s data shows content media ad spend (including all publishers plus TV, cinema and radio) will fall to a 27.2% global share in 2024, down from 71% a decade earlier. In 2013, content creators took $363.2 billion in ads. WARC forecasts that will shrink to $284.1bn this year.

At the same time, Google search and Meta’s combined share of US ad dollars has also begun to wane, from a peak of 75.7% in 2021 to a predicted 72.8% this year, according to WARC.

Insider Intelligence, which has its own research methodology, reckons that in the UK Google’s online advertising market share (excluding Youtube) will decline from 38.3% in 2022 to a predicted 34.3% this year in the UK. This gives the duopoly a combined UK digital advertising market share of around 60.6% by this estimate.

In the US, it forecasts Google (excluding Youtube) will fall from 28.2% in 2022 to 25.2% this year.

The rise of retailers selling advertising

Google and Meta’s total ad revenues will have gone up, of course. But in the US there has been a dramatic increase in new ad dollars going to Amazon, Walmart, Target, and other retail media. On those platforms marketers can place ads directly into an environment where people are already shopping.

“It's created a new wedge, a third wave in online ad spend which has seen, technically, Google and Meta’s share decline but in reality obviously the absolute spend is going up and up,” Brownsell says.

“The advantage of [retail media] is that you are reaching people at the moment of, at the point of purchase, basically.”

The US market is showing the UK what the future looks like. Amazon now takes a 14.4% share of online ad dollars in the US, according to Insider data. That’s more than Facebook (the app), which takes 10.6% of US ad spend. In the UK, Amazon takes 7.5% of budgets.

In the US, “we have seen a huge explosion in retail media spend in that market to a much lesser extent in Europe and the UK,” says Brownsell.

In fact, Amazon has broken the “duopoly” over the ad market once held by Google and Facebook, according to Insider senior analyst Bill Fisher. He now refers to it as a “triopoly.”

“Amazon is dominant in that space, it's been running retail ads since 2012, I want to say. That space is much more competitive but the UK is a little bit behind the US which has been driving this move for a few more years.”

The pandemic taught marketers lessons that were brutal for online news publishers. People were willing to shop for just about anything online, even fresh groceries, and the best place to reach them was on the sites where they were already shopping – not news sites, Fisher says.

“When we're in an environment that we're currently in economically, things are a little bit tough, and agencies, brands, CMOs [chief marketing officers], they need to prove ROI [return on investment]. So they go where it’s safe and where they get the reach and where they get the results.”

This in part explains Walmart’s expected $2 billion acquisition of TV maker Vizio and its partnership with Roku, another TV platform. The retailer is working its way up the “marketing funnel”, bypassing the news publishers who would have once carried its ads and newspaper coupons, to reach consumers directly on their devices.

The news business is thus being left behind in a pool of ad spending that is expected to stagnate, WARC’s Brownsell says. “It's a two-speed market and the money that those guys [in retail media] are making has almost become detached from what the rest of the media industry is experiencing at the moment, particularly publishing and television.”

And then there is Tiktok.

“In the US, for Tiktok we’re forecasting advertising revenue of just over $5bn, which is roughly a quarter of the size of Facebook and it's a tenth, roughly, of Meta’s annual forecasted revenue for 2024,” Brownsell says.

Notably, that’s already a bigger share than Youtube in both the UK and US, according to Insider.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog