The global print advertising market has halved in the past six years but a growing online “oligopoly” of tech giants and retailers mean digital ad revenues are still insufficient to plug the gap.

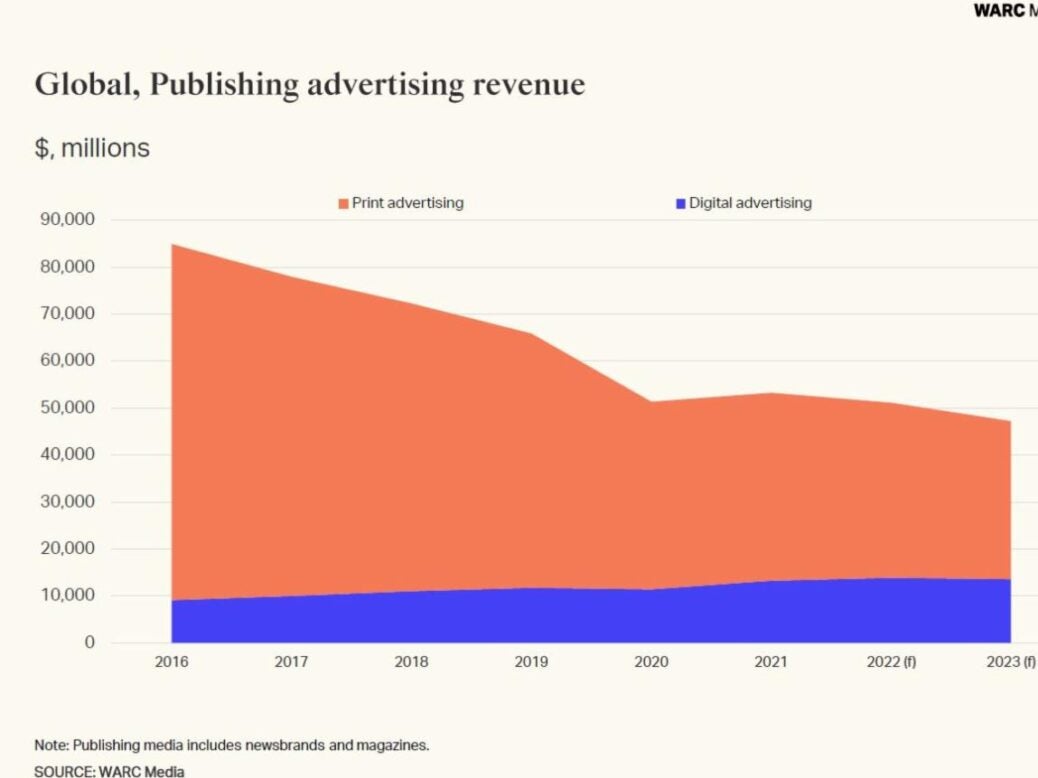

Global advertising revenue for publishers is forecast to decline by 7.7% this year to $47.2bn, according to a new report from intelligence provider Warc which estimated a total worldwide advertising market of $993bn.

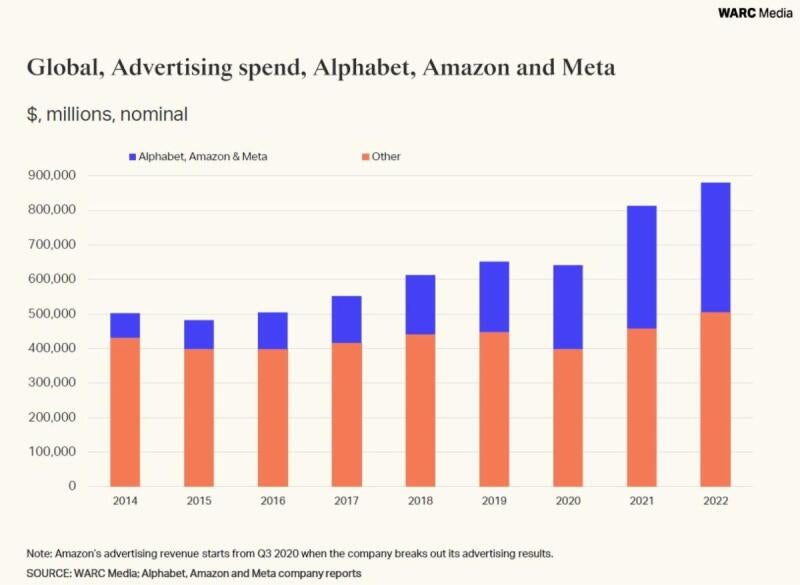

Publishers are competing with the likes of Amazon, which alone made $37.7bn in advertising services in 2022 – 80% of the entire forecast publisher advertising income for the year ahead, and more than the total print publishing market of $37.3bn.

In addition to Amazon, Google owner Alphabet and Facebook and Instagram owner Meta together take more than $4 in every $10 spent on advertising in any format around the world (so nearly $400bn in total).

Amid the growing dominance of the tech giants, global spend on publishing, video, audio and out-of-home advertising has “scarcely shifted”, Warc said, estimating that total investment will be only 1.6% higher this year than it was in 2016.

At the same time, the global publishing print ad market has halved since 2016, from $75.9bn. Report author and Warc Media head of content Alex Brownsell said: “For newsbrands and magazines, modest increases in digital ad revenue have been insufficient to compensate for print ad income losses.”

That digital ad revenue is also insufficient to help publishers become sustainable, Warc said: “It is becoming harder for content-creating publishers to remain competitive against data-rich performance channels like retail media, and sustain publishing businesses through online display revenue alone…”

Brian Morrissey, media analyst and author of Substack newsletter The Rebooting, told the report: “The reality of the publishing industry is that you really cannot have an original content model that is mostly or solely reliant on display advertising revenue.

“Publishers were complaining about Google and Facebook having a duopoly. Well, be careful what you wish for, because now it’s an oligopoly.”

Press Gazette began campaigning against Facebook and Google’s duopoly in 2017, warning that their dominance in the digital advertising market was threatening journalism’s ability to thrive and even survive.

The Warc report suggested publishing’s middle market dependent on advertising will continue to be squeezed but that niche publishers such as influential politics titles Punchbowl News and Politico can build a robust offering.

Cally Baute, executive vice-president of consumer business at Politico, said: “If we can sit in the complete centre of the bullseye – that you need Politico to do your job better if you work in government or the business of government – that creates opportunity on the advertising side of the business.”

The report noted that “advertising remains an attractive, high-margin source of revenue, meaning media owners are evolving their operating models to survive”. For example, it cited streamers like Netflix creating cheaper ad-supported tiers alongside subscription revenue, suggesting ads may be a vital part of the overall pie for companies in pursuit of profitability despite the difficulties of the market.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog