Dow Jones subsidiary Factiva is a search engine that pays – but only if you’re in the club.

The subscription-access archive, which launched in 1999 as a partnership between Dow Jones and Reuters, distributes royalties to publishers in return for their inclusion in its archive.

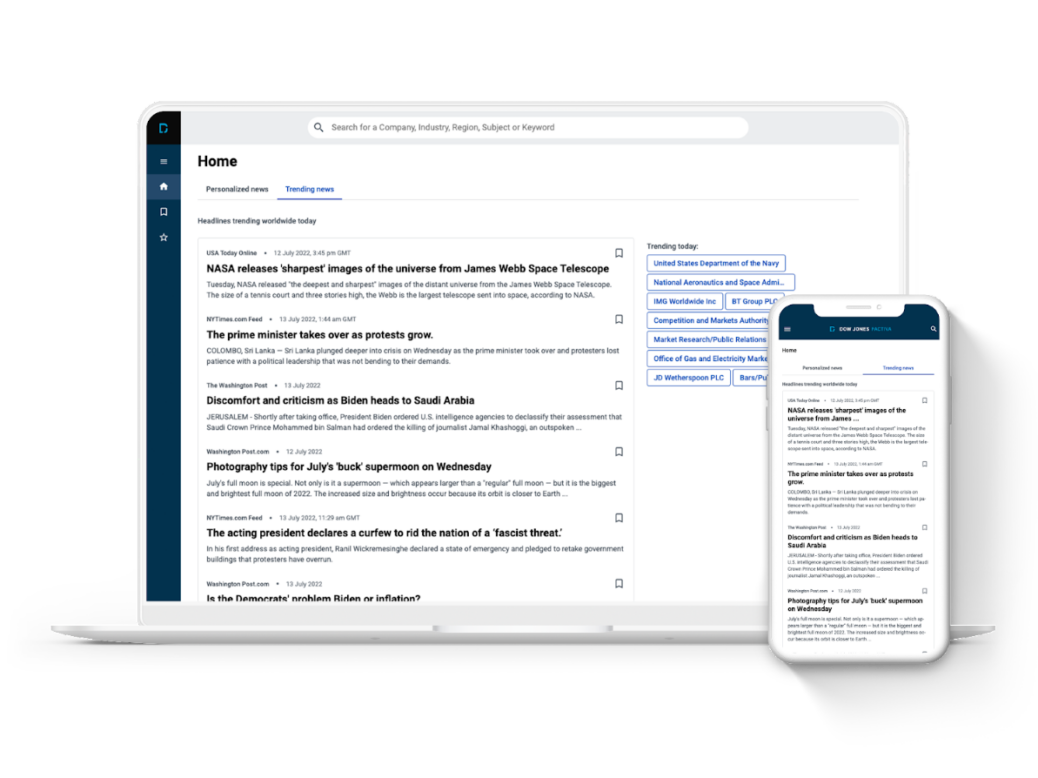

Last month the business rolled out a redesign aimed at “providing business intelligence for the next generation of leaders” as millennials and Gen Z enter the boardroom.

Prompted by that shift, Press Gazette spoke with Factiva’s general manager Traci Mabrey about how the platform works, how publishers can get included in its archives and why consumers sign up when Google remains free.

[This article is part of Press Gazette’s Platform Profile series. See also: Instagram, NewsNow, Substack, Shutterstock, Upday, Pocket, LinkedIn, Apple News/ Apple News+, Twitter, Acast, Authory, Youtube, Twitter Spaces and TikTok].

What is Factiva?

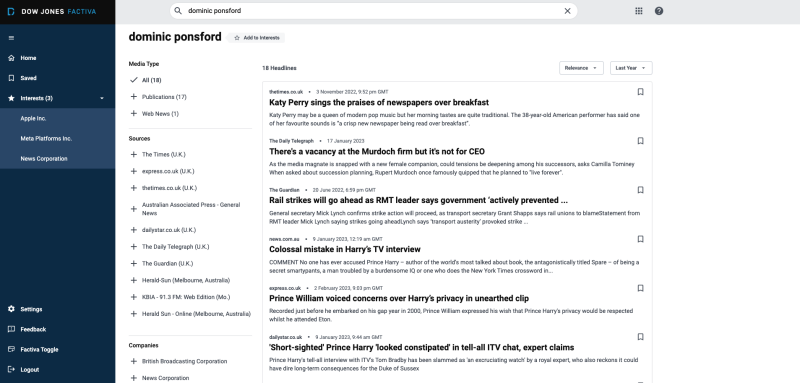

Factiva is a searchable online archive of news, analysis and research containing clippings dating back, in some cases, as far as 1944. The business charges customers a subscription fee for access to its catalogue, which it says comprises over two billion articles produced by 33,000 sources across 200 countries in 32 languages.

Unlike Google, Factiva licenses its content from publishers, paying them royalties proportionate to how much their work is in demand on the platform. This means paywalled and free websites appear on Factiva.

“We rigorously source and license third-party content, the idea being that we deliver fully-licensed content to ensure copyright compliance for our clients,” Mabrey told Press Gazette.

The business makes this paid relationship with its licensees part of its pitch to subscribers. In a January press release announcing Factiva’s redesign, Mabrey wrote: “At a time when the threat of misinformation and disinformation is ever-present, every level of the organisation needs easy access to high-quality, trustworthy news to guide their daily decisions.”

She explained to Press Gazette: “What we try and do is be a very good partner and conduit for news and media organisations globally. One, to ensure that we are transparent and we are completely accurate and trustworthy in terms of the information we’re providing from them.

“But we also look at it as an opportunity to continue to enhance journalistic output by delivering content and information into places that particularly smaller entities… may not be able to get to themselves.

“So we try and represent them very accurately and we do have a fee structure managed between them.”

How much does Factiva pay publishers?

Asked by Press Gazette how much publishers might expect to earn from a licensing agreement with Factiva, Mabrey said it depended on “the content that's provided and the digital eyeballs, if you will, that are on it.

“But I would invite anyone that is in the journalistic world who would like to be part of Factiva to give me a call directly… We can certainly talk about what the potential royalty benefit would be.”

Press Database and Licensing Network secretary general Andrew Hughes wrote in Press Gazette in 2021 that content distribution business NLA Media Access "sends around £50m to UK newspapers annually, suggesting media monitoring pays publishers around 40–50% of relevant revenue in royalties".

A quick browse of Factiva's archive suggests it has agreements with publishers including AP, Reach, The Washington Post, The Guardian, DMGT and CNN, as well as with the News Corp titles and fellow Murdoch property Fox Corporation.

News Corp doesn’t disclose how much money Factiva makes, but in February’s quarterly earnings call company CFO Susan Panuccio said Dow Jones had posted revenues of $563m – of which “professional information business revenues”, including Factiva, comprised a third.

Mabrey told Press Gazette Factiva was profitable and employs approximately 500 staff.

“We’re very glad about that, considering that we also have a very important fee structure that goes back to all of our content providers. So we're very pleased about both being able to maintain profitability and provide all of our content providers their due of the royalty.”

The company has about 900,000 users globally, Mabrey said. Many of its subscribers are businesses in need of professional knowledge management.

“Consulting is probably one of the most robust users [bases] of the entire Factiva platform, and across each of the global entities.” Mabrey did not name any customers, but said “there would be many names you would know there”.

Other customers included “journalistic entities and financial services”, as well as parts of the consumer sector, manufacturing sector, energy sector and risk and compliance.

How much does a Factiva subscription cost?

The company does not publicly disclose how much it charges subscribers.

“The predominant subscription case is that we have institutions that are buying a package either for the totality of their enterprise or for specific parts of their organisation,” Mabrey said. “And that pricing certainly does vary based on how many individuals within the organisation are going to be having access to the service…

“We are very respectful and intentional in terms of not only who can look at the content within Factiva, based on our licensing arrangements, but who those individuals can then send it to.”

Information about Factiva’s pricing is sparse, but one 2019 filing on US government spending website usaspending.gov indicates the Department of Homeland Security’s Office of the Chief Security Officer acquired three year-long Factiva subscriptions for a total of $15,552 – approximately $432 per licence per month.

Mabrey said the business monitors password sharing “quite closely”.

“It's an important auditory capability for us to have with our content providers, and we want to make sure that the content providers are getting all of the fees and royalties that they are due.”

But why pay for what you can get for free?

Even assuming $432 a month is one of the higher fees an organisation might pay for Factiva, a customer facing that price tag might well ask why they should bother signing up when Google is free.

“We have many answers for that,” Mabrey said.

“Because we are licensing directly with our content providers, we believe we're providing trustworthiness and accuracy that free search capabilities cannot provide today. Because we're rigorously sourced, because what we deliver – unlike the free search engines – are search results that are not influenced by advertising.”

She added: “We are very much focused on the professional user community. We understand that decision makers of today, unlike when Factiva began our journey, are very much doers. [They like] self-service, would like access to information and would like access to information in ways they're used to using consumer-like applications.”

Besides its search function, which is reminiscent of free search engines with additional filtering options, Factiva has features seemingly modelled on social media: a trending news feed, for example, alongside a personalised news feed and a “recommended for you” option.

Mabrey said: “Over the last 20 years, the role of knowledge management has really evolved…

“Even in a research analyst [or] an investment banking type of model, there were broadly analysts… almost the sole nature of their job was to source information, find information, relay that information…

“And while that knowledge management structure in terms of analyst capability still exists today, the savviness and self-serve requirements even of decision makers now is something that we see coming to the forefront.”

As younger, digitally native workers attain C-suite roles, Mabrey said, the information demands of “decision makers” were changing.

“The younger generations are really accustomed to getting news and insights from multiple sources, as well as news aggregators.

“We know that the way that decisions are made in the C-suite has also evolved over the last decades. Traditionally, we know that the decision makers don't have time to do research and had other people do it. Now the modern decision makers do it for themselves.

“So we are also looking at the era of social media – and while millennials and Gen Zs grew up in the era of social media, consumers are still preferring to get their news from original sources, which we think positions us incredibly well from, again, the trustworthiness and meaningful component, but also for the transparency and accuracy.

“We believe social is good for discovery and Factiva is great for decision making.”

[Read more: How to make journalism pay - Content licensing]

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog