The head of the digital subscriptions strategy at German tabloid Bild believes it still has “huge potential” and has not yet hit its growth ceiling almost 11 years on.

Bildplus, which launched in June 2013, hit 700,000 digital subscribers in late 2023 and is now up to 707,208. This makes it the biggest subscriber base in the German-speaking news market and one of the most popular paywalled news websites in the world.

Alongside Blick in Switzerland, Bild has helped inform Mail Online’s new partial paywall strategy.

About 12 to 15% of all the newsbrand’s online content is paywalled and the aim is for about 30% of articles in the top section of the homepage to be subscriber-only. In addition it includes video highlights from the German football league Bundesliga, fighting (boxing and MMA) livestreams, and access to sweepstakes and promotions.

Daniel Mussinghoff, director of premium for Bildplus, pointed out to Press Gazette that the offering has “more digital subscribers than others have in their print legacy business” in Germany and said they are “happy about those numbers but not happy enough” as they still see room to grow.

Bild’s website gets around 18 million visits per day from five to six million unique users, according to Mussinghoff. Data shared with Press Gazette showed Bild had 595.6 million visits in January, ahead of its nearest German competitor (free title) t-online on 268.9 million.

This reach means “there’s still huge potential for us and we therefore also don’t see that we’ve hit any ceiling like some discussions sometimes go,” Mussinghoff said.

Although Bild has begun receiving feedback from users about their budgets being squeezed, with some cancelling because they have had to prioritise where they spend their money, the cost of living crisis and high inflation has still not led to a decline in subscriber numbers.

In fact, subscribers are “still growing every single month,” Mussinghoff said. Some major subscriber-only events, for example a Tyson Fury fight livestream, may see a burst of new subscribers and some churn the next month, “but overall, we’re constantly growing year-on-year, constantly around 10-11% year on year”.

Mussinghoff added: “We’ve got many, many ideas that we want to implement. We’ve got many projects that we want to implement. We’ve got a lot of technical setups that we want to improve. And we’re super motivated due to the fact that we know how much potential there still is.

“And even being such a big brand, we still also see a lot of low hanging fruits for us, even though we’re in the market for ten years, and that is very motivating again… because we know that there are still so many opportunities out there that we can use for growth.”

Direct traffic shows people ‘like Bild brand’

Bild was first inspired to launch with a freemium model in part by Sweden’s Aftonbladet, an early pioneer of the format, to avoid jeopardising its “huge” advertising business. Today advertising at Bild remains bigger than subscriptions but the latter has become a significant part of the digital revenue mix.

The publisher said revenues at Bild and sister broadsheet title Welt were up 3.4% year-on-year in the first half of 2023. Almost half (48%) of revenue come from the digital business, three percentage points higher than a year earlier, meaning digital revenues are compensating for the decline in print in Axel Springer’s German media business – with digital subscriptions a significant factor (Welt also has a digital subscriptions strategy).

Similar to Mail Online, Bild has a high proportion of direct traffic. Mussinghoff suggested 70-80% of Bild’s visits come directly to the homepage while Similarweb puts the figure at 63% direct, 28% search and 5% social. Many news publishers get roughly half their traffic from search.

This high proportion means, Mussinghoff said, that “people like our brand, people know our brand, and people like the way that we tell the news” which he added is “quite unique” as a tabloid in the German market.

One of the ways Bildplus has grown has been through acquiring the rights to boxing matches which weren’t being shown on TV. One event last year for example saw Bildplus get the rights to the fight between influencers Tommy Fury and Jake Paul which Mussinghoff said worked “very, very well on subscriptions”. But also key was making sure people stuck around.

Mussinghoff explained: “We saw a niche and a potential in boxing fights, mixed martial art fights because huge TV stations weren’t showing those fights anymore. The streaming services weren’t in the market for that. And then we took that opportunity and started to license those rights.

“This audience was a new audience for us and we managed to have so many rights and so many events each and every week that they stayed for us and we created a newsletter around that, we created podcasts… and so we made sure that they not only came once to do this pay-per-view thing, but also stayed with us because they learned that we’ve got the confidence to talk about those topics, and that we’ve got more than just the event itself.”

Bild also hosted a Fame Fighting event with influencers boxing each other which was streamed for Bildplus subscribers. Mussinghoff said Bild is now looking at adapting these content models to other audiences and topics, as well as repeating Fame Fighting this year.

Similarly football highlights videos “are great but also something where you don’t want to get attached to it too much or dependent on too much, because it’s of course something that you have to buy externally through licensing deals,” he said.

Other popular, but less regular, subscriber benefits have included offering them the chance to travel to the World Cup in Brazil in 2014 on a specially chartered plane and offering early access to hard-to-get Rolling Stones tickets.

“Of course these are money-can’t-buy events that we also can’t offer every week but that help you to promote your brand,” Mussinghoff said.

“Bildplus is a sub-brand or sub-part of Bild and it helps you to create this value that you want to be perceived for and this exclusiveness that you want to be perceived with.”

He added that Bildplus does not use every product offered to it in its competitions and promotions because “we make sure that it’s certain value it has to have and a certain exclusivity and it’s not on every website in Germany”.

Journalistic content ‘the basis for everything’

Despite the success of these promotions, Mussinghoff emphasised that the most important thing is Bild’s journalistic content, which drives the majority of Bildplus subscriptions.

“So people see a story they see a headline, and that’s the reason why they subscribe. Our marketing departments are important. Our sweepstakes and promotions that we do are important. But when you take a look at the numbers, most of these subscriptions are created through the content.

“And that’s very important to us because that’s what we want and that’s what also gives our journalistic colleagues the assurance that they hit the right themes and that those themes and topics that they research are resonating with our audience and are creating this willingness to pay.”

All content types contribute, Mussinghoff added: “It’s not only sports, it’s not only crime.”

As a result one of his main pieces of advice to publishers earlier in their subscriptions journey is to “be confident about your content and focus on your content and not anything else… that has to work as the basis for everything”.

Mussinghoff described himself as “not the biggest fan of bundles” (subscription products adding another product to the core news content – as used by the New York Times) because of the fact they can lead publishers away from focusing on their journalism.

“In the past we’ve often seen publishers creating bundles as their only product or creating bundles because they were afraid that the journalistic content wasn’t good enough – to add the value because they thought well, no one’s buying just because of our content, and they thought that they needed something else as added value.

“And I just want to say if that’s the case, then you should think twice whether you want to start a paid content business or not because you should be able to sustain your business out of your own resources and out of your own journalistic content.”

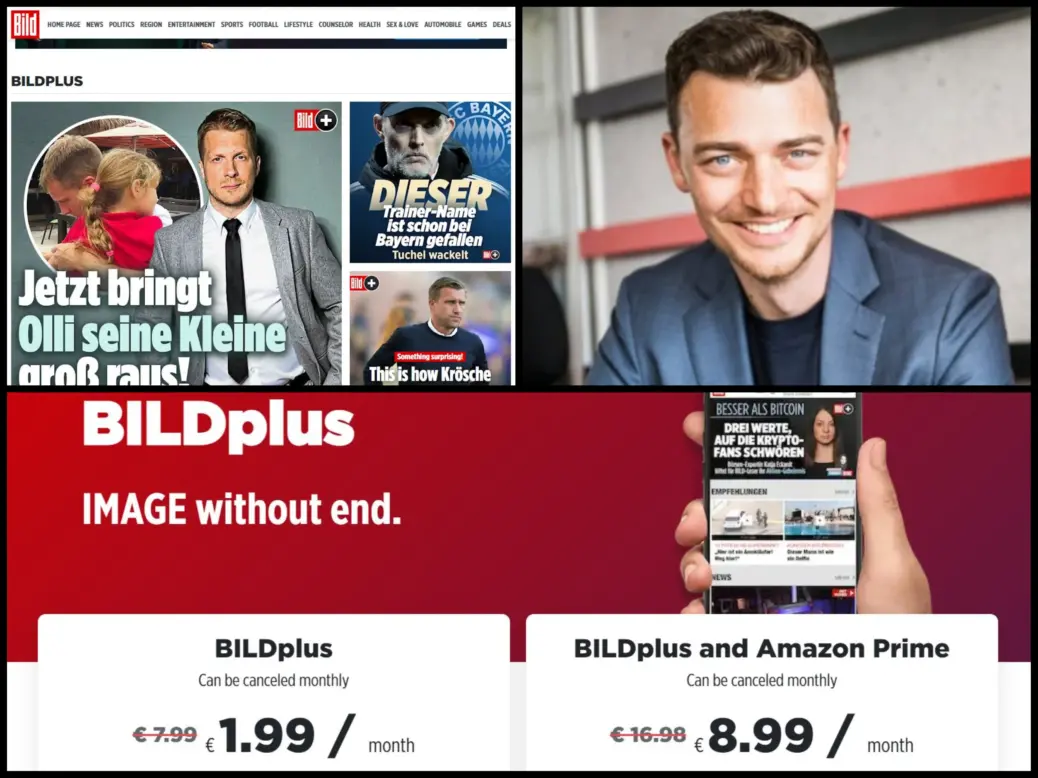

Despite this, Bildplus has “done many bundles in the past”. Most recently it launched a deal with Amazon Prime through which subscribers can get Bildplus and Prime together for €8.99 per month. That compares to €1.99 per month for the first year, followed by €7.99, for Bildplus alone.

Normally in Germany Amazon Prime costs €8.99 per month, making the bundle a monthly saving of €0.99 in the first year and €7.99 after that.

Mussinghoff said: “When you’ve got a subscriber base that is interested in your product it’s of course interesting to see whether or not you can add something to make sure that they will stay longer. And then of course you take a look at what those subscribers use or need in their life – music streaming, TV streaming, and Amazon. Those are all things where those subscribers that we already have also have a second subscription.

“And then of course you start talking to those other brands whether or not it makes sense to do the deal together to offer a different price or special added value that is included only for this bundle. And then it gets interesting because then probably two brands with a huge reach can reach huge audiences and it can also reach huge effects in terms of customer lifetime value due to the fact that you’ve bundled such important products like we did now with Bild and Amazon.”

Mussinghoff’s other key piece of advice to publishers starting out with subscriptions is to be “as simple as possible about your product and pricing strategy”. Bildplus only has one price, and one alternative with the Amazon Prime bundle, whereas some digital subscriptions have sign-up pages with a litany of different offers.

“We really focus on one product, one price, and do all the upselling afterwards. And that has been an important learning from the past,” Mussinghoff said.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog