US current affairs magazine The Atlantic has reached two long-targeted milestones: becoming profitable and topping one million subscriptions.

But chief executive Nicholas Thompson is resisting calls to use this moment to relax the paywall, go on a hiring spree or set off a load of experiments.

Speaking to Press Gazette’s Future of Media Explained podcast, Thompson said: “The first thing I have to do is continue to be disciplined – we didn’t get to profitability by overspending and making a bunch of bets that were unlikely to pay off, right? We got to profitability by investing in areas where we had fairly high confidence of good returns. So continuing to do that is sort of step one.

“Step two is going to be figuring out how to better diversify both our economic model but also what we produce and figure out ways to diversify our demographics, diversify the offerings of our journalism.”

The 167-year-old magazine brand is owned by billionaire Laurene Powell Jobs, who took a majority stake through the Emerson Collective in 2017, and chairman emeritus David Bradley.

In September 2019 The Atlantic launched its online paywall but in May the following year it laid off 17% of staff (68 people, of whom 22 were in editorial) due to the impact of the Covid-19 pandemic on in-person events and the advertising market. It reportedly lost more than $20m in 2020 and around $10m in 2021.

Since then it has seen a turnaround that includes growth in subscriptions of a double-digit percentage each year of the past four years. It announced in April it had become profitable and reached one million subscribers.

When Press Gazette last spoke to Thompson in early 2022, The Atlantic had around 750,000 subscribers of which 450,000 paid for print and digital access and 300,000 were digital-only. Today it’s around 500,000 of each.

Thompson, who joined The Atlantic in February 2021 after four years as Wired editor-in-chief, told Press Gazette The Atlantic has been “seeing growth in all the major revenue parts of our business while keeping costs under control”.

“So things look pretty good right now but I’ve been in journalism long enough to know that that’s not a guarantee for tomorrow,” he added.

Revenue is at almost $100m (£80m), of which around two-thirds is subscriptions and a third is advertising (including events). This emphasis on subscriptions has shielded The Atlantic from being as disrupted by a decline in referral traffic from Google and Facebook and a resulting challenge to programmatic advertising compared to many other publishers in the past year.

The Atlantic’s website saw 30 million visits in March in the US – flat year-on-year and 26% up month-on-month, making it the 36th biggest news site in the country.

The Atlantic’s business strategy ‘not likely to succeed’ for many others

The Atlantic has succeeded by matching its business model to its editorial model, Thompson said.

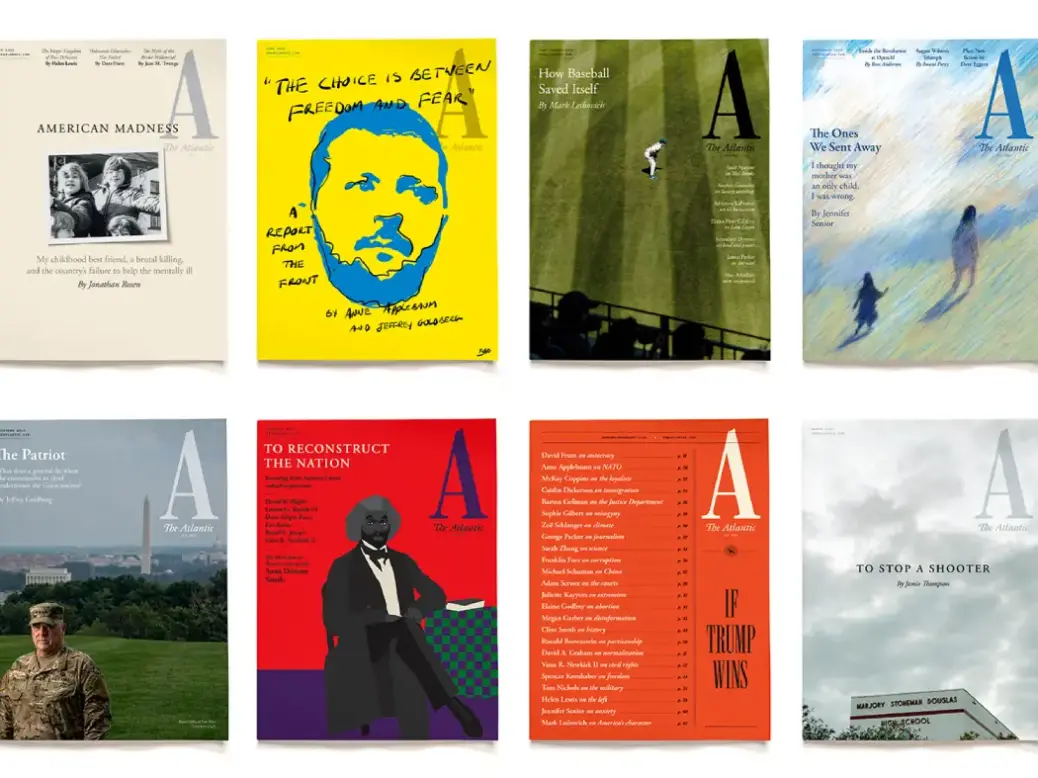

“Our editorial model is to publish not nearly as many stories as many of our peers but to every now and then, as best as we can, publish stories that lots and lots of people talk about. And those tend to increase brand perceptions, they tend to drive a lot of subscriptions, and right now the confluence of all the math behind the way our subscription engine works and our editorial strategy, along with the successful advertising strategy which has overall become more and more successful over the last year and a half or so, has put together a pretty great result.”

However Thompson acknowledged: “The Atlantic’s business strategy, which has been very successful for us, is not likely to succeed for many other publications. It just happens to work for us at this moment. It might not even work for The Atlantic in three years – we might have changed the way we produce content or the way people read might have changed so we might need to pivot with that. But it works right now.

“And so I think the lesson in media is there are lots of different business strategies. There’s lots of ways to execute them. And there are, I think, really good opportunities no matter where one is.”

Read more: Prospect CEO has ‘fixed the plumbing’ and is now looking for growth

A digital subscription to The Atlantic currently costs $79.99 (£64), print and digital together cost $89.99 (£72) and a further $30 (£24) turns the website ad-free. A couple of years ago a subscription was roughly $50.

Thompson said despite the price rise, and a tightening of the paywall, churn has stayed “pretty consistent”.

This is because, he said, of the work that has been done on identifying which subscribers are less likely to retain – for example, they discovered that people who subscribe out of trials are less likely to stay after a year.

“The reason that surprised me is I would have thought, actually, if you subscribe in a trial and then you keep your subscription, you’ve actually committed to The Atlantic twice – you sign up for the trial, and then you’ve kept it,” Thompson said.

“I would have thought that after a year, you’d be equally likely. It turns out that’s not the case. It turns out that for whatever confluence of reasons, if you sign up for a trial, even if you keep your subscription active, after a year you are like, I don’t know, 7-8% more likely to churn.”

Last month The Atlantic published a story by former Time managing editor Richard Stengel suggesting democracy “dies behind paywalls” and that publications should make “all 2024 election coverage and all information that is beneficial to voters” free to all readers.

Asked for his response to this idea, Thompson said: “This particular argument, as you can imagine, is not one that has completely persuaded me.

“My view is I have a very specific role here, which is to make sure that The Atlantic is in good financial state, and that when I leave this job it has its future insured for as long as we can see out over the horizon.

“I want the Atlantic to be sustainable. I’m not trying to maximise profits, I’m trying to make it sustainable. I would be delighted to have us have small profits into the infinite future. My ideal state for The Atlantic would be for it to continue to grow and to be sustainable, slightly profitable over the long, long, long, long, long run. That’s what I’m trying to get to. And I believe that one can do that most efficiently through paywalls.

“And so the argument that you should not have a subscription and you should open it all up for everyone to read? Well, if the cost is the future of The Atlantic, this publication that was founded in 1857, by abolitionists to stop the American Civil War. That’s not a trade off I’ll take.”

Thompson added that The Atlantic does disseminate the ideas in its stories widely, making those that are “highly in the public interest” free to read, distributing some through syndication platforms, and offering free access to university and college students.

‘Trump bump’ 2.0? Atlantic CEO predicts ads down, subs boost, traffic marginally up

Asked to predict the impact of the upcoming US election, after many news publishers saw a “Trump bump” in traffic and subscriptions during the ex-president’s previous election campaigns and time in office, Thompson anticipated an “increase in subscriptions, decline in advertising and less of an increase in readership than most people expect”.

“I don’t think there’s going to be the same traffic boom for Trump coverage as there was during the last election cycle,” he explained.

“We’ve seen that our coverage of Trump, and I think coverage at other publications matches this, that the spikes that people saw in 2016 and 2020 are less likely to come.

“People will be very interested in this election, it will be a huge international news story, there will be a winner, there will be a loser, there will be dramatic moments, there will be twists and turns, it will be a wonderful story, there’ll be great books written about it. I don’t think that publisher web traffic is going to spike. So in our various models we haven’t modelled a huge spike into it. We’ve modelled a slight increase.

“We do know that it’s going to be terrible for advertising, right? So we have a lot of advertisers who essentially say they want to go dark from September through November. They don’t want to be associated. They know we run a lot of political content. They don’t want to be running any advertisements around what they assume will be a highly toxic, highly divisive election. So we have forecast a substantial decline in advertising.

“Then there’s the question of whether there’ll be an increase in subscriptions and my guess is probably. Our political coverage is fantastic, we ran some of the best stories about the 2020 election, we put together a fantastic January/February issue about what could happen in a Trump presidency that drove a lot of subscriptions.”

In advertising, like other areas of the business, The Atlantic’s goal is “to not maximise revenue, but to maximise profitability,” Thompson said. This has included examining what ads and what type of selling have the best margins.

Print adverts, including luxury advertisers on the back page of the magazine, amount to a “small revenue line, but they are profitable”.

The Atlantic also has a branded content studio that works with large brand partners, for example making a podcast series with art gallery Hauser and Wirth, a magazine about AI with Google, and a series of videos for Microsoft.

Meanwhile direct sold ads on the website are seeing particular growth in the auto, entertainment and tech industries, Thompson said.

What should The Atlantic’s next goals be?

When he joined The Atlantic in 2021 Thompson planned to find a strong third revenue stream to sit alongside subscriptions and advertising but although they have tested a number of things, they are “all rounding errors on the P&L,” he said.

At Wired affiliate revenue is a strong area, but he concluded that it was not such a good fit at The Atlantic, saying the only natural areas to make it work were book, film or TV reviews, linking to pages where people could buy the books or stream the content talked about.

Thompson said: “We built an affiliate module on our book reviews and it’s fine, right? It generates more revenue than we’d get if we didn’t, but people don’t really think of The Atlantic as a place that’s guiding commerce. There isn’t that brand association the way there was at Wired, for example.

“People don’t buy as many books, they certainly don’t spend as much money buying books as they do buying televisions or buying headphones and iPads and Kindles and all the other things we did at Wired. So it’s a relatively small category, a relatively small revenue and so you’re getting relatively small commissions, and it just doesn’t really add up.

“We also have an IP business where we license the content that we create in the magazine or on the website. We work with creative agents in Hollywood to sell it to studios. That is a good business, but it’s a hits business and, you know, Hollywood’s been on strike and there’s all kinds of other complexities. So that’s gone fine, but it’s not a major revenue source for us either.”

For now Thompson is working hard “to identify what the next strategic step for The Atlantic should be”.

“We have to choose the next set of goals and we haven’t decided on them yet,” he said. “There are a lot of things under consideration. You could imagine that, you know, let’s try to get to a million and a half subscribers. Let’s try to be profitable for three consecutive years. Or we could come up with an entirely different set of goals based on the demographics of our readers or the number of stories.

“So we’re debating, negotiating, figuring it out. I’m pretty confident that we’ll come up with some goals but it’s pretty hard to find exactly the right goal for your organisation at a given moment.”

Listen to the full conversation with The Atlantic CEO Nicholas Thompson on Press Gazette’s Future of Media Explained podcast.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog