From the deadly toll of the war in Ukraine on journalists to the rise of The Sun in the US, here are 12 charts which tell the story of 2022 for news media.

1) Journalists protest low pay in the sector

Those not impacted by the cost of living crisis have been few and far between – and journalists are no exception. Journalists at Reach, Al Jazeera, the New York Times and National World’s Scottish titles have been among those who have joined the picket line or been vocal in expressing their discontent about pay and conditions.

This year, Press Gazette commissioned a salary survey to better understand pay in the sector. We found that most readers received a pay rise this year.

The largest single group of respondents (39%) however, said that the increase they received between 2021 and 2022 was less than 5%. To put that in context, consumer price inflation in the UK rose by 11.1% in the 12 months to October 2022.

2) Another worrying year for press freedom

2022 was another bad year for press freedom and journalist safety. According to Reporters without Borders annual roundup, 533 journalists – more than ever – were in detention as of December this year, up from 488 at this time in 2021. Meanwhile the number of journalists killed has also risen, with 57 deaths in 2022 – a 19% increase compared to 2021. Eight journalists lost their lives in Ukraine according to RSF. The Americas however was the world’s most dangerous region for the media, accounting for nearly half (47%) of journalists killed worldwide.

3) Ad revenue held up in 2022 but looks bleak for next year

Despite the gloomy global economic picture in 2022, adspend in the news industry in 2022 was not as dire as thought.

Although the Advertising Association and WARC which publishes regular adspend forecasts recently downgraded its 2022 outlook for the media industry as a whole, most news media seem to have bucked the 2022 trend, with several adspend predictions revised up somewhat, particularly for online media.

The outlook for 2023 however, is bleak.

AA/WARC expects that adspend will decrease for most news media in 2023, with regional media and magazines likely to be hardest hit with a 7% and 6% year-on-year fall in spending respectively.

4) The New York Times continues its strong revenue run

Success in a digital age is not easy, continuing to elude many publishers. The New York Times however, is one of the outstanding examples of how to successfully transform into a digital reader revenue-supported business. The publisher now has 9.3 million total subscribers across print and digital and is on track to reach its goal of 15 million total subscribers by the end of 2027.

Subscription revenue meanwhile continues to grow. The company reported revenue of $382.7m in the third quarter of this year, up on the last quarter, and is additionally forecasting a 17 to 20% increase for the fourth quarter of 2022.

5) Editorial redundancies gather pace

Recession in the UK, and a bleak adspend forecast has led to newsrooms tightening their belts throughout 2022.

According to Press Gazette’s editorial redundancies tracker which tallies job losses in the UK, Ireland and the US, at least 1,391 editorial staff have lost their jobs or have been threatened with the loss of their job in 2022 so far, with at least half of those cuts occurring since the last days of September.

According to the National Union of Journalists, the real figure is however likely to be higher. A representative from the union in October confirmed to Press Gazette that they are dealing with a rising number of redundancies, most of which would not be reported.

6) Publishers are seeing success with digital subscriptions

While digital revenue has, for the most part, yet to make up for the decline in print – particularly in local news – some publishers are starting to see success with digital subscriptions.

Despite some concerns prompted by Netflix's early 2022 losses that consumers might be abandoning their sign-ups, digital only subscriptions have continued to grow for news publishers.

According to experts at Mather Economics, the number of digital subscriptions in the US will overtake print in 2023.

7) Print revenue is still king

Revenue however, continues to lag. Currently 85% of subscription revenue in the US still comes from print, while just 15% is digital.

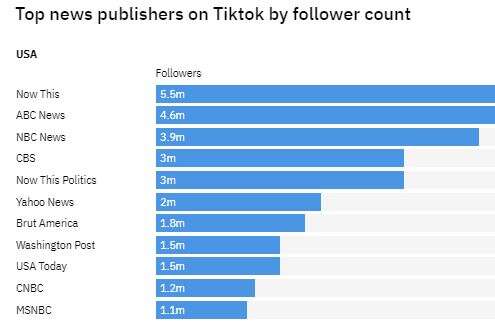

8) Publishers turn to TikTok

Around half of the leading news publishers in over 40 countries now regularly publish content to Tiktok, according to a study this year by the Reuters Institute for the Study of Journalism (RISJ). Among the countries where the fast-growing social media platform is particularly popular is the UK 81% of leading publishers regularly use it.

Report author Nic Newman of RISJ told Press Gazette: "UK publishers are really worried about access and audiences and that's the imperative both from public broadcasters whose audiences are no longer coming to television, but also subscription publishers who are really looking for the next generation of subscribers."

Mail Online was the most-followed publisher in Europe and the fourth-most followed worldwide (4.3 million).

9) Consolidation of UK local news continues

Falling circulation and advertising revenue means the trend to consolidation in local news has continued in 2022 as regional publishers strive to survive.

Earlier this year Norwich-based Archant, which publishes four daily and 50 weekly titles was acquired by Newsquest.

Last year, National World completed a £10.2m deal to take over the UK’s third largest publisher JPI (formerly known as Johnston Press).

Press Gazette analysis suggests that owbership of the UK regional press is more concentrated than ever with the biggest five publishers controlling 88% of daily circulation, while digitally, all but 15 of the 50 biggest digital regional brands are owned by the UK’s largest publisher Reach.

10) The crisis deepened in local news in the US

New research earlier this year from Northwestern University shows that the US newspaper industry has lost 2,500 titles and more than 40,000 newsroom jobs since the mid-2000s.

As a result 70m Americans – a fifth of the nation’s population – now either live in a "news desert" or in an area at risk of becoming one.

Yet while the story of local news has been overwhelmingly bleak, there are some more hopeful spots.

LION Publishers, which represents more than 400 local independent online news companies across the US and Canada, revealed that its members on average each generated revenues of $125,000 last year, up 33% on 2020. Two thirds of the more than 400 outlets that are part of the Institute for Nonprofit News meanwhile reported that they grew total annual revenue from 2018 though 2021, and the median growth was 25%.

Despite some successes however, the Northwestern University research underlined that digital growth is yet to make up for the decline of print.

"Digital alternatives remain scarce, despite an increase in corporate and philanthropic funding," wrote report author Penelope Abernathy.

11) The British Journalism Awards recognised more women than ever for their work

We are almost there when it comes to gender parity in both shortlists and wins at the British Journalism Awards. In 2022, women’s share of the shortlist was their highest ever at 48%, while the 49% of winners that were female is among the highest since the BJAs began 11 years ago.

Overall, the trend over those 11 years has been positive – in 2012 just 24% of those shortlisted and 25% of winners were women.

12) The Sun’s US digital edition went from strength to strength

Since launching in January 2020, the UK tabloid’s US digital edition has seen a strong run of growth. According to Similarweb, the US Sun has gone from 23.5 million monthly visits in September 2021 to 44.6 million a year later.

The Sun's head of digital told Press Gazette in October that they have "incredibly ambitious aspirations" and "don’t really see a ceiling" on how far they can grow Stateside.

The site which now has almost 100 journalists was the 23rd biggest news site in the US in Press Gazette’s latest ranking of the biggest news sites in the US for November.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog