The ten biggest local news websites in the UK are all owned by commercial giant Reach, according to the latest Press Gazette ranking.

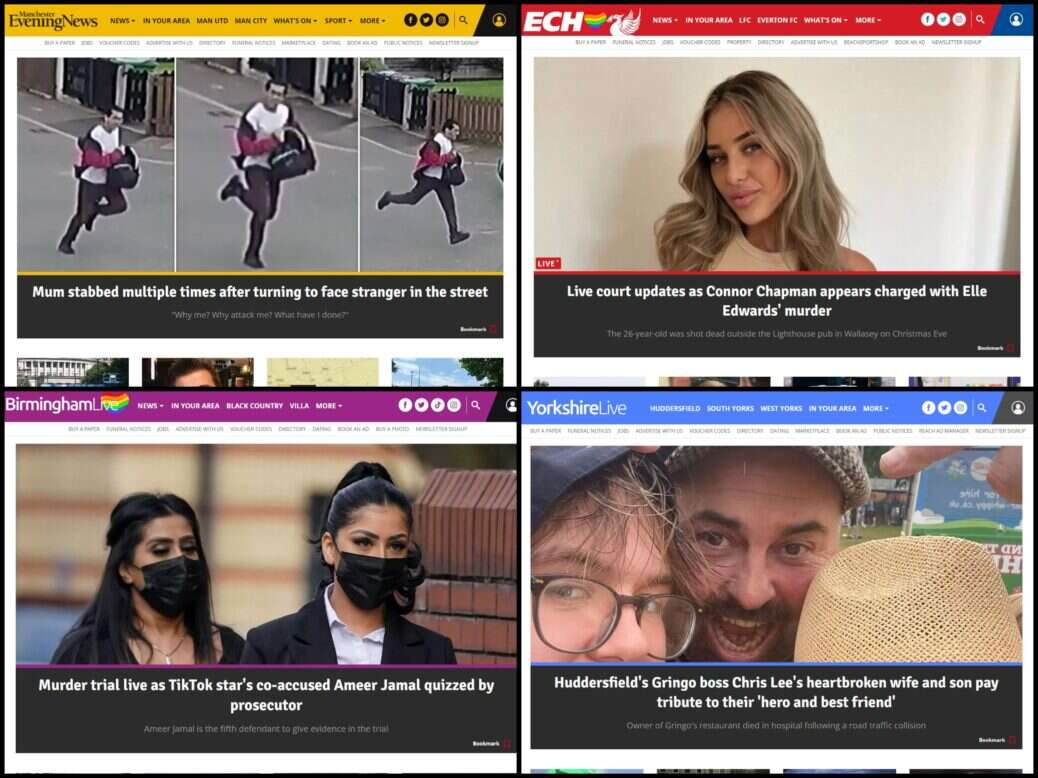

Manchester Evening News (the MEN) was the UK’s largest regional newsbrand reaching 12.6 million people in April – 25% of the UK online population over 15 – according to data from Ipsos iris.

Second-ranked was Liverpool Echo which reached 9.1 million people (18% reach), while Birmingham Live was third (8.2 million people, 16% reach).

The three regional news websites regularly feature among Press Gazette’s monthly ranking of the top 50 newsbrands in the UK, which includes the international, national and local websites frequented by the largest numbers of the UK online population.

The trio were also among five regional newsbrands in this ranking that reached more than one in ten UK online adults.

Examiner Live (5.1 million people), Chronicle Live (5 million), My London (4.7 million), Nottinghamshire Live (4.2 million), Lancs Live (3.1 million), Bristol Live (3 million) and Leicestershire Live (2 million) complete the rest of the top ten list of biggest regional newsbrands by audience size.

For our list, we used Ipsos’ ranking of the top online brand groups and selected the 50 biggest "local" newsbrands. We excluded sub-national brands such as Wales Online and Daily Record which cover the entirety of one of the UK’s constituent nations.

Reach dominates but fewer brands from the regional giant in the 2023 ranking

Although the list is dominated by Reach, the UK’s largest regional publisher, fewer of its brands featured in this year’s ranking compared to our 2022 list. Last year Reach’s brands accounted for three-quarters of the top 50 table, compared to 62% this year.

Ipsos data also suggests that the overall audience size to Reach's brands in the top 50 has shrunk. Of the 31 Reach local newsbrands on the list, all but seven recorded a year-on-year decline in audience, with Hull Live (1.2 million visitors, down 68% year-on-year) and Kent Live (822,124 visitors, down 60%) seeing the largest falls compared to April last year.

Just one of the top ten fastest-growing newsbrands (Nottinghamshire Live) was owned by Reach, compared to half last year.

A spokesperson for Reach said, "We have been very open about the challenges posed by Meta's change in focus away from news, and this is reflected in these numbers, which still demonstrate the undeniable impact of our local titles - several of which rival even national competitors.

"Meanwhile, we continue to see direct and brand-advocate audience numbers grow, and our customer value strategy has meant that our regional brands have built up loyal audiences. Our job now is to continue engaging with those people directly and listening carefully to what they tell us they want from us, and build an even stronger relationship with them."

Growth at Newsquest and National World

Among the newsbrands published by other publishing houses on our list, there was more widespread growth. Of the 19 non-Reach titles featured, all but three grew their audience size year-on-year, with all of the seven Newsquest titles on our list seeing growth.

Oxford Mail (audience of 629,168, up 74% year-on-year) was the fastest-growing Newsquest brand in our ranking and the third fastest-growing in the top 50 overall, behind National World’s Glasgow World (audience of 795,984, up 201%) and London World (audience of 693,949, up 164%). Both brands were among eight city brands launched by National World since 2021.

Overall, the Reach newsbrands in our ranking saw a 19% fall in audience between April 2022 and April 2023 (not de-duplicated). Every other publisher saw an increase with Newsquest, whose brands’ un-deduplicated audience was up 34% and National World, up 26%, seeing the biggest increase among the publishers with more than one newsbrand in the ranking. National World recently reported that 2022 digital revenue was up 26% year-on-year, representing 20% of its total income.

Digital growth for some publishers contrasts to continued print decline across the regional press. Local daily newspaper sales in the UK fell by an average of 19% year-on-year in the second half of 2022 according to the latest figures from the Audit Bureau of Circulations (ABC), while non-dailies audited by ABC saw their January to December circulations decline by an average of 13%.

Yet, despite digital growth, revenue continues to present a challenge. Paywalls are still uncommon in UK local news, while revenue from digital advertising for the local news sector is expected to remain largely static in 2023 and 2024.

Page views down at Reach brands

Reach’s local newsbrands also saw a decline in page views. While National World’s Yorkshire Post was the newsbrand with the single biggest drop in page views (down 63% to 3.8 million), all but five of Reach newsbrands in our ranking saw a fall in page views compared to April 2022.

Kent Live (3.3 million page views, down 53%) and Cheshire Live (2.8 million, down 52%) recorded the largest drops in page views at Reach. In a trading update in May, Reach, which also publishes the Mirror and Express national titles, warned that changes to how Meta presents and prioritises news on Facebook had hit revenues which fell by almost 6% in the four months to April.

National World's Glasgow World was also the fastest-growing by page views, increasing 241% year-on-year to 3.1 million. It was followed by Newsquest’s Glasgow Times (3.2 million page views, up 67% year-on-year).

Looking at engagement, audiences spent most time overall with the two biggest regional brands by audience size, the MEN (84.8 million minutes) and Liverpool Echo (47.6 million minutes).

Audiences spent most time with Kent Online on average

Although it ranked 23rd for reach, Iliffe-owned KM Media Group's Kent Online came fifth for total minutes spent (17.6 million minutes). In addition, audiences spent an average of more than 12 minutes with the brand, more than any other title in the list.

Reach’s Teeside Live and Hull Live (each eight minutes per user on average) were second and third-best ranked for time spent per audience member. Ten of the 15 best-ranked newsbrands for time spent per user were Reach properties.

Ipsos iris replaced Comscore as the industry-recognised standard in 2021. Ipsos iris data is partly derived from a panel of 10,000 people aged 15 and over that is designed to be nationally representative. The participants have meters installed across 25,000 personal devices to passively measure website and app usage.

This data is combined with data from participating websites that are tagged so all devices visiting the site can be identified and logged.

Publishers often have their own internal audience metrics, which can result in different figures. Press Gazette uses Ipsos for its UK news audience ranking stories to be able to compare across publishers.

From January Ipsos increased the sources of embedded browser traffic (web content viewed within a mobile app) counted in its data. Its monthly data now includes webpages consumed within other mobile app embedded browsers such as Linkedin, Twitter, Google News and Instagram, as well as Facebook which has been counted in its data since 2021. Ipsos has also updated its total internet population figures to align with the latest Pamco survey estimates.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog