More than two-thirds of Google traffic to the biggest news websites is now coming from its Discover feed, suggesting a worrying reliance on this source of ad revenue.

Since Google Discover was rebranded and relaunched in 2018, publishers have built a growing reliance on referrals from this content feed, served to users on Google’s native mobile apps and within its Android operating system.

Exclusive to Press Gazette, new data from analytics platform Chartbeat finds that 68% of Google traffic to its network of almost 2,000 global news and media websites now comes from this interface (versus the remaining 32% from search).

Of publishers’ overall traffic, Google now makes up 25%, according to Chartbeat. This is divided into 17% from Discover and 8% from search.

This shift has accelerated after Google expanded its rollout of AI Overviews. For many publishers Discover is the largest single source of visitors.

[Read more: Google Discover has become Reach’s ‘biggest referrer of traffic’]

While Google monetises Discover via ads, this is a product that primarily exists for strategic reasons, not because of its commercial returns or potential.

Alphabet’s financial reporting doesn’t break out Discover revenue – it is bundled within its “search + other” line – but a back-of-the-envelope calculation based on the user figures we do have (800 million monthly active users in 2019) and making some assumptions about the MAU:DAU ratio, scroll behaviour and ad load suggests it’s probably generating between $0.5bn and $2bn.

That’s 0.1-0.5% of enterprise revenue. Google could close Discover and the fallout from investors, as well as the impact on its core (search and advertising) and growth (cloud and AI) businesses, would be near-zero.

Discover gives Google ‘power’ in its relationship with publishers

Far more important than the revenue it delivers, though, Discover gives Google power in its fracturing relationship with the publishers it relies on for content to power those core search and AI revenue lines.

As referrals from organic search decline, driven by the deployment of AI, Discover traffic goes some way towards filling that gap.

[Read more: How Google AI Overviews is fuelling zero-click searches for top publishers]

This allows Google to defend the cashless value exchange it offers to publishers and gives it a bargaining chip over the media. Google has shown itself willing to use this to its advantage in securing access to content and complicating regulatory enforcement.

In France, for example, in the face of new copyright obligations, Google pushed publishers to sign no-cash licensing deals across Search and Discover, effectively using the traffic from the latter to force publishers to accept the unpaid use of content in the former.

It does so today with AI. Publishers can remove content from Google’s AI Overviews or AI Mode using the ‘nosnippet’ command but this impacts prominence on Discover as well as on general search.

If the declines in organic search traffic continue – and regulators don’t stop this flagrantly anticompetitive conduct – there will be a point when publishers determine that the only reason to remain indexed for search is the traffic delivered from Discover.

Google Discover comes under less regulatory oversight than search

Google is also free to manipulate Discover according to its strategic interests at any moment in time. Whereas search is being designated and regulated by the Competition and Markets Authority under the UK’s new digital competition regime, this regulatory oversight does not extend to Discover.

And unlike changes to the search algorithm – which are subject to high levels of industry scrutiny and impact the performance of its core business – as a personalised feed of little commercial importance, Google can arbitrarily opt to change the content it surfaces in Discover.

This has happened to the severe detriment of UK publishers in the last couple of years. My understanding is that such changes have led directly to significant journalist job cuts at national newsbrands.

As well as giving Google the leverage to extract value from publishers to fulfil its content needs, the growing reliance on Discover traffic drives media businesses to act in ways that are contrary to their long-run interests.

At a time when AI intermediation is profoundly threatening media business models, the strategic focus for almost all publishers should be creating direct, paying relationships with loyal readers. These should be focused around serving a specific need (and ideally one which cannot be served by AI) for a clearly-defined audience. Pursuing success on Google Discover is orthogonal to that.

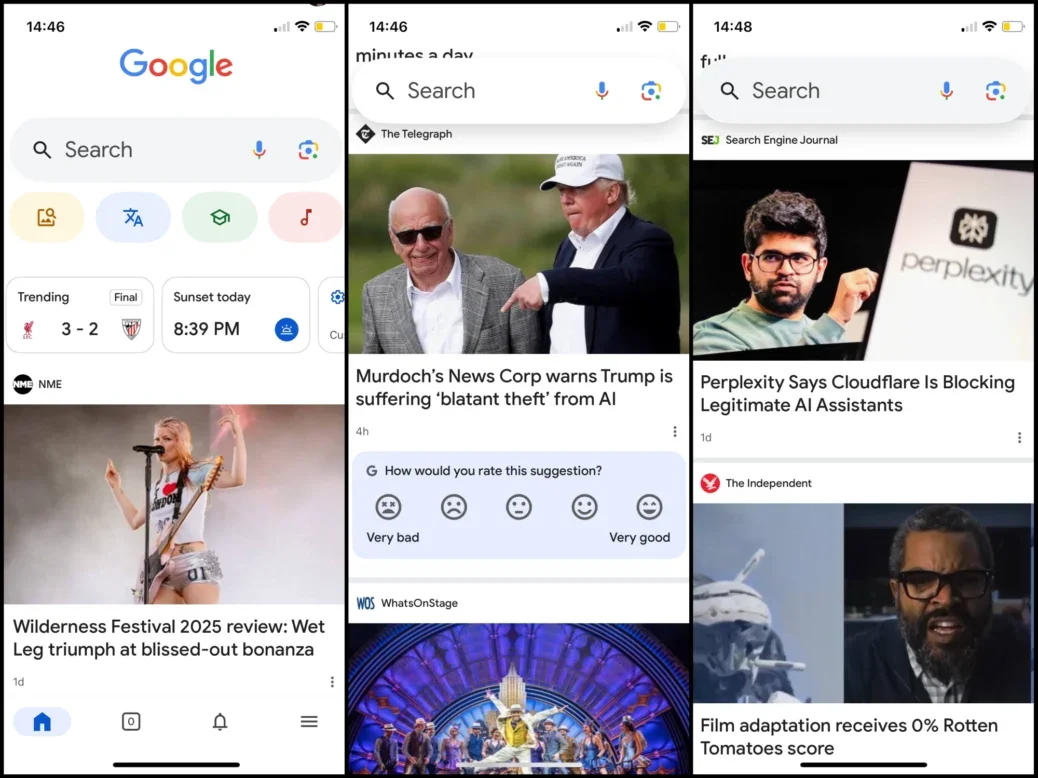

Whereas users from search arrive at publisher sites in order to satisfy a need, this is not the case for Discover. Instead the product serves content that we might enjoy, often in places where the user hasn’t even specifically sought out that type of material, for example the Google.com landing page on mobile devices.

The content that performs well on Discover therefore diverges from conventional search. It rewards stories that create curiosity with the headline, catch the eye with striking imagery, as well as timely or breaking news. In short, it incentivises the creation of viral, clickbaity content of the type that consumers are unlikely to pay for, whether that’s with their data or cash.

As a result, Discover traffic is ephemeral: users click through when something has caught their eye but are unlikely to visit a second page, return to the site or convert via a subscription or affiliate sale. In general, it doesn’t deliver the type of traffic that creates long-run value for publishers.

It also presents challenges for commissioning. Performing well on Discover is as much art as science – it’s substantially more volatile search with individual stories receiving huge spikes of traffic (that can deliver really meaningful advertising revenues for publishers) but the benefits are fleeting and must be earned again tomorrow with something else.

All of this diverts attention and resources away from serving core audiences with genuinely valuable journalism; the focus that will deliver sustainability and resilience for media in this new era.

Finally, the growing reliance on Discover creates a new platform dependency that’s subject to all the risks inherent in that. Particularly when the intermediating platform is owned by Google which, with its use of content in AI Overviews and AI Mode, has proven itself willing to disregard the interests of publishers and act in a brazenly anticompetitive manner in order to secure an advantage elsewhere.

Large parts of the industry have become dependent on Discover but this is an increasingly precarious position. This traffic should be treated as a bonus and not the foundation of a sustainable audience strategy.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog