The UK advertising market’s post-Covid-19 recovery is expected to be slower than previously thought, with total ad spend forecast to be down 14.5% in 2020.

The Advertising Association and marketing agency Warc, who publish a quarterly ad expenditure report, now predict the UK’s ad market will not fully recover until 2022.

This is because slower growth than previously anticipated for 2021 means any gains made next year are considered unlikely to offset this year’s losses.

Market growth is expected to restart from Q2 in 2021 but Warc said it would need to rise by a further 2.1% next year to meet 2019’s £25.2bn.

- To find out more about the future of marketing, download Lead Monitor’s white paper: B2B marketing after a pandemic: 8 key lessons for senior marketers

- Sign up for Press Gazette’s fortnightly Marketing Matters email newsletter here

Despite this, magazine brands and regional newsbrands are predicted to perform well in 2021 with year-on-year growth of 18.8% and 16.2% respectively due to “strong growth in their online formats”.

James McDonald, head of data content at WARC, said: “Advertising trade remains depressed, and the rising likelihood of sustained localised lockdowns over the winter, a disorderly exit from the European Union in December, and a prolonged economic recovery embodied by rising unemployment, now leads us to believe that the industry will not fully recoup this year’s losses until 2022.”

In July the AA and WARC forecast a return to growth of 16.6% next year but this has now been downgraded to 14.4%.

Adspend is expected to fall by 14.5% in 2020 to £21.5bn because of the coronavirus pandemic, down £3.6bn on the previous year.

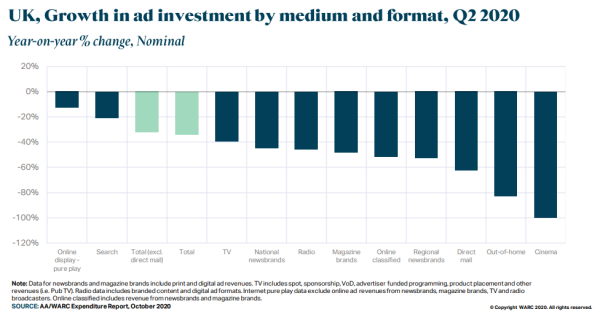

The biggest losses were in the second quarter, described by Warc as the worst quarter ever recorded, when adspend fell by 33.8%.

Social media and paid search, which together make up almost half of the UK ad market, recorded their first annual falls of 17% and 20% respectively, although they were among the few sectors to grow in the first three months of 2020.

The UK Government was the biggest advertiser in Q2, more than doubling its spend to support coronavirus-related campaigns.

The DCMS distributed £35m for public health information advertising across 600 UK local, regional and national print titles since the start of the coronavirus pandemic – of which more than 60% (£21m) went on locals and regionals (example pictured).

Adspend changes by format in Q2 2020. Picture: WARC/Advertising Association

Although the final quarter is usually strong thanks to Christmas, this year it is expected to drop by 10.5% (£724m) compared to last year.

Despite its obvious advantages compared to other parts of the sector that have reduced footfall or have been shut down altogether, Warc said no online advertising formats are yet “back to the frothy heights of 2019”.

Advertising Association chief executive Stephen Woodford said: “These stark figures demonstrate the strain that all parts of the advertising ecosystem were under during the second quarter. Large parts of our industry and the wider economy were effectively shut down.”

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog