Advertising spending has been forecast to grow across the board in the UK next year with the exception of national and regional newspapers and magazines.

In both the newspaper and magazine industry, advertising income is estimated to be declining, according to the AA/Warc Exenditure report.

In the national press slight digital growth is failing to cancel out a sharp drop in print advertising.

And in the regional press both print and digital advertising are estimated to be declining.

National newsbrands (the national press) attracted £1.1bn of advertising last year (down 9.8 per cent), of which digital comprised £224m (up 2.1 per cent) – the report states.

Regional newsbrands (the regional press) fell 12 per cent to just over £1bn of which £196m was digital (down 1.7 per cent year on year).

The pace of decline for national and regional newsbrands is forecast to slow slightly next year to 7.9 per cent and 8.6 per cent respectively.

The quarterlyreport found that total UK advertising grew 4.4 per cent to £21.1bn in 2016 and is set to grow by a further 3.2 per cent in 2017.

Chief executive of the Advertising Association Stephen Woodford said: “That adspend held up after the referendum is another marker of the strength of the UK’s advertising and media industries. As the Government gears up for Brexit negotiations and a new industrial strategy, it must prioritise protecting this global advantage.”

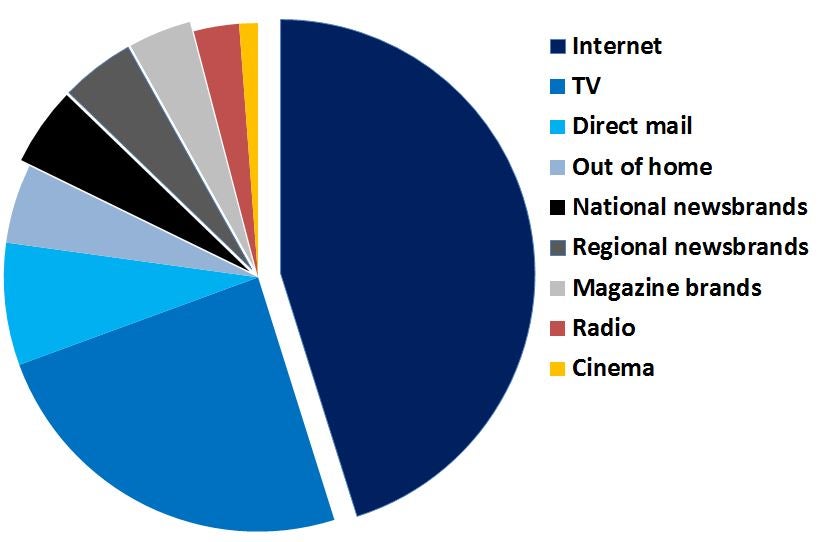

How the UK’s £21.1bn 2016 advertising spend was shared:

Internet was by the far the biggest UK advertising category in 2016 attracting nearly £10bn (up 14.4 per cent year on year).

Within that, mobile grew 45.9 per cent to £3.8bn – the fastest growing category.

TV was next biggest on £5,3bn (up 1.6 per cent), followed by direct mail £1.7bn (down 10.4 per cent).

National newsbrands (the national press) attracted £1.1bn last year (down 9.8 per cent), of which digital comprised £224m (up 2.1 per cent).

Regional newsbrands (the regional press) fell 12 per cent to just over £1bn of which £196m was digital (down 1.7 per cent year on year).

The pace of decline for national and regional newsbrands is forecast to fall slightly next year to 7.9 per cent and 8.6 per cent respectively.

UK advertising expenditure, 2015–2017

(source AA/Warc)

| Adspend 2015 (£m) | 2015 vs 2014

% change |

2016 (Estimate) | Forecast 2017 | ||

| Adspend (£m) | y/y % change | y/y % change | |||

| TV | 5,270 | 7.3% | 5,353 | 1.6% | 1.6% |

| of which spot advertising | 4,760 | 6.7% | 4,790 | 0.6% | 0.7% |

| of which broadcaster VOD | 175 | 20.7% | 202 | 15.4% | 12.4% |

| Radio | 613 | 6.5% | 637 | 3.9% | 2.1% |

| of which digital ad formats | 20 | – | 27 | 31.4% | 20.0% |

| Out of home | 1,059 | 3.9% | 1,111 | 5.0% | 2.2% |

| National newsbrands | 1,223 | -10.8% | 1,102 | -9.8% | -7.9% |

| of which digital | 220 | 2.5% | 224 | 2.1% | 2.2% |

| Regional newsbrands | 1,176 | -6.2% | 1,036 | -11.9% | -8.6% |

| of which digital | 199 | 14.8% | 196 | -1.7% | 3.8% |

| Magazine brands | 941 | -5.2% | 885 | -6.0% | -5.1% |

| of which digital | 282 | 5.8% | 289 | 2.6% | 3.6% |

| Cinema | 240 | 21.9% | 262 | 9.2% | 2.4% |

| Internet | 8,702 | 18.6% | 9,957 | 14.4% | 9.5% |

| of which mobile | 2,622 | 60.8% | 3,826 | 45.9% | 26.0% |

| Direct mail | 1,912 | 1.4% | 1,714 | -10.4% | -7.8% |

| TOTAL UK ADSPEND | 20,260 | 8.1% | 21,145 | 4.4% | 3.2% |

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog