The chief executive of “all you can read” magazine and newspaper app Readly has set out a two-year plan for reaching long-term “robust” profitability.

Philip Lindqvist told Press Gazette that despite the UK’s apparent low willingness to pay for online news, he believes there is still plenty of room to grow there and in Readly’s other European markets.

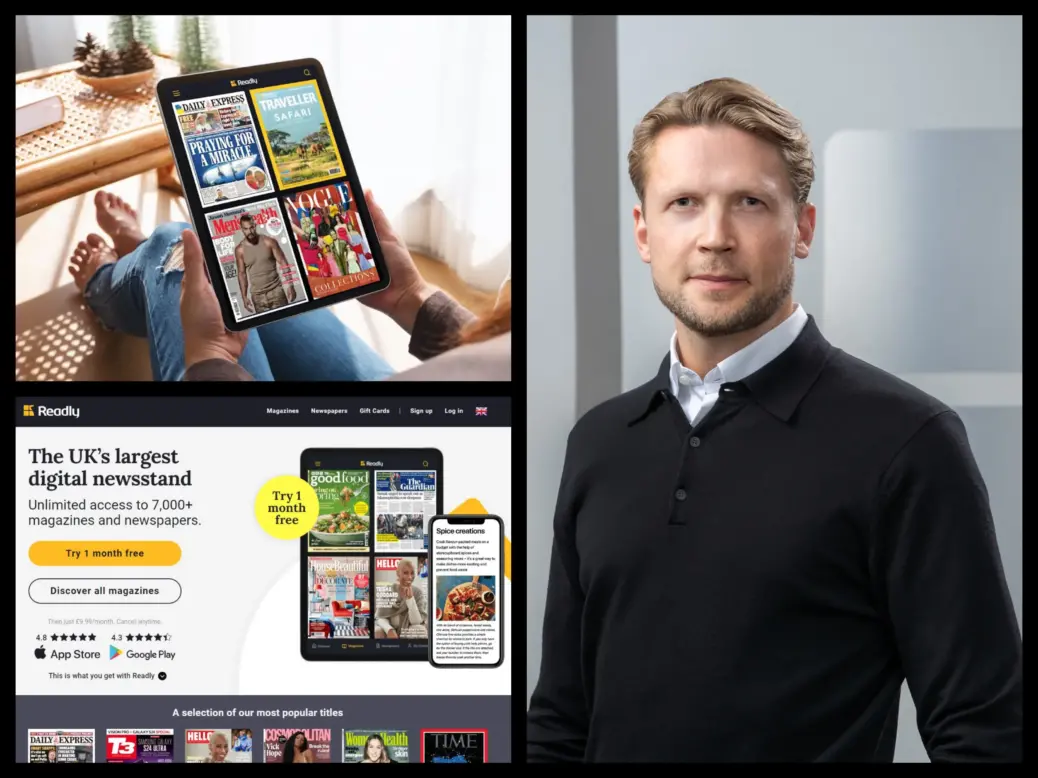

Readly, which launched in its home country of Sweden in 2013 and in the UK a year later, has 7,370 magazines and 324 newspapers as part of its package, which costs £9.99 in the UK or SEK 149 in Sweden (£11.38) and €14.99 (£12.80) in other European markets.

Overall it had 464,494 full-paying subscribers at the end of 2023, 2.7% higher than a year earlier but down 2.9% from a Covid-driven peak of 478,362 at the end of 2021. Average revenue per user is higher, however, up from a peak of SEK 93 (£7.11) at the end of 2020 to SEK 119 (£9.10) in Q4 of 2023.

In the UK the newspaper publishers signed up include Reach (the Daily Mirror, Daily Express, Daily Star and many local titles), The Guardian, Metro, the i, Evening Standard, City AM and The Independent.

Magazine publishers signed up include Conde Nast (GQ, Conde Nast Traveller, Vanity Fair, Tatler), Hearst UK (Cosmopolitan, Esquire, Good Housekeeping, Country Living, Harper's Bazaar, Women's Health), Bauer Media Group (Heat, Closer, Take A Break, Empire), Immediate Media (Radio Times, BBC Good Food, Olive) Stylist, Gay Times, and many more.

Readly pays publishers based on the amount of time users spend with their content and the number of pages read. Lindqvist described this relationship as "the core of our strategy": "We need to be contributing to publishers."

In Q3 and Q4 of 2023, and across the full year, Readly reached profitability in its adjusted EBITDA (earnings before interest, taxation, depreciation and amortisation). In 2023 it reported adjusted EBITDA of SEK 17m (£1.3m), up from a loss of SEK 77.7m (£5.9m) in 2022.

Lindqvist, who became Readly CEO in May, described this as a "breakthrough" and a "milestone" on the "journey to reaching what we think of as robust long-term profitability" but said next they have to reach profitability in the cash definition.

"It's not only enough to be profitable for one or two quarters. We also need to be generating cash, positive cash, on a sustainable level to be able to continue to invest in our content, in our user experience."

Readly's adjusted operating loss (EBIT - earnings before interest and taxation but without adding back depreciation and amortisation) was SEK 28.4m (£2.2m).

Readly, which was listed on Nasdaq Stockholm but in October switched to Nasdaq First North Growth Market, a division of Nasdaq Nordic used for smaller companies, saw revenues grow 14% year-on-year in 2023 to SEK 677m (£51.7m). This was put down to price increases in Germany and Sweden and "favourable currency effects".

Part of that has already included a headcount reduction - 17 employees and consultants left in October when the product and tech teams were merged - to reduce costs.

Making mobile Readly users as loyal as tablet readers

But primarily the strategy puts strong focus on improving Readly's user experience on mobile. Currently its most loyal users, according to Lindqvist, flick through its magazine and newspaper digital editions on tablet - an experience that is "not an equally strong use case" on mobile.

"Historically, Readly has a very strong product market fit for tablet users," he said. "So if you have an iPad and you use Readly, you are typically very loyal, very happy and spend quite a lot of time with Readly. And that's great. We're very happy about that. We will do what we can to maintain this customer base.

"Most people have a smartphone but a lot of people don't have tablets. A lot of people who do have a tablet don't carry it with them. So not being as good as we are on the tablet is a limiting factor that we are addressing."

One potential way of doing this, Lindqvist explained, is to experiment with creating an AI text-to-speech function so people can have articles read to them.

The tool has been soft-launched in the UK with a small subset of articles but he said so far "it's working well. The voices sound good. Of course you hear that it's still an AI or machine, which is fine, but you can really listen to the content..."

He added: "During the course of this year we want to try some alternative setups where you could perhaps build a playlist or get recommendations so you can have a longer listening session - maybe when you're commuting, or if you're on the subway where it's not really as easy if you're standing up to read, or you're taking a walk, or you're taking a run - you can listen to articles in your areas of interest."

In the UK, just 9% of 2,000 people in the UK surveyed for the latest Digital News Report from the Reuters Institute for the Study of Journalism said they had paid for online news in the past year. This means there has only been a small increase since 2016 when the survey found 7% were willing to pay.

Germany and France, two of Readly's other core markets, are not much higher on 11% each. By contrast a third of people in Readly's home country of Sweden say they pay for online news.

However, Lindqvist sees "ample growth" potential in all of Readly's markets despite these numbers.

"The penetration of digital all-you-can-read services is still so low, so even if there are local differences, the room to grow is still big enough in all of these markets. We are a leader in all you can read direct-to-consumer magazine and newspapers in Europe, but we are still relatively small. I mean, we're within the range of half a million subscribers. So there's still ample growth to be had in all these markets."

Readly has also decided to be more specific about its target audience and focus on those people with a proven propensity to pay rather than everyone.

"Historically, it's been more about being an ubiquitous service like the 'Spotify of magazines'. However we have redefined it now.

"We have a product that is not for everyone. It's for a lot of people, but it's not for everyone. And our target group is people with an established habit or an established willingness to pay for editorial content."

Why Readly revenues can be part of publishers' digital transformation

In the UK, the latest magazine ABC figures published this month show digital editions have been massively boosted by "all you can read" services like Readly. The digital circulation of 147 UK magazines rose by 15.4% year-on-year on average in 2023.

At Immediate Media's BBC Science Focus magazine, 105,456 of its 107,646 digital sales total was "all you can read". Bauer's Car magazine had 57,725 all you can read sales out of 60,201 and at Grazia it was 47,031 out of 48,238. ABC says that "all you can read" numbers only include editions that have been actively opened by a device for viewing, and there can only be one view per device.

Lindqvist noted that Readly contributes a "double-digit percentage of digital circulation to a lot of strong established magazine brands".

He added that for many magazine publishers "successful digital transformation is a combination of revenue streams: direct digital subscriptions and other revenue streams whether those are events or affiliate, shopping, e-commerce, but also revenues from players like Readly".

Readly's relationship with publishers has evolved in the past ten years, Lindqvist said, as "previously publishers were unsure "whether we were cannibalising or contributing to them.

"Over the years working together with publishers, those that joined the platform early but also from the outside those that were hesitant to join and wanted proof before they joined, it's been over and over established that we contribute to publishers' businesses - and it's real money now.

"Readly started ten years ago as a start-up - then we were very small, now we're starting to be bigger, and over those years we've contributed more than £100m to publishers and just looking at 2023 last year, it's in the range of £30m only in one year. So we like to think that we are contributing to that digital transformation with how we fit into that portfolio of revenue streams."

People tend to stay in a direct subscriber relationship with a brand if they have a "very strong relationship" with it, Lindqvist said. But other people may have previously been subscribers but left for various reasons, whether they moved away from print or found a subscription doesn't fit into their lifestyle and started to prefer other media formats, and these are the types of users who may come back to magazines through Readly.

"So in that sense, we managed to attract subscribers that some of the magazine brands don't manage to attract on their own," Lindqvist said.

Although Readly saw both revenue and subscriber growth in 2023, Lindqvist said they are "not growing as fast now and that's intentional".

He explained that "unit economics", or how profitable each of Readly's customers is, are now the core focus.

"So what goes into that equation is, of course, things like loyalty, how long they stay - there is a cost associated with attracting a customer and subscriber acquisition cost. And the longer those users stay, the more loyal they are, the better the unit economics become. So that's one factor. We've done a lot of things to improve loyalty."

Improving the mobile experience will boost loyalty, Lindqvist said. But he added: "Of course, the core of loyalty, the core of user satisfaction and the core of why users come to Readly is our content - the content, the publishers, the brands. That's what we've built everything around."

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog