The new chief executive of Future John Steinberg has said other publishers “would kill for the deck of cards that we’ve been dealt” as they battle the current “challenging environment”.

He was speaking to Press Gazette as Future shares fell 14% on publication of half-year-results which showed revenue flat, but profits down and full-year results expected to be at the low end of expectations.

Steinberg, who joined Future on 3 April, also said he hopes to make the publisher “an innovative company, like a Google or an Amazon”.

“I want us to be able to do lightweight, cost-efficient experiments and see where they go,” he told Press Gazette on Thursday.

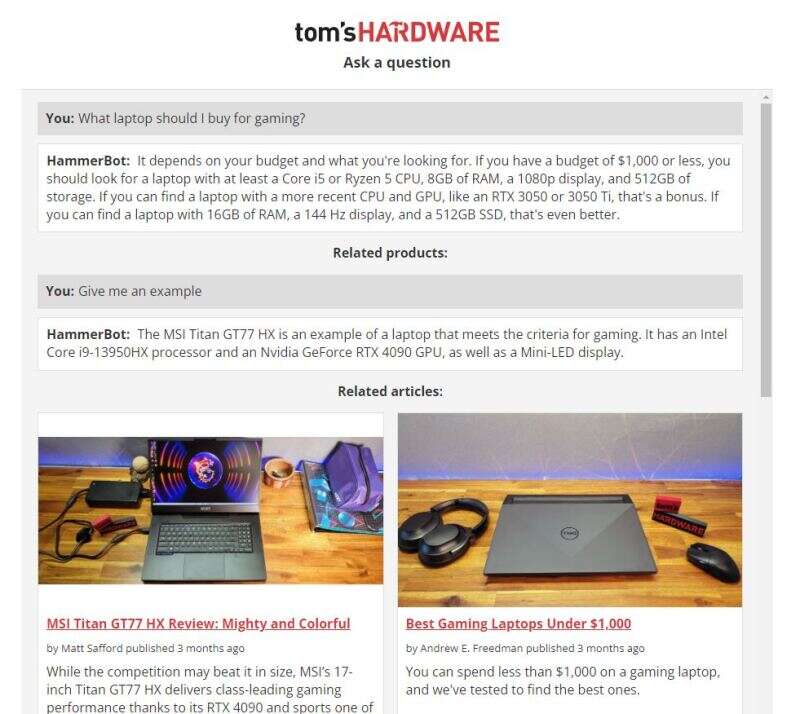

One experiment that launched on Thursday is an AI chatbot on the Tom’s Hardware website that enables users to ask questions and be recommended products and specific articles they may find helpful.

“We want to roll it out to other sites,” Steinberg said. “I mean, you could imagine on Marie Claire it giving fashion or makeup advice before presenting relevant articles on doing a particular style or the like.”

Steinberg, a former president and chief operating officer at Buzzfeed which is now using AI to create quizzes and travel articles, said the Tom’s Hardware chatbot can be a “beacon for how AI and articles can work together in concert with one another”.

“The other area where we’re using AI is in Australia right now we’re testing using AI to generate product specifications which are then carefully checked and edited by an editor and that’s a time-saving technique,” he added. “We will not be using AI without editor intervention and editor use.”

Asked how else he was innovating at Future so far, Steinberg listed the things he is “focused on right now”: “They may not be as exciting as the chatbot but diversifying our traffic, building our US trading relationships, doing more branded content, which has our highest revenue per user of any product that we sell.

“Focusing on home pages, video creation and distribution – video is only 11% of our on-site ad revenue right now. So there’s a lot of headroom for us to be doing more in video. And then events – we just had Decanter’s World Wine Awards last week and that’s an event that makes millions of revenue and millions of profit, and so I think events will be central to our strategy as well.”

Steinberg also said Future will begin focusing on digital subscriptions in a way it never has before.

“We have hundreds and hundreds of thousands of subscribers across all of our print portfolio and looking at transitioning them or getting them to take a bundle of print and digital is definitely going to be a focus of mine this year, and next year,” he said.

“We need to experiment there. We need to give it a try. I think the New York Times is the beacon and the leader in digital subscriptions and so we’re going to study them and see how we’re able to replicate a digital subscription strategy.” The NYT now has 9.73 million subscribers, of which 9.02 million are digital-only.

Future’s legacy magazine subscription portfolio reported an organic decline of 5% in the half-year put down to people unsubscribing from their pandemic subscriptions, but subscriptions now make up 48% of the publisher’s total magazines revenue which it said was a “robust source of recurring revenue”.

“To date we haven’t had much of an effort underway on digital subscriptions,” Steinberg said, “so we’ve sort of left off the table a whole revenue line… we need to explore it. We need to try to make it work.”

Future HY 2023 organic revenue and profits down

Future’s half-year results to 31 March, before Steinberg’s arrival, show revenue flat at £404.7m but organic revenue (excluding acquisitions that had not been in the portfolio for a full year) down 10%.

Pre-tax profit was down 18% to £66.4m and adjusted operating profit declined by 3% to £130.3m. The company said this was "partly mitigated" by cost-saving initiatives in "offices, staff location and re-prioritisation of investment".

As a result Future has set out a "cautious outlook" for the full year, as Steinberg put it, at the bottom end of market expectations. Explaining why, he said: "First of all FX [foreign exchange] is is a headwind now in H2, whereas it was a tailwind before.

"We're not expecting audience improvement because in the period a year ago," he continued, explaining that the Amber Heard versus Johnny Depp trial last year "drove an enormous number of sessions so we're going to be lapping that huge spike.

"We're not assuming an improvement in macro trends. We're investing in US growth... But on the cost front, we are seeing the benefit of the cost savings initiatives that are going to continue to roll into H2." Some £5.3m was spent on restructuring in the half-year.

However Steinberg added: "I think we're in a challenging environment but others would kill for the assets and positions that we have," later repeating: "I think people would kill for the deck of cards that we've been dealt."

This is largely, he said, because Future "focuses on intent media as I like to call it - people who have an intention to explore their passions, or research a specific product or something like that. And I think that's really powerful as opposed to other types of media, which don't necessarily have that kind of strong passion behind them."

Steinberg added: "I would say that everybody is dealing with the same digital ad macro environment. I would say that we are privileged with the set of assets and the diversification that we have and the high intent and the fact that we have the affiliate revenue, we have the magazine print revenue, which actually buffeted up nicely against the digital trends during the period.

"The fact that we have all this diversification - and we have Go Compare which was up 4% during the period - I think has served us really well and has really made a steady shift that can deal with these particularly aggressive currents that are out at sea right now."

'Silver lining' of 'resilient yield'

Future's magazine revenue in the half-year was £139.2m, down 5% year-on-year on an organic basis, compared to £132m from advertising and other media (down 15% organically) and £133.5m from affiliates (down 10%).

In particular, digital advertising revenue was down 18% "despite improved monetisation due to the impact of lower online audiences," according to the results published on Thursday. "Importantly, the yield has remained very resilient as a result of the quality of our audience, and a favourable mix with more direct advertising. This demonstrates the group’s ability to deliver valuable audiences to advertisers."

Steinberg said his "silver lining headline" of the results was that "despite diminished audience, advertisers wanted to pay up to reach our audience".

This also related, he said, to affiliates which, despite the 10% drop, grew its eCPM (the unit price paid for product e-commerce) by 7%.

Future's results statement twice mentioned the effect on audience of a major Google algorithm change on some of its technology sites such as Tech Radar. However, the company and Steinberg noted that it kept its Comscore position as number one publisher for consumer technology in both the US and UK.

'Huge growth opportunity' for Future in US

It also claimed the position of number one in the UK and four in the US in the homes vertical with brands such as Ideal Homes, Real Homes and Livingetc, and number four in the UK and seven in the US for fashion and beauty with brands like Marie Claire and the May 2022 acquisition of Who What Wear.

The US is a "huge growth opportunity," Steinberg said, noting that it is "where my experience, knowledge and network are". As well as Buzzfeed, Steinberg's previous roles have included chief executive for North America at Mail Online, board member at Bustle Digital Group, and founder and chief executive of financial news streamer Cheddar News.

Currently 41% of Future's revenue comes from the US, with the rest from the UK. The company said the bigger organic year-on-year decline in the US (17% versus a 5% drop in the UK) was in part down to a 22% decline in digital advertising and other media revenues and a 24% dip in affiliates, offset by 3% growth in magazines largely in subscriptions - although the publisher has more magazines in the UK.

Steinberg said: "We need to invest in sales force there. Right now, our yield in the US is actually higher than our average yield in the UK.

"The issue in the US is that we're not selling enough because we're just now establishing the relationships with the brands and the agencies, and so we really need to focus on that and we really need to build out that sales force and invest in it and invest in sales support."

Despite his history at Buzzfeed, where he worked between 2010 and 2014, Steinberg is not put off by the current difficulties at some digital media companies such as his former employer which has closed Buzzfeed News and Vice which has declared bankruptcy.

He said: "I think that there are a handful of companies that specialise in high intent media - I would say our peers are Ziff Davis and Dotdash at IAC, and Red Ventures - and so I don't feel like we're in the same category as others in the digital media landscape that may be struggling right now. So I feel very confident about our position."

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog