Almost a third (31%) of news publishing bosses believe the ongoing decline of advertising revenues is the biggest risk to their organisation’s future success, according to a new report.

The second biggest risk, according to 21% of the more than 90 news executives and managers from 51 countries, would be an inability to diversify revenue streams.

The continuing Covid-19 pandemic, plus fears over a second wave, was cited as the biggest concern by 13% of those taking part in the survey (which was carried out about six months ago, before cases rose over the winter and the vaccine roll out began).

The World Press Trends report, published by the World Association of News Publishers (WAN-IFRA), found paid-for digital content was the top investment priority for 2021 – followed closely by reader revenue technology.

Asked “what is the single most important change that has to be implemented in their organisations in the coming year?” 44% said accelerating digital transformation strategy – likely focusing on audience-first, reader revenue, data and product development projects.

Fears around ad revenues remain prominent despite ongoing growth in reader revenues.

Mail Online, the world’s second biggest English language newspaper website, yesterday launched a legal action against Google because it said monopolistic practices around advertising technology were stopping publishers from growing their revenue.

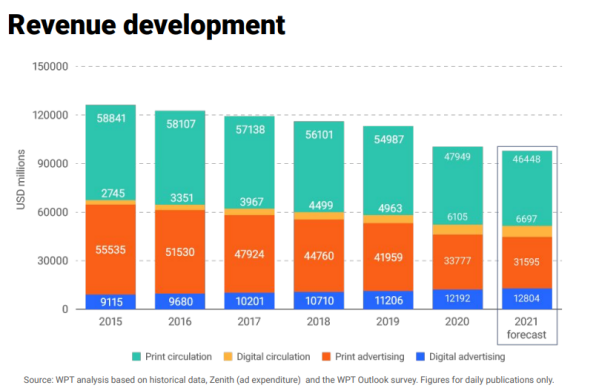

WAN-IFRA chart on revenue development

Digital reader revenue was up by a quarter last year but still only made up 6% of publishers’ total worldwide revenue, WAN-IFRA estimated.

Digital readership grew by 36% while print readers declined by 11%.

WAN-IFRA cited Chartbeat data showing that the proportion of subscribers among news publishers’ audience grew everywhere around the world in 2020, as did the loyalty of those subscribers.

The report said: “Digital subs (or some form of it) alone are not a panacea for solving a publisher’s or the industry’s business model challenges.

“But it can go a long way in building a more sustainable future and aligning the entire news operation (editorial, tech/data, commercial, marketing) – all focused on your audience, serving it, learning from it, and, ultimately, reaping from it. It’s a cultural change, and one steeped in data – the importance of a data culture cannot be overstated.”

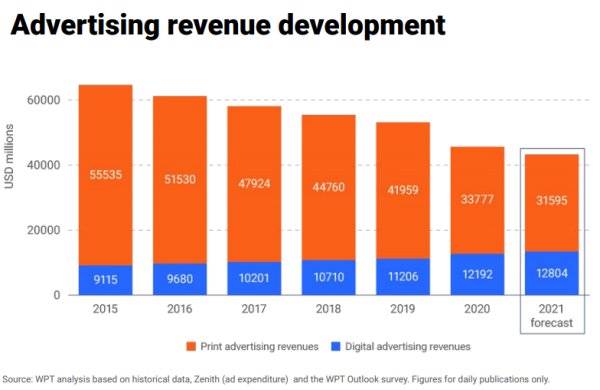

WAN-IFRA chart on advertising revenue development

Advertising was still cited as the single most important source of income (by 27%), followed by subscriptions (21%) and single-copy sales (10%).

“It is easy to get lulled into thinking that the ad side of the business is dead,” the report said. “It’s not. It is indeed challenging, and getting more challenging… but quality publishers are still rolling out smart, premium advertising strategies.”

WAN-IFRA estimated that publishers increased their digital ad revenue by 9% last year despite budgets shrinking because of Covid-19 – but it warned the departure from third-party cookies means “challenges will abound”.

[Read more: How Google is building an internet without cookies – and why publishers are concerned]

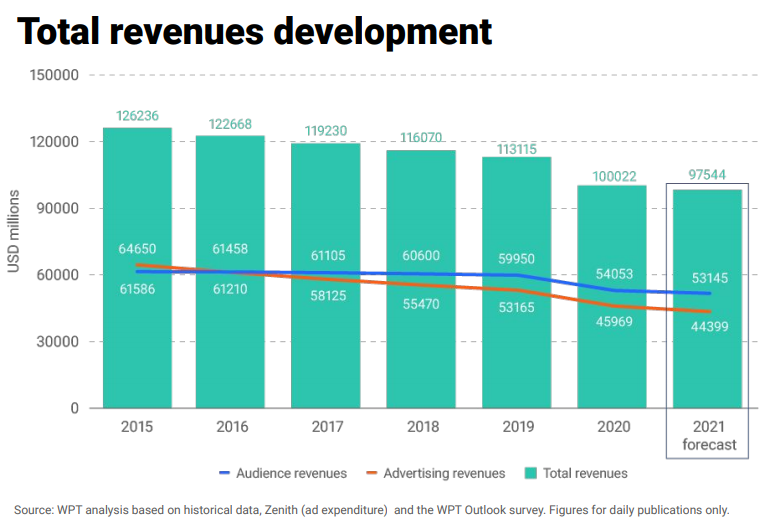

WAN-IFRA chart on publishers’ revenue changes

Two-thirds told WAN-IFRA’s survey their companies will fully recover from the pandemic.

“It’s worth noting again that news organisations in many markets around the world were already facing big financial challenges pre-pandemic,” the report said.

“So one of the clear silver linings of the crisis has been how most publishers smartly (and quickly) adapted to the situation, implementing new working conditions, efficiency measures and workflows while introducing new products and content.”

On average, publishers reported that they reduced their staffing by 4.4% over the previous year with WAN-IFRA describing the cuts as “inevitable but not brutal”. It pointed out that the vast majority of these publishers had seen double-digital revenue declines.

Picture: Shutterstock

Read New Statesman Media Group’s free white paper: How to define, discover and develop actionable leads in B2B marketing

Read New Statesman Media Group’s free white paper: How to define, discover and develop actionable leads in B2B marketing

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog