The coronavirus pandemic has cost the UK news industry more than £2bn in lost events revenue, but the future of events looks more positive as the industry puts into action lessons learned during lockdown.

Live physical events could return as early as summer 2021 if all goes well with the roll-out of Covid-19 vaccinations, leading to an easing of lockdown restrictions, but the comeback is expected to be gradual and likely won’t include large-scale exhibitions this year.

Virtual events, an industry which grew up in a matter of months during the pandemic, will continue to play a role even when a return to “physical” events is made possible, industry experts have said.

“Hybrid” is the buzzword for events in the post-pandemic age, with companies reluctant to give up the advantages gained through digital – e.g. larger audiences, easy access to big names and data insights – while also meeting the demand for face-to-face interaction.

“I don’t think we’re ever going to go back to where we were before, in the sense that the product will be different. We’re never going to let go of that digital piece,” said Orson Francescone, managing director of FT Live, the Financial Times’ events arm.

The pandemic’s impact on events, which pre-crisis were a growing revenue stream for publishers, particularly in the B2B sector, was considerable. A rapid switch to virtual events by the industry has helped to offset some of the losses, but not all suited the transition.

Lost events revenue for the first half of 2020 across B2B publishers and business intelligence companies (per published full and half-year results) was pushing £2bn. This lost income has had a knock-on effect on total revenues, which are down across the industry.

Business intelligence and events company Informa revealed in September that it had cancelled more than £1bn of physical events revenue for 2020. The group now predicts total revenues of up to £1.7bn for the year, down from £2.9bn in 2019 – a drop of 41%.

B2B specialist Euromoney reported total revenues down 16% (£66m) for the year to the end of September 2020, with pre-tax profits falling by 45% to £57.4m. The group’s annual report said the drop in profits reflected “the significant impact of Covid-19 on our physical events business…”. Revenue from events was down 57% for the year, from £126.2m to £53.8m.

At Ascential, which owns Retail Week, the impact of Covid-19 on events revenue was £98m. Events made up a third of total revenue in 2019, in the first half of 2020 this fell to just 2%. Pre-tax profits fell 99%, from £61.7m for H1 2019 to £0.4m for the same period in 2020.

Revenue from events and exhibitions at Mail Publisher DMGT fell by a third (35%) in 2020 to £79m, down from £119m the year before – a drop of £40m. Adjusted operating profit for DMG Events fell from £22m in 2019 to £4m last year.

In its annual report, the group said DMG Events, which runs B2B conferences in the energy, construction, hospitality and leisure sectors, had been “severely affected by the impact of Covid-19”.

Prior to Covid-19 it hosted more than 50 events each year, attracting over 300,000 visitors and exhibitors. The business held no physical events in the last seven months of 2020. It did run several virtual events, but said these were “not financially significant”, only helping to “maintain the brand profiles, expand audiences and sustain customer relationships”.

But DMGT said it believed the “longer-term outlook for events and exhibitions is strong, as the importance of face-to-face events increases in a digitising world” and it would launch new events “where opportunities arise”.

The group reported pre-tax profits down 60% to £52.4m for the year to the end of September 2020. Total revenues were down 10% year-on-year, a drop of £134m.

| Company | Events revenue fall | Total revenue H1 2019 | Total revenue H1 2020 | Pre-tax Profit H1 2019 | Pre-tax Profit H1 2020 |

| Ascential | £98m | £144.3m | £236.2m | £61.7m | £0.4m |

| Informa | £1bn+ | £1.4bn | £814.4m | £377.8m | £71m |

| RELX | £483m | £3.9bn | £3.5bn | £1.1bn | £858m |

| Total revenue 2019 | Total revenue 2020 | Pre-tax Profit 2019 | Pre-tax Profit 2020 | ||

| Euromoney | £72.4m | £401.7m | £335.3m | £104.6m | £57.4m |

| DMGT | £40m | £1.34bn | £1.2bn | £134.3m | £52.4m |

Press Gazette spoke with event directors at the FT, Bauer Media and Hearst UK about the impact of the pandemic on their events, the switch to digital and what the future of the industry looks like.

Events revenues were expected to be down at each publisher during the pandemic, although not all have published their accounts for 2020.

Financial Times

In a normal year, the Financial Times would run about 150 physical events around the world – mainly B2B conferences for key industries, such as finance. Its first digital event during the Covid-19 crisis was a webinar in April titled the Global Economic Emergency.

“We turned [the event] around in four days and we got 8,000 people registered for that… it was suddenly like ‘crikey, clearly there’s something in this’,” said Francescone, who joined the FT in November 2019 and has more than ten years’ experience in events organising, having previously worked at Haymarket Media Group, DMGT and Euromoney.

He said the webinar’s success was the “spark” that led to The Global Boardroom, a new digital-only event born as a result of the pandemic and delivered within five weeks, drawing 150 speakers and more than 50,000 people attendees over three days in May 2020.

It has become the FT’s most profitable event and its “biggest launch ever”, Francescone told Press Gazette. Guests included ex-UK prime minister Tony Blair and ex-US vice president Al Gore, a line-up it might have taken up to two years to organise in normal times.

“The power of digital meant that suddenly in five weeks we could corral this incredible audience from all over the world because people could call in on Zoom,” he said. “That was a huge eye-opener for us. Suddenly we went from digital being a bit of a lifesaver to digital being a big opportunity.”

Francescone said digital events had allowed the FT to “supercharge” the internationalisation of its audience base “in a way that could never have happened in a physical environment”.

The FT ran some 290 events by the end of 2020. Its events business, which includes public conferences as well as private client-tailored events, is now operating as digital-first.

The group’s event successes in 2020 were, however, outweighed by the cost of cancellations contributing to the need for 64 redundancies at the end of the year and an expected loss for 2020 compared to a £29m profit in 2019.

Francescone said virtual events had a low cost base – there’s no need to hire a venue and feed guests, for example – and a high profit margin, although the FT’s events revenues were down year-on-year. He said attendee data also has “a lot of value” and could be used to grow subscriptions.

The FT is using a “freemium” virtual events model, with extras such as on-demand service post-event and access to B2B networking technology costing more, while the basic ticket remains free. But the model is mainly driven by sponsorship, he said, “because it’s hard to command those big-ticket prices online”.

Francescone said a return to physical events would be driven by demand. “We can [have] the best of both worlds,” he said. “No matter what happens in the future all events are going to be hybrid… I don’t think anyone is ever going to run a large public-facing B2B event without a digital component ever again.”

These “hybrid” events could offer different experiences for those attending in-person and those engaging online, with content curated for each group. “So there will be some content that will be exclusive to people who turn up in person that you don’t maybe want to show on a digital environment.”

Francescone is relaxed about the return of physical events, which he said his team can run “with our hands tied behind our backs”, having done so for years, adding: “Compared to digital events it’s a walk in the park.”

He predicts they will return in the second half of 2021, around the autumn, but that it will be gradual and start small and localised – “an intimate dinner for 50 people in London rather than a mega international conference for 1,000 people in New York”.

“As and when we’re allowed, and it makes sense and our clients want them, trust me we will turn that tap on very quickly and with a lot of ease,” he said of physical events.

“What is not going away is the digital component, because why would we want to give up those big international audiences, both from an FT point of view and also our sponsors… are getting much bigger volumes of data.”

But he said that even when physical events come back “that doesn’t necessarily mean that they’ll all go back, because it’ll be a mix and some events will exist in digital format forever”. He added: “We’re in a world where now we can play in both models and both spaces.”

Bauer Media

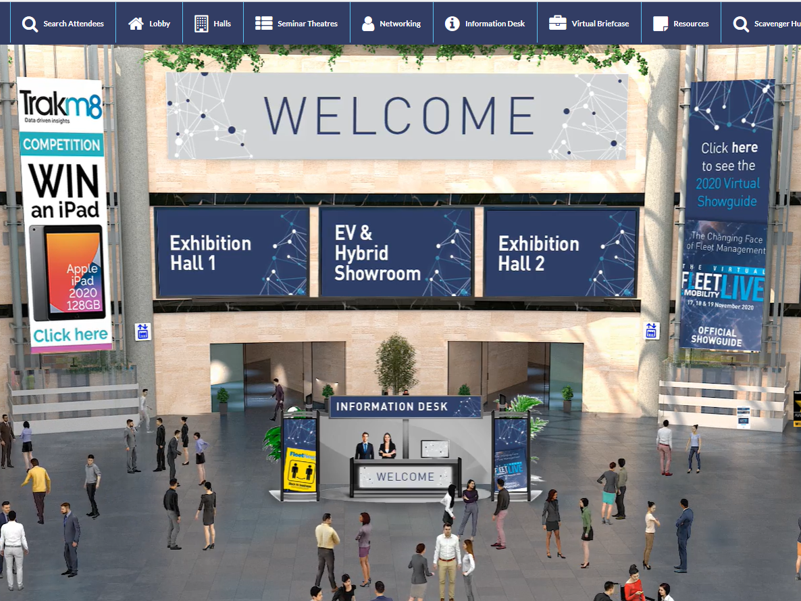

Bauer Media hosts around 60 B2B events of varying sizes in an average year, covering exhibitions, awards, conferences and group meetings. When Chris Lester, event director for Bauer Media’s B2B brands, spoke to Press Gazette in December, this had fallen to about 30.

Lester, who has nearly 30 years’ experience in the events industry, said revenues for B2B events at Bauer were down 60% from March to the end of 2020 as a result of the pandemic and lockdown restrictions. Events make up just over half of the B2B revenues at Bauer.

Lester said his team experienced “first hand” how Covid-19 would impact its events business at their last live award ceremony, the Fleet News Awards, when on the day of the event on 11 March the coronavirus was declared a global pandemic and 40% of the audience dropped out.

Bauer Media’s biggest B2B event, Rail Live, which was due to take place in June 2020 and typically hosts 5,000 visitors over two days was postponed before being cancelled altogether. “It’s a very experiential event… and you couldn’t reflect that in a virtual environment,” said Lester.

But Lester said smaller events, such as membership groups and meetings, “pivoted from live to digital with minimal impact” with attendance and revenues holding despite the change, while some events saw increased audience numbers and stable revenue.

Virtual events are “just as difficult” as physical events, said Lester. “You’ve got to invest just as much time in a virtual event as you have an in-person. Obviously it’s a different world, but you still need resource to do that – it’s not easy.”

He said lessons learned at Bauer UK include the importance of setting out the online customer journey and that “content is king, even more than with live events”, adding: “It’s the content that draws the audience in. Content is the engagement tool.”

Lester said virtual events could not match in-person events for turnover. He estimated that the loss in revenue from a total switch to virtual events would be more than 50%. “It’s clear it is a different economic business model,” he said. “Profit margins can be higher, but revenue’s much lower and cost base much smaller.”

But he said virtual engagement would continue even when physical events return. “There’s been far too many exciting virtual events to say this stops now. It shouldn’t,” he said.

“I think we’ve got to accept that we’ve been able to reach more people with our virtual events, therefore it would be madness to stop. I think the [virtual event] platforms have got better and there’s continuing development, allowing for even better engagement for stakeholders.”

He said that bringing the physical and virtual together “will form our event strategy of the future”.

Lester said events could return as early as this summer, with Rail Live set to return in June in an outdoor venue. But he said there wouldn’t be a return to normality until 2022, with some event suppliers having been put out of business by the pandemic.

Bauer Media has yet to publish its accounts for 2020.

Hearst UK

Hearst UK’s events arm, Hearst Live, normally runs from 70 to 100 events a year for its B2C titles, including Esquire, Elle Harper’s Bazaar, Cosmopolitan, Men’s Health, Women’s Health. These paid, ticketed events range from gatherings of up to 50 people to the likes of Women’s Health Live, Hearst UK’s biggest single event, which hosts up to 8,000 people.

When lockdown came into force in the UK, Hearst UK pivoted some events to virtual, but not all were suitable. It delivered fewer than ten events during the pandemic months last year.

“Our quickest pivot [to virtual] was Women’s Health Live,” said Nikki Clare, head of events at the magazine publisher. “Within three weeks we had cancelled the [physical] event, communicated to all stakeholders, and then spun it into a virtual event, which was hugely successful.”

Women’s Health Live Virtual, which was free to view, ran twice last year, in April and May, and had a total of 14m views.

Clare, who’s worked in events for 13 years, including four at Hearst UK, said interactivity was key to virtual events when it came to engaging consumers. “At a physical event it’s very unlikely you’re going to get up and leave halfway through, at a virtual event people can tune out on Zoom quite easily and you don’t really know,” she explained.

She said a live Q&A running throughout the event was one way to help “bring the content to life on an individual basis”. She also said that “content is king”, adding: “We’ve really made sure that we are curating content that works to consume at home and which is useful.”

One benefit of virtual events has been that consumers who were previously excluded from London-centric events, owing to geography, can now access them anywhere in the world.

Clare said purely digital events could not match the same level of revenue as physical events, particularly in the B2C space where the selling point is the allure of being in the presence of big-name stars or powerful political figures, for example.

But she added: “I think hybrid is where you can match it equally, if not surpass it, because actually you get access to much wider audiences… much wider talent – because is it now okay for someone to Zoom into an event, even if it’s physical.”

Hearst UK is predicting reduced revenue for 2020 but has yet to publish its accounts for the year.

Clare said the pandemic had accelerated the B2C events space ahead by five years. “There’s a lot of things that we’ve learned last year that will continue for years to come,” she said.

“I don’t think virtual is going go away because we’ve now accelerated our way of working, but it will probably be in a different way to how we’ve seen in the last 12 months because I think we’ll see hybrid as ultimately the solution that we use much more going forward.”

She predicts that September will see the first small physical events, all being well, after which time numbers will start to slowly increase.

“I would love nothing more than to get back to doing physical or hybrid events, and I think this year is definitely the chance that we will get to do that, but we just… need to make sure that they’re safe, that people feel comfortable being there.”

Picture: Bauer Media

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog