The names of thousands of offshore companies have been shared online in a “careful release” by journalists involved in the Panama Papers story.

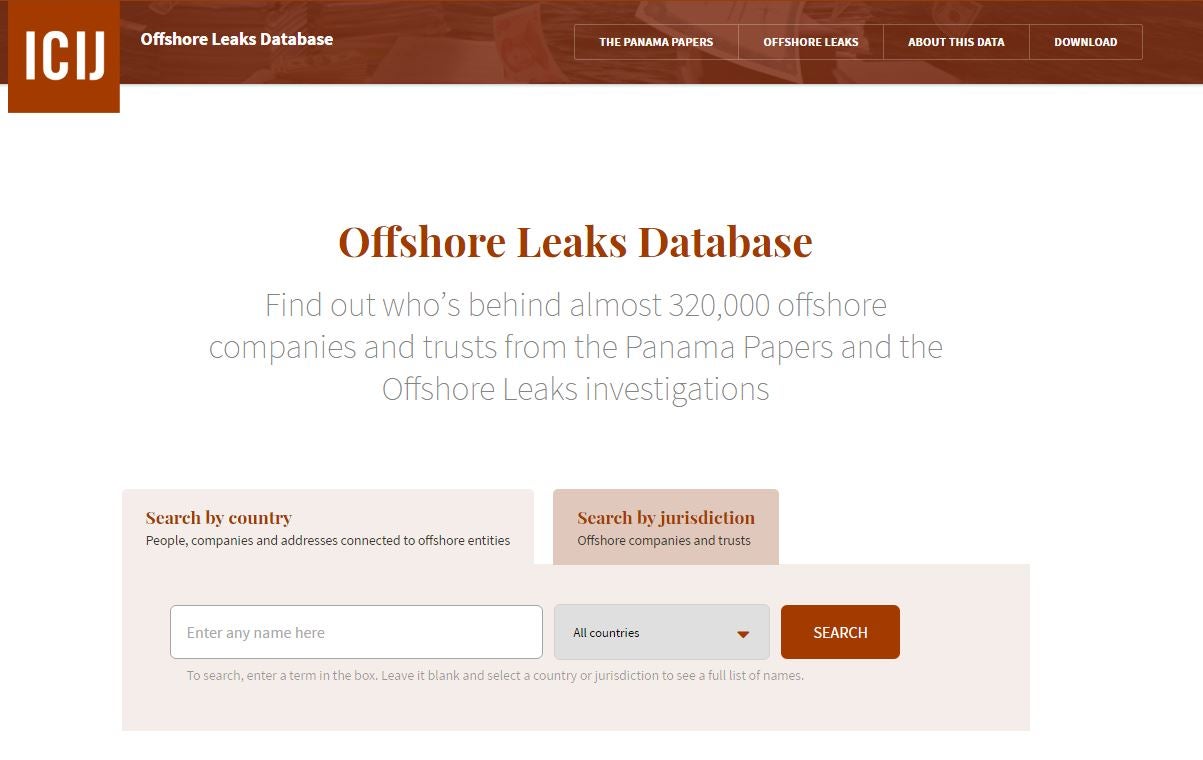

The International Consortium of Investigative Journalists released 200,000 data entities relating to Panamanian law firm Mossack Fonseca on its website yesterday evening. The leak, set up as a searchable database, contains basic corporate information about companies, trusts and foundations set up in 21 jurisdictions, including Hong Kong and the US state of Nevada.

The ICIJ, based in Washington DC, boasts an active global network of 185 reporters in more than 65 countries. It first shared data about Mossack Fonseca – who claims to have been hacked – with 107 news organisations worldwide, including The Guardian and BBC Panorama in Britain, last month.

Defending yesterday’s online data dump, the group said it was “not publishing the totality of the leak” and was “not disclosing raw documents or personal data en masse”.

It added: “The database contains a great deal of information about company owners, proxies and intermediaries in secrecy jurisdictions, but it doesn’t disclose bank accounts, email exchanges and financial transactions contained in the documents.”

A statement that must be acknowledged with a click before gaining access to the searchable database reads: “There are legitimate uses for offshore companies and trusts. We do not intend to suggest or imply that any persons, companies or other entities included in the ICIJ Offshore Leaks Database have broken the law or otherwise acted improperly (…).”

In all, the interactive database reveals more than 360,000 names of people and companies behind secret offshore structures, though some names may be duplicated.

According to the ICIJ, this newly public data represents “a fraction” of the Panama Papers, which it describes as “a trove of more than 11.5 million leaked files”.

The data was originally obtained from an anonymous source by reporters at the German newspaper Süeddeustche Zeitung, who asked the ICIJ to organize a global reporting collaboration to analyse the files

Reports based on the documents led to the resignation of Iceland’s Prime Minister David Gunnlaugson after it was revealed he and his wife had set up a company in the British Virgin Islands that had holdings in Iceland’s failed banks.

Prime Minister David Cameron, who has campaigned for financial transparency, faced questions about shares he once held in an offshore trust set up by his father. The ICIJ reported that associates of Russian President Vladimir Putin moved some $2bn through such companies. Putin’s spokesman dismissed the report.

Hundreds of economists have urged world leaders to end the era of tax havens, arguing they only benefit rich individuals and multinational corporations and serve to increase inequality. A letter coordinated by activist group Oxfam, signed by 300 economists, in the wake of the story said poorer countries were hit hardest by tax dodging.

“As the Panama Papers and other recent exposes have revealed, the secrecy provided by tax havens fuels corruption and undermines countries’ ability to collect their fair share of taxes,” the letter said. “While all countries are hit by tax dodging, poor countries are proportionately the biggest losers, missing out on at least 170 billion dollars of taxes annually as a result.”

Many of the companies that featured in the Panama Papers were incorporated in British Overseas Territories and the British Virgin Islands.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog