At first glance, the Boston Globe’s digital subscriber growth this year might appear underwhelming.

After a bumper 2020, when its digital-only subscriptions jumped from 145,000 pre-pandemic to 223,000, 2021 has seen a return to normalcy.

As of Tuesday this week, the Globe said it had approximately 225,300 digital-only subscribers – still well above early 2020 levels, but only slightly ahead on this time last year.

These headline figures only tell part of the story, however.

Like many other news publishers, the Globe’s digital subscription business boomed last year as readers – encouraged by a generous promotional offer – sought to keep abreast of Covid-19 news in Boston.

As interest in the pandemic waned – and the “bump” that accompanied Donald Trump’s presidency threatened to turn into a slump – the Globe and other publishers faced an anxious wait to find out whether Covid-era subscribers would stick around.

Click here to subscribe to Press Gazette’s must-read newsletters, Future of Media and Future of Media US |

The Globe was anticipating a flood of cancellations in the autumn of 2020 – as many new readers were moved from promo ($1 for six months) to full-price (approximately $1 a day).

The cancellations did come – the Globe’s digital subscriber count had fallen to around 216,000 by January 2021 – but not at the rate that the title’s leaders had feared they might.

Ultimately, says the Globe’s vice president for consumer revenue, Tom Brown, the Covid cohort’s retention rate proved to be the same “as groups we acquired before the pandemic”. The blow of falling reader numbers was also significantly cushioned by revenue growth as small introductory payments gave way to full-price subscriptions. Brown expects the Globe’s digital subscription revenues to be up around 30% this year.

“Because we’re moving so many people to full price at the end of their promo period in such a condensed period of time, it still meant a period of increased cancellations, which we were expecting,” he tells Press Gazette

“But this coincided with a period of tremendous revenue growth. Because at the same time people are going from a trial offer, which is essentially free for six months, to paying the full rate of a dollar a day – so about $30 a month for a subscription.

“I would say if you are not on the analytics team, it could be a little disorienting for people to see like: whoa, what are these big dips? But really, it was pretty much expected just because of the way we grew and how we grew so quickly.”

The Globe’s $1 for six months experiment

The Boston Globe first went behind a paywall in 2011, when it was still owned by the New York Times (since 2013, it has been owned by chief executive Linda Pizzuti Henry and her husband, John W Henry, who also owns the Red Sox and Liverpool Football Club).

It took the Globe about seven years to reach 100,000 digital-only subscribers in October 2018. Around this time, says Brown, “we were starting to stagnate a bit in terms of subscriber growth”.

To find new subscribers, Brown says the Globe embarked on what was seen at the time as a “radical” experiment – selling six months of access to its website for $1. Previously, it offered four weeks for $1 as an introductory offer.

“It was a big thing for us to try this test because our mantra has always been a dollar a day,” says Brown. “And we really believe that we need to charge to survive. Because the belief was we can’t go for scale like a national player can – so we really gotta maximise reader revenue in our region.”

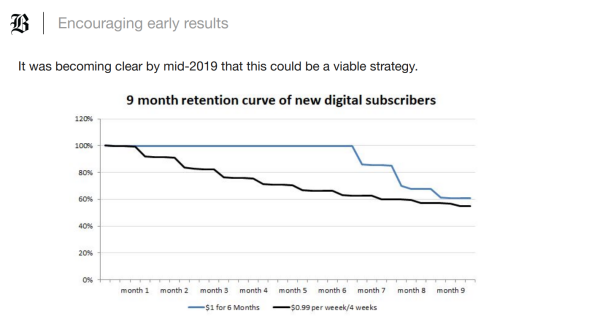

The Globe initially ran the offer for one day and tracked its success beyond the six-month period. Brown’s team found that not only did the offer attract more paying readers – “we got about ten times the conversion rate of what we’d see on a normal day” – but it also brought in highly engaged new subscribers.

“Which at first was counterintuitive to us,” he says. “But then we thought maybe what we’ve done here is tap into a new audience – an audience with a willingness to pay, but not a willingness to pay $30 right out of the gate.”

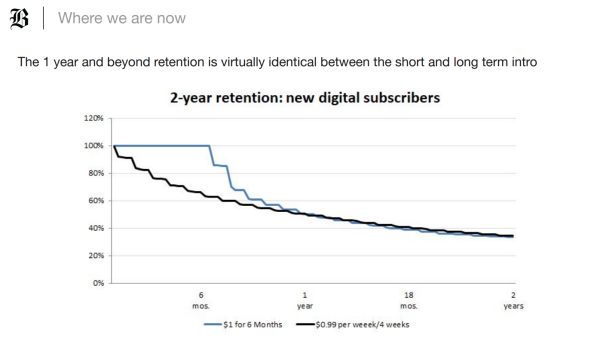

After six months, the Globe found that a surprisingly large proportion stuck with their full-price subscriptions. In the longer term, Brown’s team observed little difference in the behaviour of those who had signed up through the $1-per-six-months offer versus those who had paid $1 for their first four weeks.

The graphs below, taken from a slideshow Brown gave at an INMA conference earlier this year, compare those two sets of subscribers.

Covid ‘crystallised’ belief in our business model

The $1-for-six-months offer became standard at the Globe in the summer and autumn of 2019, says Brown. Fortuitously, this meant that subscribers were being moved on to full-price payments just as their interest in Covid-19 began to rise.

This improved retention rates at a time when “our acquisitions were shooting through the roof,” says Brown.

The Globe chose to keep Covid-19 content behind its paywall, partly because its sister websites, Boston.com and StatNews.com, were providing free content.

“And also there’s just the fundamental core value that we believe our content is worth paying for,” adds Brown. “And in order for us to continue to produce it, we need to charge for it. And at a time when what we do is even more vital to people, we thought it would actually go against our values to make our content free.”

Brown says the Globe hit its year-end target for subscribers in the early months of the pandemic.

Reflecting on this growth now, he says the Covid-19 period “really crystallised the fact that [our focus on digital subscriptions] is the right strategy for us”.

Brown says that Covid-era subscriptions are “now a very stable anchor to our base”. He is confident that the Globe’s loyal subscriber base has grown significantly over the past year, from around 60% of its total one year ago to 80% now.

He expects the Globe’s digital subscriber revenues to be up around 30% this year, following growth of more than 40% in 2020.

The Globe is also expecting its growth rate to pick up this winter following a slow year. “We’re growing at a good clip again,” says Brown, adding that the US news traffic in general fell into a “lull” between April and June, as interest in the US election, inauguration and Covid-19 waned.

The Globe’s ‘virtuous cycle’

As Brown acknowledges, the Boston Globe’s “dollar a day” digital subscription package makes it pricier than many of its general news rivals. The New York Times’ standard digital subscription, for instance, costs $4.25 a week, or 61 cents a day.

Why are Bostonians willing to pay more for the Globe?

“I don’t think you can really get what we do anywhere else,” says Brown. “You can obviously subscribe to the New York Times or somewhere else for more of a national perspective. But they don’t have the depth and breadth of what we do in our region, which I think is why we have a very sophisticated regional reader and subscriber base. And they’ve agreed with us in the sense that they’ve been willing to pay a premium price.

“We hear from subscribers all the time, and we see it in the comments a lot too. When we do something that’s really impactful, that really changes something say in government, or exposes some sort of corruption, or that type of coverage, we’ll often see outpouring of commentary from our subscribers. Like: ‘This is why you pay.’ ‘This is why you pay for the Boston Globe.’ ‘Thank you Boston Globe for doing this.’ ‘This is why people should pay for their news.’”

Encouragingly for journalism purists, Brown says that the Globe’s investigative team, Spotlight, is a major driver of subscriptions for the title.

“There are things that over-index, and there are things that slightly under-index,” he says. “And there’s one thing that really over-indexes, which is our Spotlight coverage and its ability to drive subscriptions. However, in the grand scheme of things, it’s a small percentage of the stories we’re writing…

“I think really what people want from us is a wider aperture of everything that we do… What our subscriber wants from us is that really wide variety of what a general interest news site like ours would provide.”

The main attribute Globe readers are looking for is quality journalism, says Brown, adding that this creates a “virtuous cycle” for the company.

“If we keep investing, we do well from a subscription standpoint,” he says. “We invest that back in the product, we hire more journalists. We do more immersive storytelling, more video, more investigative.

“It just becomes like that virtuous cycle where the product gets better because we have more subscribers and we get more subscribers because the product keeps getting better.”

Unless it radically changes its strategy, and starts investing in national and international news as well as regional coverage, the Boston Globe will never reach the digital subscription levels of the New York Times, Washington Post and Wall Street Journal.

But how many digital subscribers can the Globe ultimately hope to reach in the longer term?

“If I had to guess,” says Brown, “I think we could get to 450-500,000 subscribers. But to get there we’d need a slightly lesser revenue-per-user than what we have today.”

Photo credit: REUTERS/Brian Snyder

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog