When the man in charge of UK public finances is suspected to have hidden millions personally owed in tax that is a hell of a story.

And when that Chancellor of the Exchequer is running to be leader of the Conservative Party it becomes a toast-dropper.

No wonder founder of think tank Tax Policy Associates Dan Neidle picked up the prestigious Investigation of the Year prize at the British Journalism Awards in December for his coverage of Nadhim Zahawi’s business dealings.

But what does it say about the professional press that it took a tax lawyer working independently to get to the bottom of this tale?

“People who say ‘oh mainstream media are useless, the future is independent people like Neidle’ are completely misunderstanding what happened,” he tells Press Gazette over a video call from his Norfolk home.

Shoe leather journalism supported and complemented Neidle’s forensic and highly readable desk-based analysis of Zahawi’s financial dealings at every step of the investigation.

The latest public figure to get an uncomfortable public tax audit from Neidle is the Tory peer Michelle Mone, who was closely linked to a company that won PPE contracts worth £200m during the pandemic.

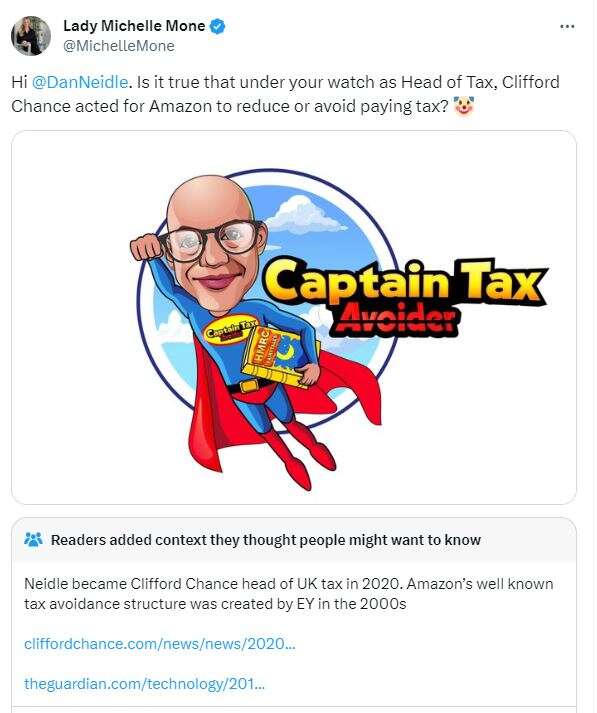

She ridicules Neidle as Captain Tax Avoider on social media in posts where she casts aspersions over his former corporate life and describes his interest in her family’s tax affairs as “creepy”.

But Neidle really is a sort of superhero, whose powers derive from the fact he has paired knowledge earned as one of the UK’s top tax lawyers with a flair for writing and a willingness to face down the sort of legal threats from his rich and powerful targets that would see many in-house media lawyer reaching for the figurative spike.

Captain Tax Avoider’s origins story

Neidle fell into journalism “completely by accident” at the time of the Tory leadership campaign to replace Boris Johnson in July 2022.

He had just retired from paid employment at the age of 48 after making his fortune as head of tax for the law firm Clifford Chance and set up a think tank dedicated to improving UK tax policy and public understanding of tax.

“People kept asking me, ‘is Jeremy Hunt avoiding tax because he sold his business?’ and I looked into that and thought no, it looks like he paid all the taxes should have done.

“Or ‘did Sunak avoid tax when he worked for that fund in New York?’ and Channel 4 did a piece on that, it looked like total bollocks and he hadn’t done anything wrong at all.

“And there was the report that Zahawi might be investigated by the Inland Revenue so I looked into that and this time it was rather different.”

Neidle stated in his first Zahawi report: “I’ve used information in the public domain, my tax expertise, and input from other tax experts, to try to ‘reverse-engineer’ Zahawi’s tax and corporate planning, and work out what’s going on.”

The story outlined how the then-chancellor had used an offshore trust to apparently avoid paying almost £4m of capital gains tax when he sold his stake in the polling firm Yougov. This contrasted with rival Hunt who had sold his company for a similar sum and paid the tax.

It was an engagingly written demolition of a leading politician’s financial dealings grounded in rock-solid legal knowledge and Neidle was clearly having fun. Until the legal threats started.

“I just wrote it up and published it and then I was just astonished by the way that he denied it, which seemed to me to be untrue.

“I thought he was hiding that he knew he had done something dodgy. I had no idea he was hiding that he’d actually been caught by HMRC and was in the process of negotiating it.”

Zahawi gets legal: ‘If I lost I could be out £2m’

Neidle then found himself on the receiving end of a legal letter after he described Zahawi’s explanation of his tax affairs as “a lie”.

The letter was marked private and confidential and Neidle was warned it would be “a serious matter” if he shared it publicly. He published it anyway.

SLAPP-style legal threats are often accompanied by a grave warning from the lawyer concerned swearing their target to secrecy.

Neidle says: “That outrages me more than almost anything else because it is a lie. I’m not a specialist in confidentiality law, but I know enough to be dangerous. I spoke to people who were not libel lawyers, but experts in the law of confidence, and they were astonished that these claims were made…

“It is pure try-on, it’s a lie and lawyers are not allowed to mislead people. That’s why I’m so outraged.”

He adds: “This was, as I understand it, absolutely standard practice by libel lawyers. Then I made a fuss about it, the SRA [Solicitors Regulation Authority] came out with a statement and said ‘don’t do this’ and people are still doing it.”

So is his advice to journalists that they should simply publish such letters?

“Where you can, absolutely publish it. Because if everybody did that, SLAPPs would stop, the whole point of a SLAPP is to is to shut down debate. If every SLAPP then was splashed over Twitter, it has the opposite effect.

“I appreciate that for many, particularly in-house lawyers at newspapers, that is a difficult call, but I wish people were a little bit braver.”

Was he initially concerned?

“When I first got the legal threat, I spoke to a few people and realised that if they proceeded with this, I’d spend a year of my life fighting a case. If I won, I’d be out several hundred thousand pounds in costs, and if I lost I could be out two million quid, maybe more. So there was definitely a moment of, ‘Christ’.

“But then I’m very fortunate that I know a lot of lawyers, a lot of tax experts, and all of them seeing this thought that Zahawi had done something deeply dodgy.

“I therefore became convinced that we were right and he was bluffing.

“And once I thought he was bluffing, it was no longer stressful. It was a fun, legal game of the type I like playing and the type I’m quite good at playing.”

Although it became increasingly apparent Zahawi was not going to sue, it did look like he was likely to “get away with it” Neidle says. Until The Sun got involved.

“What stopped that was Ashley Armstrong at The Sun when she pubished a report [in January 2023] that Zahawi, whilst he was denying to me there was anything wrong, at the same time he was settling it with HMRC and paying the exact amount that I had reported, plus a large penalty.

“If Ashley hadn’t got that story, I think Zahawi would still still be in frontline politics.”

Neidle is keen to thank other journalists who were integral to the Zahawi investigation.

“Particularly important were Billy Kenber and George Greenwood at The Times because when I first reported on it one of the bullshit explanations Zahawi gave for his father holding the interest in Yougov through a Gibraltan Trust was that his father had been there at the start and had been so significant to the founding of Yougov that it was only fair that he got a piece.

“George and Billy tracked down people from the time and found out that wasn’t true and somehow they even extracted an official denial from Yougov, so that was a critical element that I couldn’t have done. My report would have been nowhere without them doing that at the start.

“Also it would have been nowhere without Anna Isaac’s report in The Independent that Zahawi was being investigated by the HMRC which set me looking at Zahawi in the first place. And my report would have vanished if it wasn’t for Ashley Armstrong having the splash in January, and then Anna Isaac had another one soon afterwards.

“There would have been no start to my story, no development and no finale without the involvement of Anna, George, Billy and Ashley.” Armstrong and Isaac were both shortlisted for the Business, Finance and Economics Journalism category at the British Journalism Awards, in part for their work on the Zahawi story, with Isaac taking the win.

Why does he do it?

Neidle nowadays makes money from freelance journalism and speaking at events, but he gives all his earnings to a charity called Bridge the Gap, which gives free tax advice to the elderly and those on low incomes, so that the independence of Tax Policy Associates is never challenged.

Asked what his motivation is, he says: “I love being a lawyer and this is me being a lawyer and putting something back. Fundamentally I do it because I enjoy it and I enjoy the fact that it has a benefit.”

How can other journalists emulate Neidle’s success?

“What I would suggest is that they cultivate lawyers, not just tax lawyers, corporate lawyers and accountants.

“ I think there’s a widespread belief, particularly in the Guardian-reading fraternity, that lawyers and accountants are all frightful neoliberal shills and actually – surprise, surprise – they’re humans with politics varying from Trotskyist to libertarian, and most of them aren’t able to speak publicly for professional reasons, but many of them will be delighted to help with this sort of stuff.”

‘Having an enemy this useless is probably a good outcome’

Post Zahawi, Neidle has continued to make headlines – most recently with his reporting on the Post Office IT scandal and Michelle Mone.

On 29 December he reported that the Tory Baroness failed to declare her interest in an offshore trust.

Asked what he makes of Mone’s attacks on him, he says: “It’s very hard for them to sue for libel given that they admitted in a television interview to lying the last time they threatened journalists with libel. So all she’s got are quite well-drawn cartoons and playground-level abuse.”

“I don’t think she’s very good at this. It’s a bit awkward to find myself the subject of public invective, it’s obviously not something I’m not used to – I can’t say it’s very enjoyable. But if you’re going to have an enemy, having one this useless is probably a good outcome.”

Mone feels unfairly targeted by Neidle but he says his method is a simple one: “When there is a story in the public gaze which I think has a tax angle which no-one is looking at, I go into that.”

Dan Neidle versus the Post Office

One example he highlights is Tom Witherow’s Daily Mail story of February 2023 about the Horizon IT scandal which revealed a sub-postmaster had been forced to hand £320,000 in compensation back to cover £71,533 in income tax and £251,359 owed under bankruptcy proceedings.

“I looked and said that can’t possibly be right, and I started delving and I realised the Post Office had totally stuffed up the tax for the postmasters.

“Following our report the Government put pressure on the Post Office to make that right and pay out about £30m extra to cover their tax. The Post Office stuffed that up as well and didn’t do it in time for the filing deadline.

“That is probably the single thing we’ve done that I am most proud of.”

Tax Policy Associates

Neidle does not have any staff, but neither does he work alone.

“I have about 40 people now: lawyers, solicitors, accountants, KCs, retired HMRC people – all expert in different areas – and almost nothing that I’m writing is actually just my expertise.

“Sometimes I know a lot about it, sometimes I know nothing about it. I’m completely reliant on these brilliant people who just give their time for free.”

He said a forthcoming Tax Associates report on Barrowman, which will level more serious accusations against him, has around £100,000 of pro-bono lawyer time involved.

Neidle on Newsnight and the future of investigative journalism

Asked what he thinks about the state of investigative journalism in the UK he says: “I think the investigative journalists I’ve worked with do an amazing job. It’s a shame there aren’t more of them.

“It’s a shame there are a declining number of venues for them. There is The Times, The Guardian, the FT for sure in the mainstream press. Who else?

“I’m particularly sad at the changes to Newsnight. If I do a detailed report, you can’t explain it in two minutes. You need five minutes.

“Newsnight can do that and they have the resources to properly investigate it on their side as well.”

“If Newsnight aren’t doing that anymore, what’s going to be the venue on television for reports like mine?” Neidle asks.

“I’m not sure there will be, and that is deeply concerning because without investigative journalism, a lot of stuff is going to happen and we’re not going to know about it.”

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog