The top four regional publishers control 88% of the daily print market, according to new Press Gazette analysis.

Top of the list is national and regional publishing giant Reach, which accounted for 32% of the combined average circulation of daily titles that reported data to the Audit Bureau of Circulations (ABC) in the latest period for which we have data (January to June 2022). However it should be noted that many local newspaper titles are no longer audited by ABC.

The second-biggest publisher by combined average circulation was Newsquest with 29%, DC Thomson was third with 15%, while National World was fourth with 12%.

This is a significant increase on the same six-month period five years ago in 2018, when the top four publishers controlled 76% of the daily market, and on a decade ago (2013) when the top companies controlled 50%.

The analysis also found that when weekly and daily titles are combined, the leading publishers control almost two thirds (62%) of the market with Newsquest, Reach and National World controlling 24%, 23% and 16% of the market respectively.

Falling circulation and advertising revenues have in recent years led to a crisis in local news. According to the Advertising Association/WARC, at its height, advertising spend in the local press was worth £3.1bn in the UK in 2004. By 2021, this was down to just £510.5m, half of which (£250.9m) was spent online.

While some publishers are starting to see promise with digital subscriptions - Newsquest earlier this year reported that it had surpassed 50,000 digital subscribers, while Scotland-based DC Thomson counts 25,000 - digital reader revenue is still short of what's needed to sustainably underpin local news.

As a result there has been increased consolidation as regional publishers strive to survive.

In January 2021, National World, owned by former Mirror Group chief executive David Montgomery, completed a £10.2m deal to take over the UK’s third largest publisher JPI (formerly known as Johnston Press) acquiring its stable of over 200 print and digital titles which includes The Yorkshire Post, Sheffield Star and Lancashire Evening Post.

Earlier this year Norwich-based Archant, which publishes four daily and 50 weekly titles, was bought by Newsquest, two years after the East of England publisher went into administration and was acquired by private investment firm Rcapital.

National World had expressed interest in acquiring Reach last year but pulled away from the deal.

Analysis by Press Gazette suggests that the number of regional publishers reporting data to ABC has fallen sharply from over 100 in 2010 to 25 last year. Some of the fall will be due to publishers opting to no longer publicly share data on their declining circulations, while some will be due to consolidation in the industry.

When it comes to digital audience, Reach remains dominant. In 2015, the publisher started rolling out a "Live" network of sites that now covers every county in England and Wales.

Despite a fall in digital profits in the second quarter of 2022 compared to the first three months, the UK’s largest commercial publisher and owner of over 100 local and national titles has seen regular growth in its digital audience according to Press Gazette's monthly top 50 ranking of newsbrands in the UK.

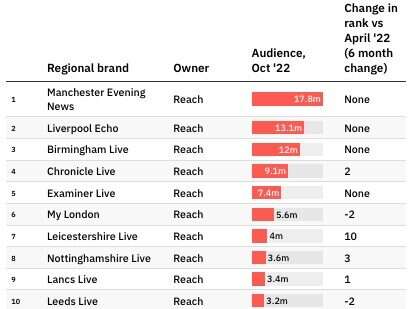

Audience data from Ipsos iris shows that Reach owns 35 of the 50 biggest UK regional news brands online based on the number of unique UK visitors to the websites, apps, and distributed content. (Press Gazette excluded national level brands such as Wales Online and Daily Record that were in the Ipsos list of regional newspaper brands).

Although deduplicated audience data to just the regional sites within publisher portfolios is not yet available from Ipsos, Reach has the largest unduplicated digital audience by far of all UK regional publishers. The publishing giant counts a collective 122.5 million visitors across the Reach regional sites tracked by Ipsos as part of its regional sites sub-group.

Reach's deduplicated UK audience in October was 37.2 million people, although some of this will include people who only visit its national brands such as the Mirror and the Express.

National World had the second largest digital audience among regional publishers in the UK at 16.3 million people (de-duplicated at the organisational level) but this includes traffic to its national brand Nationalworld.com.

The third largest audience was for Newsquest (12.8 million) which saw audience growth of 26% over the last six months, behind only Mediahuis (58%) and MNA (34%).

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog