B2B giant Informa has announced the sale of maritime information brand Lloyd’s List to Montagu private equity in a £385m deal as it announced strong profit and revenue growth for the first half of the year.

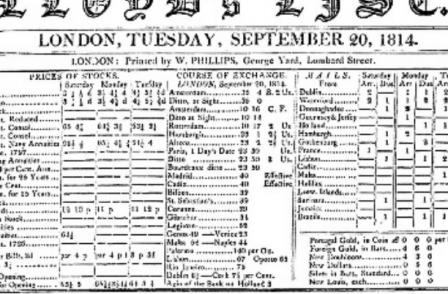

Lloyd’s List was launched in 1734 and may be the oldest B2B title in the world. The print edition closed in 2013 but it has gone from strength to strength as a paywalled website that provides news, data and marketing solutions for the industry.

The latest deal follows the sale of Pharma Intelligence by Informa for £1.9bn and EPFR for £162m.

Informa said the blended valuation of the three B2B information businesses it has sold was 28 times EBITDA, a strong multiple that suggests the investors have high confidence in future growth. Informa retains a 20% equity stake in Lloyd’s List.

Overall Informa announced revenue up 66.5% to £1.024bn and pre-tax profit of £51.4m, compared to a loss of £104.4m in the same period last year.

Growth was driven by the return of in-person events and exhibitions and strong subscription and marketing solutions growth.

Events delivered £450m of revenue in the first half, which the company said was 80% of equivalent revenue in pre-pandemic 2019. It continues to be hampered by the slow reopening of China.

Informa reported strong growth from its customer data platform IIRIS with a claimed “known marketable audience” of 12 million (up from 10 million in March).

Informa’s two main business are academic information and B2B, where it operates across a range of sectors and geographies.

It announced a major expansion of its B2B audience and marketing capabilities with the acquisition of US-based Industry Dive for £323m in July. Industry Dive currently publishes 27 “Dive” brands including BioPharma Dive, Construction Dive, Cybersecurity Dive, Food Dive, Healthcare Dive, MedTech Dive and Waste Dive, with a total audience of 13 million and more than 100 journalists.

Informa’s share price was steady following Thursday’s results announcement and it currently has a market capitalisation of £8.7bn on the London Stock Exchange.

Press Gazette is hosting the Future of Media Technology Conference. For more information, visit NSMG.live

Read the Informa H1 2022 results announcement in full.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog