On some basic financial measures, the New York Times’ $550m acquisition of the Athletic is one of the priciest media deals in recent history.

The Athletic generated revenues of $65m in 2021, according to NYT chief executive Meredith Kopit Levien. The takeover, therefore, values the Athletic at 8.5 times the size of its turnover – this for a company that made operating losses of $55m in 2021.

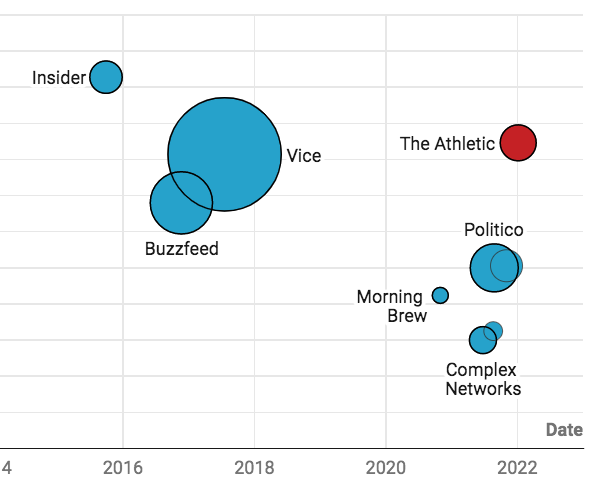

The Athletic’s price-to-revenue ratio appears out of kilter with other recent media deals (see chart below), and is more in line with the multiples that were being achieved five years ago by the likes of Buzzfeed and Vice Media.

Today, many in the media industry look back on 2016 and 2017 as a bubble period for digital media companies.

Buzzfeed, which now includes HuffPost and Complex Networks, has endured a tough start to life as a public company and currently has a market capitalisation of around $600m. Vice Media reportedly struggled to raise money at a valuation of $2.5bn last year.

Click here to subscribe to Press Gazette’s must-read newsletters, Future of Media and Future of Media US |

The New York Times Company will hope that its Athletic deal proves more comparable with Axel Springer’s $442m deal to buy Business Insider in 2015.

According to Axel Springer investment slides, Insider generated revenues of $43m that year, giving it a value-to-sales ratio of 10.3. Thanks to its continued growth over the past seven years, Axel Springer’s takeover is generally considered to have been good business.

As the graph above shows, high-profile digital media publishers have consistently attracted valuations five times greater than their annual revenues over the past decade.

The Athletic deal comes in at the pricier end of the spectrum, especially when compared with valuations attached to Politico, Axios, Complex Networks and the Hill last year. But that doesn’t necessarily mean the Athletic was overpriced.

When investors are weighing up what a company is worth, “it essentially comes down to a single factor,” says Neil Begley, a media-focused credit analyst at Moody’s in New York. “Which is a company’s ability to grow its revenues.

“There are lots of companies that don’t have profits but are worth significant amounts of money because there’s an expectation that, at some point in the future, they’ll be profitable.”

Speaking to investors last week, Kopit Levien said she expects the Athletic to reduce its operating losses over the next three years before turning a profit in 2025.

Last October, the Information reported on projections showing that the Athletic expected its revenues to top $150m in 2023, which would certainly represent the sort of growth that is attractive to investors.

Last year, The Athletic generated $47 million in revenue and expects the revenue to increase to $77 million this year. It doesn't expect to be profitable until 2023.https://t.co/BeeYqRbNxK pic.twitter.com/KVSNuQXlgR

— The Information (@theinformation) October 10, 2021

Of course, Buzzfeed of 2016 and Vice of 2017 were also forecasting fast revenue growth when they achieved their valuations. Investors started to fret when these targets weren’t met.

“A lot of times when you branch off and have a new form of media – and this is true of many industries – they give off a hype around them,” says Begley,

“And either the company quickly grows to profit and has considerable market share and brand awareness, or the field gets more competitive. And if the bar is not terribly high, that takes the shine off the asset and the valuations with it.

“I don’t think the bar is particularly high when it comes to internet-distributed media. Any media company can start up one of these businesses – and they do almost on a monthly basis. So there isn’t really a particular exclusive arrangement or distribution model or anything like that that gives them the same strength that yesterday’s media always had.”

The risk for the New York Times, then, is that the Athletic – like some of its digital media predecessors – doesn’t live up to its hype and is usurped by other digital media startups.

The Athletic, though, has something that neither Buzzfeed nor Vice could fall back on: 1.2m paying subscribers.

“If you have a subscription base to accompany your advertising base, that’s always going to lead to a more dependable revenue stream,” says Begley. “And the difference with a subscription base is people are actually paying for it. It probably means that it’s more important to them.”

Douglas McCabe, the chief executive of London-based media analysis firm Enders, believes that the consensus on what makes for a good media business has shifted in recent years, away from mass audience companies like Vice, and towards subscription businesses like the Athletic.

“I think the days of just building scale and generating advertising revenue in order to fund an entire newsroom are probably over,” he says. “I think people have more sophisticated views of what it is they are building now.

“The kind of themes that we are seeing is those businesses that focus down on utility or one very specific aspect of the market – one or two beats, one or two specific areas of journalism – are the businesses that seem to be doing better.

“I’m thinking about the Athletic, I’m thinking about Politico, I’m thinking about Tortoise to some degree.”

He adds: “Loyal, dedicated user bases, membership models – certainly at the very least registered users – are just so much more valuable than just relying on traffic, just relying on an advertising model.”

The merits of the New York Times’ $550m investment in the Athletic will likely be debated for years to come.

It’s worth noting that the NYT’s share price fell 10% last Friday morning after the deal was announced (it’s since recovered a little), which suggests not all investors were convinced by the Athletic’s 8.5x valuation.

But McCabe, for one, is optimistic about the tie-up.

“Any acquisition, in one sense, is a bet,” he says. “But I don’t think it feels such high risk.”

He notes that some early Athletic investors have criticised the startup for selling out now. “I think what they’re saying is the value of this business can only go up from here, provided they don’t make any terrible mistakes,” he says.

“Certain things have not been factored in yet. There’s additional geographies, there’s expanding the number of sports that are covered, there’s the advertising layer, there’s the new touchpoint, they’ve talked about going into betting a bit more. There’s all sorts of innovations and ideas that the Athletic originally could explore.

“The argument I would make is that the New York Times can accelerate and expand on this much more quickly and much more effectively than the Athletic could on its own. I may be right, I may be wrong on that. But you can see the logic.

“From the point of view of the New York Times, which has absolutely set its stall up as a subscription business, it doesn’t feel like a high-risk approach to me at all.”

Note: Some of the revenue figures used in the chart above rely on unverified reports from trustworthy news sources. Follow these hyperlinks for sources on revenue figures for HuffPost, Insider, Buzzfeed, Vice, Morning Brew, Complex Networks, the Hill, Politico, Axios and the Athletic.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog