News websites that rely on display advertising revenues are facing an “unprecedented” decline in the market, new forecasts seen by Press Gazette show.

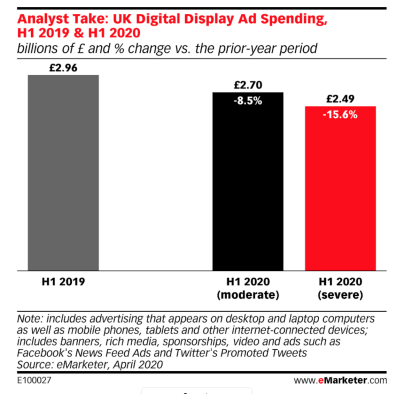

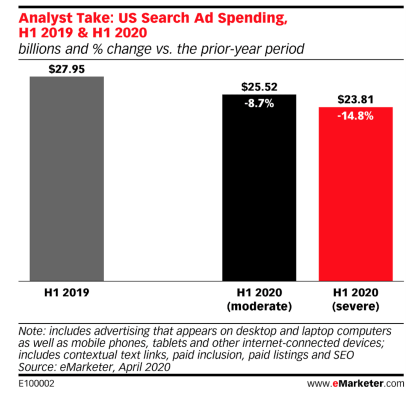

Sections of the digital ad market could fall by as much as a fifth in the first half of 2020, according to “severe” scenario predictions drawn up by eMarketer analysts.

Even in “moderate” circumstances, most of the North American and UK market will decline in the coming months, bringing to an end years of growth.

The figures are revealed in eMarketer’s recently-revised forecasts for digital advertising spend across the US, UK and Canada for the first half of the year.

Table from UK advertising market report by eMarketer

In a “severe” scenario, analysts are predicting spending falls of 18 per cent in the US digital display ad market, 16 per cent in the UK, and 21 per cent in Canada.

This would total a £5.8bn decline across these three markets – from £32.3bn to £26.5bn – primarily concentrated in the US, which is by far the biggest of the three (see chart below).

News organisations across these nations, and many others, have already been hit hard by the advertising market slump, resulting in thousands of workers losing their jobs or being put on furlough.

In the UK, Independent Digital News and Media yesterday revealed the Covid-19 crisis would cost its business a six-figure sum in lost advertising.

In “moderate” circumstances, eMarketer is forecasting that the digital display ad market – large sections of which are commanded by Facebook – falls by five per cent in the US, nine per cent in the UK, and 11 per cent in Canada, equal to a near-£2bn decline overall.

Digital search advertising revenue, which is dominated by Google, is also forecast to fall significantly. Digital video advertising, which is smaller than the display and search markets, could rise in some geographical areas under “moderate” circumstances but would fall under the “severe” scenario.

“Digital advertising has been growing for many years now,” said senior eMarketer analyst Paul Briggs, explaining that before the Covid-19 crisis began, analysts were predicting “strong growth” across digital advertising markets this year.

“This is unprecedented,” he said.

“The only other economic event that would have impacted advertising [to this extent] would be the recession in 2008/2009. And at that point in time digital advertising wasn’t as developed as it is today. So it’s very hard to compare that time period to this time period.”

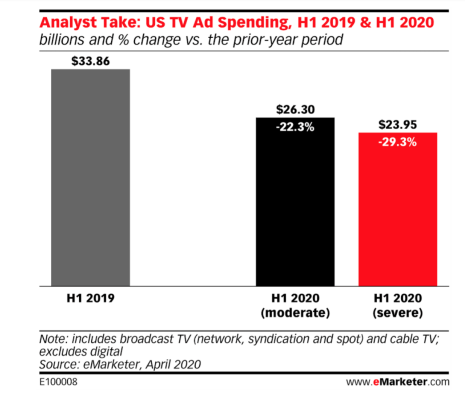

The TV ad market is expected to be hit even harder than its digital rival. Analysts at eMarketer are predicting falls of around 30 per cent across the US, UK and Canada TV markets in their “severe” scenario, or 22 per cent in “moderate” circumstances.

Briggs, who is based in Canada, said: “We expect TV to be hit particularly hard because of the halting of professional sports leagues and cancellation of events around the world, and the postponement of the Summer Olympics until 2021, all of which drive large audiences and ad revenues for live, linear TV.”

The figures are based on revised forecasts for the first half of 2020. Analysts have not yet produced figures for newspaper and magazine advertising markets, which are smaller than the others.

Picture: Reuters/Phil Noble

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog