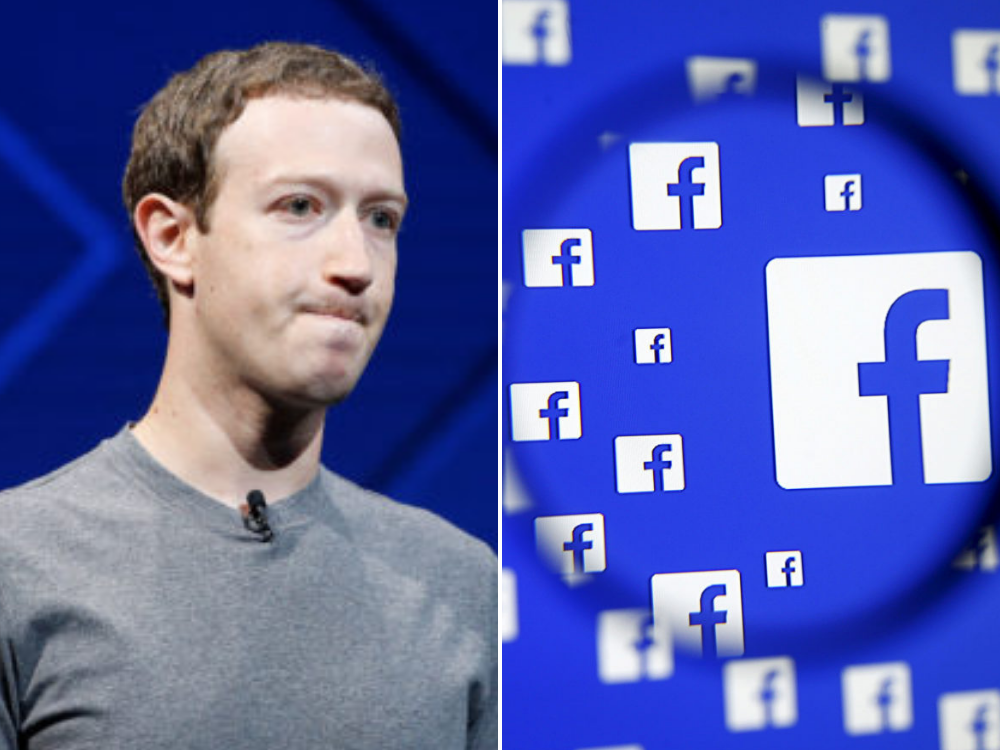

A group of Facebook investors is seeking to remove Mark Zuckerberg as chairman, citing several controversies facing the tech giant, including its dominance in certain markets.

The motion, which will be voted on by shareholders at the firm’s annual general meeting next month, is for Facebook to take on a new independent chairman to oversee Zuckerberg’s performance as chief executive.

In a letter to their fellow shareholders last week, those pushing the motion noted that the company has been “rife with controversies that have harmed investors” in recent years. They cited accusations of “anti-trust violations”, which include concerns about Facebook and Google’s dominance of the online advertising market.

Facebook and Google are known as the “Duopoly” because of their dominance over a market that is crucial to many online news providers.

“Dozens of states, led by New York, are investigating Facebook for anti-trust violations,” the investor group said. “These states, composed of both Democrats and Republicans, are examining Facebook’s size, wealth, market power, handling of consumer data, ad-targeting practices and their role as gatekeepers of communication.”

The message also highlighted concerns over “data breaches, privacy incidents, Cambridge Analytica, the Russian hacking of the 2016 election”, and several other issues including the “open hostility” shown to the company by senior Democrats. Part of the letter noted:

House Speaker Nancy Pelosi accused Facebook of being “accomplices for misleading the American people with money from god-knows where.” She went on to say “The Facebook business model is strictly to make money. They don’t care about the impact on children, they don’t care about truth, they don’t care about where this is all coming from, and they have said even if they know it’s not true they will print it … All they want are their tax cuts and no antitrust action against them … They have been very irresponsible … I think their behavior is shameful.”

The proposal for an independent chair has been submitted by Trillium Asset Management, as well as the New York City Pension Funds as well as the Treasurers of Illinois, Pennsylvania, Rhode Island, Connecticut, As You Sow, Dana Investments and the Northwest Coalition for Responsible Investment.

The group has made efforts to remove Zuckerberg at previous AGMs in 2017 and 2019. Last year the investors claimed to have won 68 per cent of independent shareholder votes. However, this only amounted to about 20 per cent of the overall vote because Zuckerberg himself controls a large portion of voting shares.

Facebook is urging investors to reject the proposal this year. The company said that its board, which includes a “lead independent director”, already provides “independent leadership and oversight of management”.

It said: “Our board of directors currently has no established policy on whether or not to have a non-executive Chair and believes that it should make that judgment based on circumstances and experience.

“Our board of directors currently believes that the most effective leadership model is that Mr. Zuckerberg, our founder and controlling stockholder, serves as both Chairman and CEO. We believe our board of directors is functioning effectively under its current structure, and that the current structure provides appropriate oversight protections.

“We do not believe that requiring the chair to be independent will provide appreciably better direction and performance, and instead could cause inefficiency in board and management function and relations.”

Picture: Reuters/Stephen Lam & Reuters/Dado Ruvic

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog