Could a “for sale” sign be going up soon on America’s biggest selling news weekly Time? And its sister publication Fortune? The Wall Street Journal suspects so.

Declining sales, fewer ads and the current financial crisis are taking their toll on Time Warner’s magazine publishing division. Third quarter earnings suffered a 35 per cent drop.

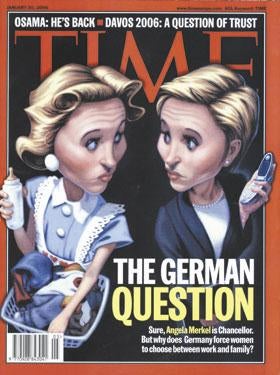

Time Inc, long a cash cow for its parent company, has suffered in recent years from the steady shift of ad dollars from print media to the web. Hardest hit have been the journalistically serious and news-oriented publications such as Time and Fortune, although entertainment and lifestyle titles such as People and InStyle have not escaped unscathed.

In the past six years, Time’s ad pages have declined 25 per cent. As a result it is no longer the company’s biggest profit-maker. It has dropped to third place, behind Sports Illustrated and People.

The question is whether, in the present economic situation, there are any would-be buyers. Time and Fortune are big-name titles and the Wall Street Journal suggests that as “trophy buys” they could fetch a price in excess of their economic value.

These days, the publishing side of Time Warner accounts for only nine per cent of the company’s income, compared to 36 per cent from its cable channels, 23 per cent from its TV stations and about the same from its film business – figures that reflect the declining importance of the print side of the business.

In another indication of the decline in American news magazines, US News and World Report, the third of the big titles, is switching to monthly publication. Originally it planned to switch to a fortnightly, but at the last minute it was decided that was not drastic enough to offset rising costs and declining income.

Lately the magazine, which is owned by real estate magnate Mort Zuckerman – who also owns the New York Daily News – has switched from covering the news to providing customer advice and evaluating the best American colleges, hospitals and other institutions.

In the first six months of this year, its sales averaged 1.6m – compared with Newsweek’s 2.7m and Time’s 3.4m.

One reason for the decline in news magazine sales, according to the New York Times, is the increasing availability of instant news and analysis on the web, plus the rising sales of The Economist and The Week. The Economist now sells almost 750,000 copies in the US, and The Week about 500,000.

Meanwhile, media shares on the New York Stock Exchange, suffered big drops yesterday. Shares in News Corp nosedived almost 17 per cent on the news that profits in the quarter ending 30 September fell 30 per cent to $515m compared to $737m in the same quarter a year ago. It was the second day running that News Corp shares suffered a big drop.

Chairman Rupert Murdoch blamed the drop on the “economic downturn” which he predicted will last at least until 2009.

To cut costs he announced that there are plans to “outsource” the work of 10 of the 17 plants that print his newly acquired Wall Street Journal which, it is hoped, will save at least $30m a year.

He also plans to merge the “back-office” administration of the Journal with the New York Post.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog