The UK’s digital advertising market grew by 17.3 per cent to £10.3bn last year – but nearly all the extra money went to Google and Facebook.

The latest figures from the Internet Advertising Bureau are based on data from its members (which include both the digital giants and news publishers).

Search advertising online grew from £4.361bn in 2015 to £4.99bn in 2016.

Social media advertising grew from £1.251bn in 2015 to £1.731bn in 2016.

This means that £1.14bn, or 94 per cent, of the £1.217bn growth in the UK advertising market went to search engines and social media. Google and Facebook are reckoned to control about 90 per cent of each market, meaning the US giants accounted for the vast majority of the growth in UK online advertising.

The latest IAB figures, compiled by PWC, do not reveal how much internet advertising is being spent with the publishing industry.

But in 2015 news brands (which include national and regional newspapers) made £419m from digital advertising in the UK, according to the Advertising Association. The new figures from the IAB suggest this total will be at best flat year on year for 2016.

The figures come as Press Gazette this week launched its Duopoly campaign which has the slogan “Stop Google and Facebook Destroying Journalism.”

It highlights concerns about the extent to which these two platforms now dominate UK digital media, at the expense of news publishers.

And the figures confirm concerns that Google and Facebook are together swallowing nearly all the growth in online advertising.

Publishers are concerned that they are not receiving a fair share of the money made from their content on these platforms and that Google and Facebook profit from fabricated news and extremist content. Press Gazette has launched a petition urging the Google and Facebook chief executives to tackle these issues.

According to Advertising Association data, the national and regional press share of the UK advertising market declined from £5bn in 2005 to £2.4bn in 2015.

Internet Advertising Bureau/PWC Digital Ad Spend report 2016 highlights:

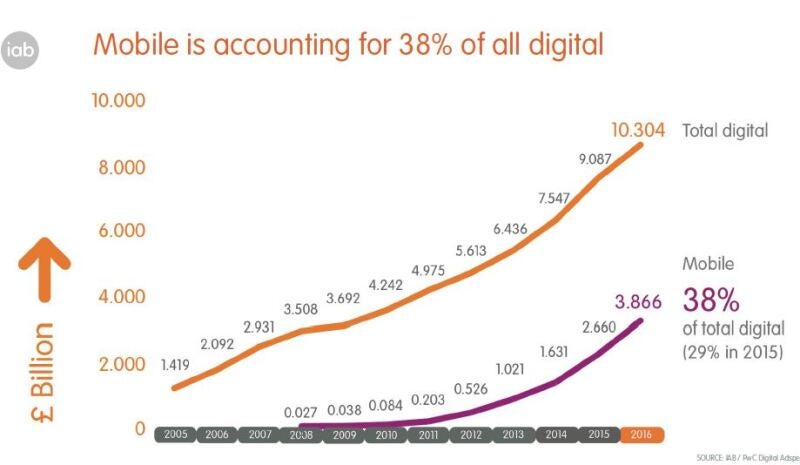

Mobile advertising drove most of the growth in 2016, up £1.2bn to £3.87bn in 2016.

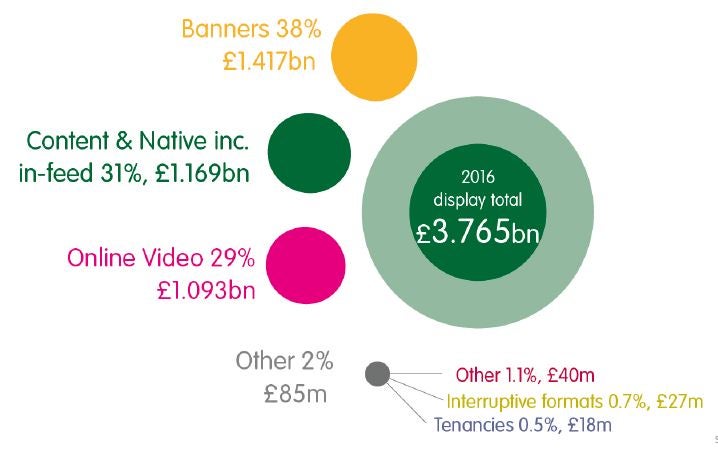

The £3.8bn spent on display advertising in 2016 was evenily split between banners, native advertising (including in-content ads) and video.

While display advertising fell 8 per cent year on year, both native and video are said to be growing fast.

Some 72 per cent of digital display advertising was traded programmatically in 2016, up from 63 per cent in 2015.

This is forecast to grow yet further to account for between 80 and 90 per cent of display advertising spending.

Of this total some 24 per cent is said to be sold via programmatic indirect, these are open exchanges which offer brands little control over where their adverts appear.

Automated online advertising technology has come in for sharp criticism because as little as 30 per cent of the money spent by brands goes to publishers. It can also lead to adverts appearing next to unsavoury and extremist content.

The total UK advertising market (including print, outdoor, radio, cinema etc.) is worth around £20bn a year.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog