BBC Panorama last night shone a spotlight on a tax avoidance scheme run by some of the stars of BBC comedy show Mrs Brown’s boys.

Star and creator of the show Brendan O’Carroll responded by telling Panorama: “I reserve the right to take the most severe legal action available to me. That is lawyer speak. I would have just said: ‘Fuck off’.”

Some 380 journalists, including 31 from the UK, have been working on the International Consortium of Investigative Journalists’ Paradise Papers investigation into 13.4m leaked documents revealing the tax avoidance methods of the rich and famous.

The BBC, The Guardian and Private Eye are among partner organisations working on the investigation.

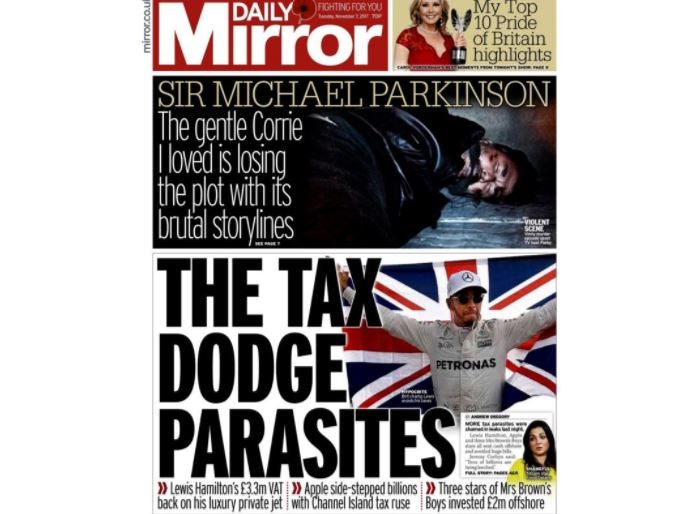

Last night BBC Panorama revealed how racing driver Lewis Hamilton avoided paying VAT on a £16.5m private jet and how the rich are able to enjoy a lavish tax-free lifestyle by channelling their money through tax havens around the world.

Panorama reported Mrs Brown’s Boys actors Patrick Houlihan and Martin and Fiona Delany took £2m received from the production company owned by creator and star of the show, Brendan O’Carroll, and transferred the money overseas, the BBC reported.

Documents allegedly show money paid into a UK firm by the production company was transferred to Mauritius companies through a trust which took 12.5 per cent.

These companies, said to be under the actors’ control, then used a third party to pay loans into the three actors’ personal UK bank accounts, it is claimed.

O’Carroll told the broadcaster neither he nor his companies had been involved in a tax avoidance scheme or structure.

A spreadsheet showed that, in December 2015, Houlihan’s offshore company had assets of £696,349, Fiona Delany’s £715,122, and Martin Delany’s £725,030, the BBC said.

Houlihan told the Irish Times he did not fully understand the scheme, and that he had to Google what tax avoidance was when he was contacted by a BBC reporter.

The Paradise Papers revelations today dominated UK national newspaper front pages.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog