Radio and podcast company Global was “outraged and really surprised” by the BBC’s proposal to carry advertising on some of its podcasts in the UK.

The BBC is looking at whether it could run adverts in podcasts on third-party platforms like Apple and Spotify, rolling them out from late 2024.

Podcasts would remain ad-free on its own platform BBC Sounds and news and current affairs would not be affected.

Other high-profile brands like The Archers, In Our Time or Desert Island Discs would not be included in the initial rollout but could come later.

A BBC spokesperson said: “Listeners will continue to hear BBC audio without ads on BBC Sounds, but as many of our podcasts are available on commercial platforms like Apple and Spotify where adverts are the norm, we look to carry them in some of our content to generate more revenue to support the BBC, licence fee payers, our suppliers and rightsholders.”

Global warns of ‘market distortion’ from BBC podcast adverts plan

Commercial rival Global, which owns LBC and podcasts including The News Agents and My Therapist Ghosted Me which go out through third-party platforms and its proprietary Global Player, has become one of a number of industry voices to oppose the idea.

Global chief strategy officer Sebastian Enser-Wight told the Lords Communications Committee last week for its future of news inquiry that the company was “outraged and really surprised” to hear the plan.

He said it would be a “market distortion” to use “licence-fee payers’ money to generate content that is then supported by advertising”.

Referring to the public service division of the BBC versus BBC Studios, Global chief strategy officer Sebastian Enser-Wight cautioned against the BBC duplicating content which is available in the commercial sector and distorting the advertising market.

He said the BBC “has some truly unique and distinctive content and it’s a shame that we see that being under-invested in and in fact having its funding cut at the same time as other elements of the BBC are looking to mirror our output.”

Global and others ‘will certainly suffer’ from BBC podcast adverts plan

Enser-Wight said: “This is the first time we will have ever seen the BBC carrying advertising on its content that is also available through BBC platforms. So this is analogous to BBC One putting all of its content on Youtube and telling the viewers they can either watch it on Youtube and it will be ad-supported or they can watch it on iPlayer.

“So we are surprised to hear the BBC think this is something that will be approved and we would very much hope that Ofcom or indeed Government will intervene.

“I think our concerns about it are really the simple economics. If the market is suddenly flooded with an influx of new inventory, ultimately the prices will go down…

“…it is a matter of deep concern for us and I know not just for the radio industry but television broadcasters as well because I think they can see clearly that if adverts are allowed on one content form then the logical progression is that advertising will be carried on all BBC formats.”

Owen Meredith, chief executive of the News Media Association which represents all the major newspaper brands many of whom have expanded into podcasting, also opposed the idea: “The news that the BBC is apparently set to muscle into the UK advertising marketplace by competing with commercial players for advertising around audio output is very alarming. Such an intervention will profoundly distort competition, wreaking havoc on commercial players right across the media and advertising sector.”

Global ‘not actively pursuing’ BBC Sounds deal

Enser-Wight was also asked about the commercial sector’s negotiations with the BBC for it to host some of their content on BBC Sounds but he said Global was no longer “actively pursuing” this.

He said: “In past negotiations with the BBC we actually saw similar issues about access to data, transparency that we see with tech giants so I think our fear was certainly that even if, and we hadn’t made a decision whether it would or wouldn’t be the right thing to be carried on their platform, I don’t think the economics would have worked. It’s certainly not something we’re actively pursuing… We have a long wishlist when it comes to the BBC but that’s not at the top of it.”

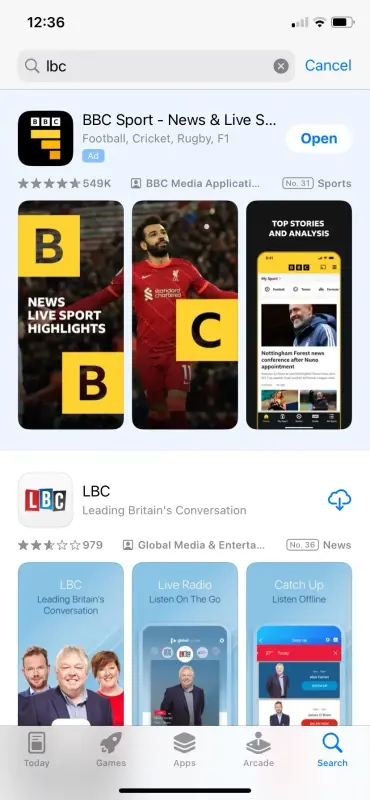

He also noted that users often see a BBC app at the top of results when they have searched specifically for LBC because the BBC has purchased that result (see image at the bottom of this story for example showing BBC Sport appearing above LBC).

Enser-Wight said: “That to us is the thin end of the wedge and raises two questions: one is, is there a risk that in the future all results will be paid for, so not just the first one but could we be in a world where in order to appear in the search results we have to pay the platforms?” He added that he hoped the Digital Markets, Competition and Consumers Bill will give the Digital Markets Unit powers to act if this ever happens.

He added: “And I guess the slightly secondary concern for us is should the BBC really be trying to misdirect customers exclusively searching for LBC towards their own apps?”

Radio ‘very fortunate’ to have strong advertising market

Enser-Wight also said that despite difficulties in the advertising market for other media businesses radio has seen “successive growth” aside from the two Covid-hit years of 2020 and 2021. He said 2022 recorded £740m in advertising revenue for the radio sector, the highest ever, and 2023 was likely to have been another record year.

Although there are no segmented figures showing the health of news radio specifically, Enser-Wight said LBC is seeing a “similar trajectory” although “it is tougher” because of advertisers’ concerns that placing their ads alongside hard news could negatively impact their brands.

“Luckily, more recently we’ve seen advertisers realise actually this isn’t the case and they actually have a very engaged audience listening to a news channel – perhaps more so than a music channel.”

This means that LBC has also seen an “uptick year-on-year in revenues,” he said.

Tom Cheal, managing editor at LBC, told the committee that more than 70% of 15 to 24-year-olds tune into radio each week, citing RAJAR figures. “I think that is a cause for some optimism, that’s not to say we don’t face challenges but we’re intent on focusing our products and our core station brands in the right areas to appeal to those audiences and continue to engage them,” he said.

However in news radio, across commercial stations and the BBC, the “only real area of growth” over the last decade has been among 55-and-overs “so in some ways there is a challenge there to try and entice audiences into the world of live radio.

Cheal said people aged between 25 and 44 are however “very heavy users” of news podcasts as “they often go in search of a product which provides more analysis and in-depth context of what’s going on in the world”.

He cited The News Agents for which there is a “huge appetite… precisely because people want to turn to trusted voices to help them make sense of wider issues and challenges be it in politics or other broader trends”.

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog