Reach has met its target of signing up ten million registered users ten months early and says it is on track to double its digital revenue by the end of 2024.

However rising printing costs and energy bills mean a “modest” drop in operating profits is expected this year.

In the 52 weeks to 26 December 2021 Reach operating profit was up 9.2% on an adjusted basis to £146.1m and pre-tax profit was up 9.3% to £143.5m.

Reach said the results showed strong recovery following 2020, which was hard-hit by the Covid-19 pandemic with operating profit down 12.8%.

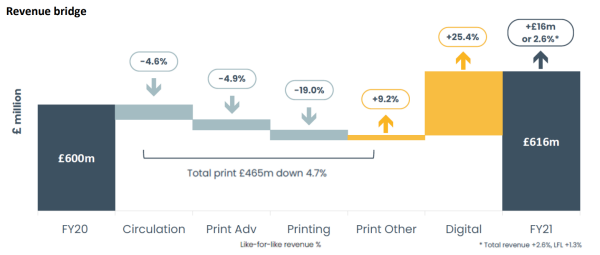

Reach said revenue was up 2.6% to £615.8m with digital revenue up by 25.4% in a year or 38.6% over two years to £148.3m. Digital is now 24% of the overall revenue mix, up from 15% in 2019, and has more than offset the decline in print and other revenues.

Diagram showing Reach revenue changes from 2020 to 2021. Picture: Reach 2021 results

Chief executive Jim Mullen said: “Reach is transitioning from a company that was primarily focused on managing print decline to one that is establishing a sustainable future with a digital business that is growing strongly.”

Digital growth

A “significant contribution” to the digital boost came from reader registration strategy. Reach had set a target of 10 million registered readers by the end of 2022 but said this had been met early in the year – following landmarks of 5 million at the end of 2020 and more than 9 million at the end of 2021.

Reach said in its results: “With more of our registered customers logged in we can track their content consumption and develop the insights that are key to our data-led advertising products.”

In October Reach launched “one tap” registration which allows Google users to register and log in with one click and, it said, had led to a significant increase in the number of logged-in sessions per month. Other frictionless log-in options are expected to follow.

A key source of sign-ups are Reach’s 300-plus email newsletters, ranging from daily news briefings to interests or short-term “obsessions” such as the Winter Olympics or TV series such as Peaky Blinders. Reach said page views from newsletters more than doubled during 2021 to more than 50m per month.

Last week the company revealed it is creating 12 new jobs in a local email newsletters team with financial and technical backing from Google.

As well as customer registrations, around 25% of the growth in digital revenues came from the Plus+ portfolio of data-led products that started to roll out to brands and advertising agencies in the second quarter.

Reach said the Plus+ suite lets it “categorise data sets by geography, by reader behaviour and preferences, and produce targeted data sets for client campaigns”, adding that the more than 200 campaigns to have gone out so far were “driving improved results for advertisers while attracting significantly higher digital revenue yield”.

Reach will “continue to innovate and enhance our use of AI and other tech solutions to help monetise our first-party data sets,” Mullen said.

“In 2022, machine learning and AI will deliver insights across customer relationship management, editorial, marketing and ad tech, and will continue to drive our digital transition,” he added.

Reach launched some 26 new sites in 2021, fulfilling its aim to cover every county in England and Wales.

Print decline and costs warning

Print revenue last year was down by 4.7% like-for-like, with circulation down 4.6% and advertising down 4.9%.

Despite this Reach said print recovery had been “better than originally anticipated” with “resilient” circulation supported by investment in availability, marketing and product enhancement.

Newsprint costs have increased due to a “reduction in industry production capacity and a strong recovery in demand compared to the previous year, when demand was suppressed by Covid-19.

“Growing demand for packaging materials, reduced availability of recycled fibre and increasing costs of shipping and energy contributed to a significant increase in newsprint prices versus 2020.”

The company warned: “The business is transitioning to become more digitally driven and the ongoing cost base reshaping will in part help fund continued investment. However, the impact of inflation, which began to affect the business towards the end of 2021, has now intensified, particularly in print production.

“This has primarily been reflected in the cost of newsprint (paper for printed products), which having previously been impacted by rising distribution costs and supply challenges, now also reflects the significant increase in energy prices. As a result, the gross impact of inflation in 2022 is expected to be higher than in recent years.”

But chief executive Jim Mullen (pictured) said: “Despite inflationary pressures in print, we’re committed to maintaining our focus on sustainable long-term profit growth, investing in product innovation and a more personalised user experience.”

Advertising revenue was down 4.9% on a like-for-like basis, further to a 28.9% decline in 2020. Reach said areas like food, retail and entertainment had been buoyant although leisure and travel remained subdued. It also benefited from Government public health messaging campaigns.

Scale is ‘huge opportunity’

Reach said just under 42m people now visit its sites each month and said its scale was a “huge opportunity given that we have not historically achieved our full digital potential”.

Page views declined 2.8% year-on-year due to the huge boost from the early Covid-19 pandemic in 2020, but were up 29% compared to 2019.

In 2021 Reach used savings from its job-cutting transformation programme in which around 550 roles were cut in 2020, which cost £16.5m, and two print site closures to create about 400 journalist jobs.

Mullen said the company will “continue to seek cost efficiencies as we transition to a more digitally-driven future”.

Reach is debt-free and delivered £141.3m of adjusted operating cash flow during 2021, with cash balances growing to £65.7m.

Reach proposed a final dividend of 4.46 pence per share, an increase of 4.7% on 2020.

The results also showed a further £29m has been put aside for legal claims relating to phone-hacking, compared to £12.5m in 2020. Reach said last year it believed its legal costs could hit £106.5m. A provision of £41m to be used over the next three years remains outstanding.

The “home and hub” project to get most staff working at home or in a hybrid model permanently cost £23.7m last year.

Picture: Reach

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog