Euromoney’s half-year results show cancelled events due to Covid-19 are set to cost the UK-based business intelligence company £9.2m.

But despite this the B2B information provider has emerged relatively unscathed from the financial meltdown brought on by the virus, according to half-year results released today for the six months to 4 June.

Revenue is up 1% year on year at £186.3m for the period and operating profit fell 11% to £41.1m. Profit before tax fell 15% to £39.4m.

The profit drop was mainly due to the impact of Covid-19 on face-to-face events. The group has, however, run 44 virtual events during the period affected by Covid-19.

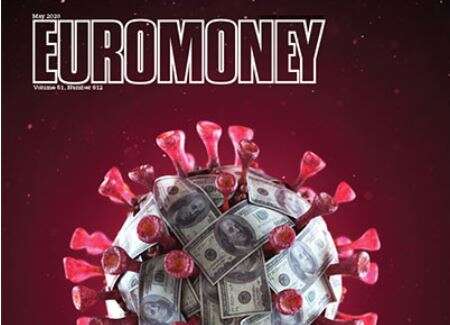

Euromoney half-year results

The group said that the cancellation of events had led to a five percentage points drop in revenue growth and a two percentage points drop in operating profit margin. This equates to a £9.2m hit on revenue and a £3.7m hit on operating profit.

Euromoney’s share-price has taken a tumble from £13.20 at the start of the year to £7.22 at the start of this week.

The share price has however bounced back and stood at £8.85 at time of writing, giving the group a market cap of £947.5m.

Press Gazette’s analysis shows that business information companies have been the most resilient sector of the news business in terms of the impact on share prices .

Chief executive Andrew Rashbash said: “Euromoney’s 3.0 strategy delivers must-have embedded content. This strategy has never been more relevant and drives the momentum we see across our businesses.

“We have underlying growth in two of our three segments; strong performance in pricing, and good growth in data and market intelligence following our investment in that segment; and we see promising signs that our turnaround plan for our asset management businesses is working.

“We have taken swift action to address and manage the impact of Covid-19, which creates short-term uncertainty in our business, particularly our events.

“We are ready to run our market-leading events when restrictions on face-to-face gatherings are lifted; until then, we will run virtual events where they deliver value to clients.

“Our strong balance sheet and resilient renewal rates in our subscription businesses, which make up two thirds of revenues, give us confidence that we will emerge strongly from the current global crisis”.

Euromoney Institutional Investor half-year results in full

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog