The US Department of Justice has launched a lawsuit against Google alleging the company engaged in “a systematic campaign to seize control” of the digital advertising market.

The suit makes similar allegations to a class action claim being brought against Google in the UK.

But whereas the UK action seeks to win damages for publishers, the DoJ hopes to make Google split up its ad tech business.

The two cases are separate, subject to different legal tests and will play out on different timelines. But developments and discoveries in one may affect the other.

Economic analysis previously cited by Press Gazette suggested market abuse by Google could have reduced UK publisher ad revenues up to 40%. Similarly, the DoJ claim alleges that Google itself believes “increased competition between [its ad exchange] AdX and publishers using header bidding would increase publisher revenues by 30% to 40%”.

Below, Press Gazette digests what the two lawsuits do and what they mean for publishers.

The UK Google ad tech lawsuit

Filed in November, the UK lawsuit is an opt-out class action claim seeking to recover as much as £13.6bn from the tech giant.

The claim, which is being brought by former Ofcom director Claudio Pollock and argued by law firms Humphries Kerstetter and Geradin Partners, alleges Google has breached competition law by abusing its dominant position in the online advertising marketplace.

The full details of the claim are not yet public but will be published on the Competition Appeal Tribunal website at some point later this year.

However, the claimants do note on their website that their case is strengthened by a €220m fine levied by the French Competition Authority against Google already.

In that case, the French authority found Google had depressed publishers’ revenue by, the site says, depriving “publishers of the ability to benefit from undistorted competition between ad exchanges” and diverting advertising business “from rival ad exchanges charging potentially lower commissions”.

Humphries Kerstetter partner Toby Starr told Press Gazette the claim in the UK was not a follow-on, however, and did not rely on the French authority’s finding.

“But it is helpful background to the claim that we bring and the claim we bring does make similar allegations,” he said, adding that the French competition authority is “recognised and respected”.

“We’re confident that we will make the same case good,” he said.

Starr said at some point “probably towards the end of this year” there will be a certification hearing that decides whether the claim can proceed.

“After that, there will be a process which is more familiar to most litigation lawyers: going through exchanges of documents, exchanges of witness statements and expert reports. And then a trial and those steps are expected to take another two to three years after the certification hearing.”

Resolution could come sooner, however, should Google settle the claim.

The claim is funded, so publishers do not need to pay anything toward the lawsuit, whether it succeeds or not. And because the claim is opt-out, affected publishers are automatically considered to be involved in the claim.

Should the Competition Appeal Tribunal give the suit permission to proceed, the claimants say “we will let you know about next steps and when you will need to let us know about your business so we can assess what losses you may have suffered”. But for now, publishers do not need to do anything.

The US Department of Justice ad tech lawsuit against Google

The details of the Department of Justice’s claim against Google are, conversely, public and laid out in a 150-page filing published in January.

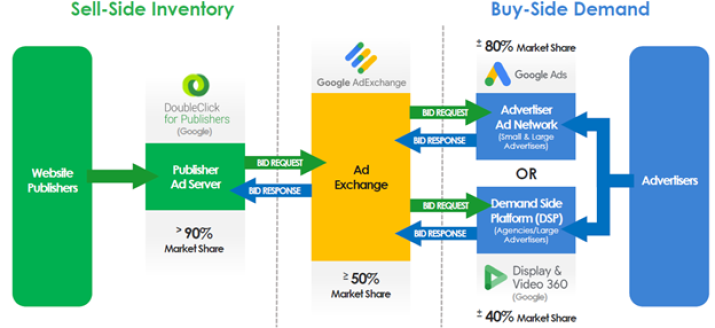

The DoJ alleges Google embarked on a deliberate and sustained campaign to establish itself in each part of the advertising technology market: providing technology to both advertisers and publishers and by running the ad exchange that matches buyers with sellers.

According to the US government department: “Google has thwarted meaningful competition and deterred innovation in the digital advertising industry, taken supra-competitive profits for itself and prevented the free market from functioning fairly to support the interests of the advertisers and publishers who make today’s powerful internet possible.”

The lawsuit presents a timeline of Google’s monopoly beginning with the launch, in the early 2000s, of both a tech tool that helped advertisers buy space on third-party websites and a publisher ad server that let publishers manage ad sales.

When the latter proved unsuccessful commercially, the DoJ says Google bought “the market-leading publisher ad server”, now known as Doubleclick for Publishers, or DFP. It also bought AdX, an ad exchange that mediated advertising space auctions.

The DoJ suit says that thereafter Google used its dominant position to both raise prices and entrench its position. For example, it says, Google forced publishers to use AdX and DFP if they wanted access to the company’s advertising demand, and the company allegedly “manipulated its publisher ad server to give the Google-owned AdX (and only AdX) the opportunity to buy publisher inventory before it was offered to any other ad exchange”.

Perhaps most dramatically, the DoJ alleges that Google actively conspired to undermine header bidding, a practice whereby publishers would add code to their websites ensuring non-Google advertising exchanges could bid for inventory before Google preferentially steered bids into its own exchange.

To prevent the spread of header bidding, the DoJ argues, Google launched “Open Bidding” - a tool that the US government says was presented as an analog of header bidding but actually got Google “a guaranteed seat in every auction, regardless of whether Google’s ad exchange offers the best match between advertisers and publishers”.

Google denies the claims in the suit, saying it "attempts to pick winners and losers in the highly competitive advertising technology sector" and that it "largely duplicates an unfounded lawsuit by the Texas Attorney General, much of which was recently dismissed by a federal court. DoJ is doubling down on a flawed argument that would slow innovation, raise advertising fees, and make it harder for thousands of small businesses and publishers to grow."

Unlike the ad tech claim being brought in the UK, the DoJ claim does not seek damages for publishers in its action – instead asking the United States District Court for the Eastern District of Virginia to give damages to the US government and eight US states.

But the impact could nonetheless be significant for publishers. The filing also asks the court to order Google’s divestiture from, “at minimum, the Google Ad Manager suite, including both Google’s publisher ad server, DFP, and Google’s ad exchange, AdX”.

In terms of the timeline, another DoJ lawsuit against Google, focusing on its dominance in search, was filed in October 2020 and is expected to go to trial in September of this year: from there, the presiding judge estimated the trial would last five and a half weeks or so. If a similar timeline applied for the new DoJ suit it might be 2024 before a trial begins.

As to the trial itself, experts are divided over whether the case is as clear-cut as the DoJ puts it.

Former Federal Trade Commission deputy director Daniel Francis told Politico that, while the lawsuit touched on "traditional concerns like acquisitions and inducing exclusivity... it also includes some allegations, like self-preferencing, that — at least on traditional views — don’t seem to violate existing law.”

"To a generally conservative and skeptical judiciary," he said, "that’s going to be a hard sell."

But other law experts with whom Politico spoke thought it sat comfortably under existing antitrust law. Bill Kovavic, a former FTC chair, said: "The case has a coherent story, and it’s zeroing on missed opportunities from the past," when the US government declined to intervene in Google's acquisition of Doubleclick.

And Florian Ederer, an economics professor at Yale specialising in antitrust policy, told the site that the case will not necessarily "be easy to win. It’s big, it’s ambitious, but it’s not a Hail Mary."

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog