Press Gazette has listed the biggest newsletter-based publishers in the world and spoken to several about how to build an email-based news business.

This year, less than six years after it was founded, Virginia-based publisher Axios was sold to US cable giant Cox Enterprises for $525m (£435m), while B2B specialist Industry Dive was acquired by Informa for $389m (£323m). Both companies are set to make at least $100m revenue in 2022 and have a focus on newsletters.

“Five years ago, people thought this was a ‘mom and pop’ type business,” says Tim Huelskamp, a former venture capitalist and co-founder of 1440, a daily newsletter company with a staff of nine . “Now you’re starting to see pretty big exits like Industry Dive.”

While B2B players such as Industry Dive and Future-owned SmartBrief built up their newsletter-led publishing businesses over a decade ago, more publishing startups are now jumping on newsletters as a way to reach targeted audiences through relatively low overheads. Many of Axios’ local news sites in the US employ just a handful of journalists in a city.

"What's different is the way in which disruptors, in particular, have seized upon email because it doesn't require you to have all that expensive keeping your website up to date. It's a much lower cost model to produce two or three emails and I think that really opens up lots of new opportunities, not for mainstream brands, but for alternative brands or even individuals as we've seen with the Substack and Revue phenomenon," says Nic Newman of the Reuters Institute for the Study of Journalism.

What makes the newsletter format so valuable?

In an industry that has seen advertising revenues swallowed up by tech platforms and traffic at the mercy of social media algorithms, owning the audience relationship is valuable.

"With email there's no platform risk," says Huelskamp. 1440's newsletter reaches 2m subscribers directly through its email of "impartial" news and claims a 55% open rate.

Huelskamp adds: "[Email] is the original killer app."

Use of email for news is particularly popular among older, more wealthy readers. According to the 2022 Digital News Report an average of 17% of readers across 42 markets used newsletters for news each week.

Newsletter-first publishing makes talking to niches financially worthwhile

Targeting reader niches is where newsletter-first publishers come into their own. US media company The Skimm publishes The Daily Skimm newsletter whose 7.5 million readership are largely millennial women. Recent Hubspot acquisition The Hustle reaches some 2.5 million (mostly) men in business and technology.

While a few startups such as 1440 say they have managed to generate "an eight-figure revenue" through a generalist product, most newsletters focus on smaller demographics who can be sold premium subscriptions for specialist information or who make up verticals valuable to advertisers.

Niche does not however have to mean small. Both Axios and Industry Dive built multi-hundred-million dollar businesses out of dozens of specialist newsletters.

The Skimm meanwhile has grown through adding podcasts, a mobile app, and online courses to its four newsletters.

"What you'll see is a lot of these businesses that have started out as newsletter-first or newsletter-only will then push into other areas. So they'll start to have website presences and other channels that they'll look at as part of the growth story," says Newman. "Once you've got that loyalty and that little community, you can build additional models on top of it and everything can kind of start to scale."

6AM City: $1m in revenue on $250,000 costs in each market

For local news-focused newsletter publishers, expanding horizontally is a natural option to scale.

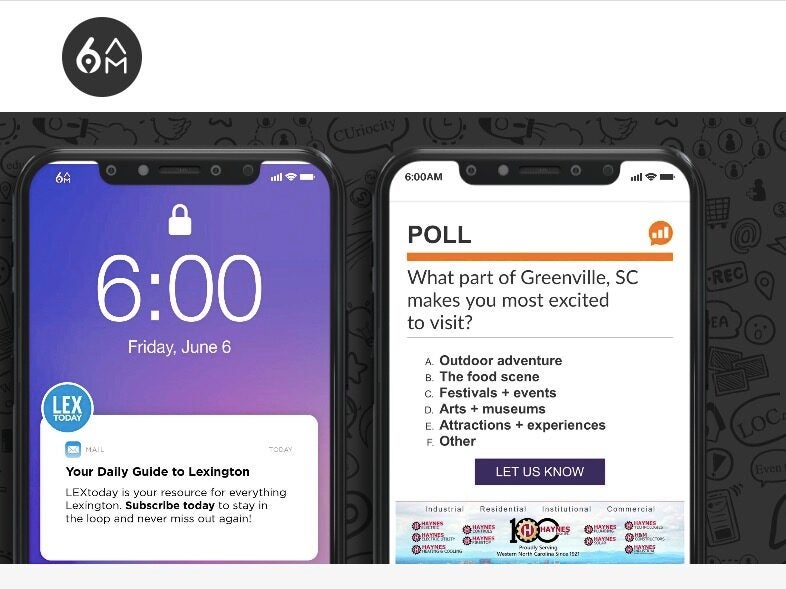

Fast-growing startup 6AM City is one example.

The newsletter-first publisher, which launched with a single newsletter in Greenville, South Carolina in 2016, currently covers 25 cities. The company added 18 new markets and almost tripled its subscriber base to over one million people in just six months.

The company, which has a policy against covering local politics or crime, makes around 85% of its revenue through ad sales, the overwhelming majority of which is local.

"It's important for us to maintain a balance of local, regional and national advertising for the sustainability of the product and for market acceptance. People locally really want to see what resonates with them. They want to see their local stores and brands elevated over national products," says co-founder and chief operating officer Ryan Heafy.

Educating local advertisers on buying placements in newsletters has been a challenge, says Heafy, because most people are used to buying TV, billboards and print radio. The company’s avoidance of crime and politics however, he says has appealed to a lot of buyers.

"A lot of folks are coming to us because they don't want to advertise with TV stations anymore, because they're between a homicide, a sexual assault and a car accident."

Last year 6AM City made $3.5m in revenue which was lower than hoped as a result of the pandemic, but it expects to hit just under $10m this year with profitability coming in early 2023.

Heafy says its revenue model will allow the company to easily expand its newsletters into dozens more small and mid-sized markets.

"There's probably about 75 markets in the United States that we could go into and easily operate with our unit economics," says Heafy. On ad sales alone, he says that the company can make a million dollars in annual revenue in each city within three years. Operating costs average around $250,000 per market. The company fixes its costs per city at around the equivalent of four full-time employees.

While the company is exploring additional ways to increase the margins on its newsletters such as through selling digital classifieds, an e-commerce store and a membership programme, Heafy says that newsletters will remain the core of the business.

"It was newsletters from day one. We didn't even have a website until almost 18 months into the company,” he says. "What we'll probably do is evolve with technology - building strong user profiles and data behind things that help inform our content, decisions and our advertising placements and being positioned for the future as things continue to evolve."

While the company is looking to explore video and other animated content that can bring in subscribers, it's not tempted to throw its resources at the video-based social networks that are popular right now.

Email remains unpopular with younger news consumers - just 3% of 18–24s in the US use email as a main news source compared with 41% who say social media. 6AM City however has even dropped its Twitter presence entirely in favour of Linkedin where it says it can build better connections with business leaders in its markets.

"The conversion with email is pretty significant," says Heafy. "Email is not going to go anywhere and we feel very safe in that space for the foreseeable future."

Press Gazette is hosting the Future of Media Technology Conference. For more information, visit NSMG.live

Picture: taken from the 6AM City website homepage

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog