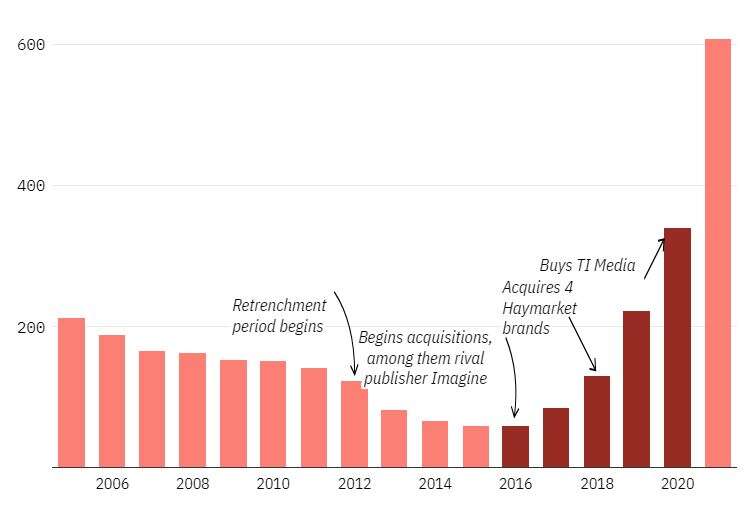

Pre-tax profits at specialist publisher Future have once again ballooned, this time more than doubling to £107.8m in its full-year results for 2020/2021.

Only five years ago, though, the company was reporting losses of £30m. We’ve taken a look back over the ways its fortunes have changed since the 2007-08 financial crisis to see how Future went from growing, to shrinking, to growing again.

It’s a company that shows investors are betting on news media companies in a way that hasn’t been seen since the high-water mark of print profitability in the mid 2000s. Future’s market capitalisation has doubled over the last year to more than £4bn.

2007-08: Digital growth begins

In 2007 Future’s online advertising revenues rose by 50% to £6.9m, making up 12% of the group’s whole advertising revenue. It marked a trend: by the time of its July 2008 earnings release it had seen “a 39% increase in online advertising revenue more than offset a 2% reduction in print advertising revenue”.

Future’s then-chief executive Stevie Spring prophesied in November 2007 that the company would perform well in a downturn, arguing that because Future targets specialist hobbyists rather than general readers, its customers’ demand for tailored content could endure through financial pressure.

2009-2011: Stevie Spring resigns

Spring's assessment doesn't seem to have immediately borne out, though: by November 2009, weakness in Future's US operation had seen company-wide pre-tax profits fall 61%, The Guardian reported.

May 2011 brought news of a further 45% drop in Future's pre-tax profits - but also that for the first time its digital operation had made a profit.

The Guardian reported in October that year that CEO Spring and finance director John Bowman "have fallen on their swords to help Future cut costs", saving an estimated £1m a year with their resignations.

2012: Retrenchment as gaming mags close

The company closed six gaming magazines between September and December. Future’s head of entertainment told Press Gazette in November that year that the closures arose “as Future continues to focus on its strategy on accelerating digital growth across its international digitally-focussed brand business”, with staff to be redeployed to other publications within its stable.

The company claimed the same year that it was “close to returning to profitability” in the US and that visits to its websites had risen more than 50%. It had made sales of over £5m through Apple Newsstand in the year since the service launched, and by November group digital revenues were up 30% to £20.6m.

2013: Huge cutbacks in the UK

Once again, whereas print revenue dropped 9% from £40.8m to £37m, digital turnover continued to increase, this time from £9.2m to £12.4m. The company reported in May 2013 that in the first half of the year its websites had attracted 51m unique users – as many as they had received for the whole of 2012, in half the time.

The group had announced in April that it would be reviewing its structures “to identify further efficiencies which will benefit the group”. That introspection bore a bitter fruit in September that year, when Future announced it was to make 55 redundancies in the UK.

The company’s chief executive at the time, Mark Wood, said in a statement that “approaching 60% of our advertising now comes from digital markets. As Future becomes an increasingly digital business, we need to reduce costs and staff levels devoted to print products and downsize back office and support activities.”

Two months later, the editor, deputy editor and technical editor of a Future magazine named Linux Voice left the title, citing “top-down meddling” from the company as the reason. Contrary to the prior year’s claims from Future that its US operations were close to profitability, Linux Voice’s outgoing deputy editor told Press Gazette that it “is losing lots of money”, complaining that even though his publication's circulation was growing, Future “insisted that all magazines had to cut 16 pages regardless of how well they were doing.”

2014: Heavy job cuts and losses

Unfortunately for Future, the Linux Voice editors appear to have been correct in their assessment of the company’s finances. In May 2014 the business reported a £30.6m pre-tax loss for the six months to March, and this time the cuts were not directed at page numbers: more than 200 jobs were axed across the UK and US. Worse was to come: in November the group revealed revenues had dropped from £82.6m in 2013 to £66m, and that it had reduced staff numbers from 980 to 577.

2016 and onwards: Zillah begins

Following her appointment in April 2014, Future’s new chief executive Zillah Byng-Thorne embarked on a huge programme of expansion.

In October 2016 the group bought out rival Imagine Publishing for £15.9m, acquiring 30 titles. In January the next year, it saved a clutch of rock magazines from the collapsed publisher Team Rock for £800k. It acquired Centaur’s home interest division for £32m in July 2017, with Byng-Thorne announcing the new titles “will significantly add to our scale and momentum, while further diversifying our revenue streams”.

Already fortunes appeared to have reversed: in May 2017, Future reported a 373% year-on-year increase in its operating profit to £3.8m.

Acquisitions continued through 2018 and 2019, with Future dropping tens of millions of pounds at a time on specialist magazines covering realms as diverse as music, football, and practical caravanning.

By the end of 2020, Future had gone from owning fewer than 100 titles to more than 220. But the growth brought two tangles with the Competition and Markets Authority: first in 2018, when Future dropped a proposed purchase of gadget magazine Stuff following talks with the watchdog. Then, in March 2020, the CMA told the business it could not proceed with its £140m buyout of TI Media without selling off three “closely competing” titles.

Future announced in November 2019 that revenues had grown 70% from £130.1m to £221.5m, and that pre-tax profit had tripled to £12.7m in the year ending 30 September 2019.

2020: The pandemic effect

The publisher reacted quickly to March 2020’s global shutdowns, temporarily cutting freelance budgets and closing six magazines – including the nearly 20-year-old Official Xbox Magazine.

Perhaps giving belated credence to former chief executive Stevie Spring’s 2007 prediction, the business weathered the worst of the pandemic well. Future was able to pay back money secured from the government’s furlough scheme in July 2020, and Byng-Thorne would later tell Press Gazette in a May 2021 interview that the group had given all its staff £1,000 to help with the cost of home working.

Indeed, the adverse global situation has so far only seen Future's position grow: in October 2020 it announced its plan to make 150 new hires, and the next month that it had tripled pre-tax profits for the second year in a row. The latter announcement was coupled with the news that Future planned to spend £594m on GoCo Group, owner of price comparison site Go Compare shortly after buying entertainment publisher Cinema Blend.

In 2021 it has also bought Australia-based financial comparison website Mozo, Marie Claire US, and Dennis, publisher of The Week and its family of titles.

The company has put its 2021 success down to the diversity of its revenue streams - with Byng-Thorne describing the combination of advertising, recurring reader revenues and affiliate/ecommerce as her "holy trinity" - as it reported pre-tax profits of £107.8m. Staff are set to share in the success with the maximum amount being paid out in the all-staff annual profit pool bonus scheme on top of a new shares scheme. Future's sights are now set on North America, where it sees huge potential for growth.

Picture: Future

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog