Print subscriptions are said to be growing at Conde Nast despite widespread cutbacks over the last year and a shift in focus towards digital output.

Last year Conde Nast merged the global editorial teams at several of its international magazine brands including GQ, Wired, Vogue and Conde Nast Traveller under a new digital-first strategy designed to produce less duplication of content.

The changes also involved a new focus on digital income streams over print advertising revenue, with about 25% of the company’s revenues over the next four years invested into prioritising the expansion of video and digital content to boost online subscriptions and e-commerce.

GQ deputy global editorial director Adam Baidawi told Press Gazette that despite the digital-first switch print magazines had not been significantly affected. GQ, he said, was “as good as it’s ever been” as he reported a 77% year-on-year increase in its newsstand sales for its March 2022 edition.

He added that there was a “romanticised” vision of print-centred magazines that was becoming “less and less sensical” in the age of the internet.

Baidawi, who also serves as GQ UK’s head of editorial content, highlighted that across its titles, Conde Nast had seen more than 14 billion annual video views in 2021, up 18% from 2020, as well as a 38% overall increase in digital ad revenues.

Last month, chief executive Roger Lynch told the New York Times the digital-first changes meant Conde Nast was “no longer a magazine company,” saying it has “70 million people who read our magazines, but we have 300 something million that interact with our websites every month and 450 million that interact with us on social media”.

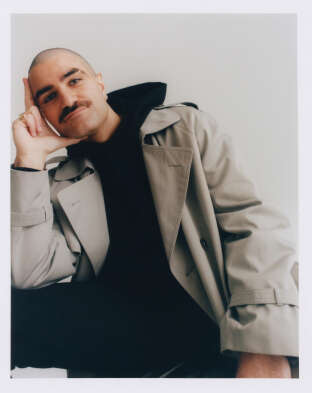

Adam Baidawi, Conde Nast / GQ

Picture: Conde Nast

Baidawi told Press Gazette: “Conde Nast, as much as anything else, is in the business of shaping and reflecting culture. Culture moves, and we have to move with it.

“If you take GQ, for instance, I don’t think we were in a position to shape and reflect culture with 21 siloed businesses around the world centred around print products.”

He added: “I think our previous model worked really well for a very, very long time. I also think it was very romanticised and that over years it became less and less sensical in a globalised world.”

Baidawi went on: “I grew up with Conde Nast magazines. I’m the sucker who paid 22 Australian dollars to buy British GQ in Melbourne, Australia at the newsstand… I still think we’re making comfortably the best print magazines on Earth.”

He said print subscriptions are “actually up” across the Conde Nast portfolio this year but that “print for us is just one focus. It’s one product in a portfolio that we’re really proud of”.

Jenna Rak, Europe director of audience development, social media and analytics at Vogue, explained the shift in strategy further.

She told Press Gazette: “Culturally, we’ve also seen a shift in readers’ desire towards good content regardless of origin.

“The structural changes we’re making reflect these behavioural shifts and we’re building teams to create content for both global and local readers.

“We knew this was never going to be an overnight success. The reorganisation of teams takes time and we need to retell the story of what Vogue is to both readers and advertisers. Traffic is growing in most markets and the total global audience for Conde Nast is up 28% versus 2019.

Baidawi added: “This wasn’t a little band-aid we had to rip off. This was a total overhaul of the way we work,” explaining that 40% of Conde Nast’s global web traffic before the changes was crossing borders to read content.

“We were doubling and tripling up on a lot of the same work a lot of the time… We were all racing out to cover the same fashion shows, the same film releases, the same album drops, we were repeating each other’s work,” he went on.

“There was a 12-week window in 2020 in which Rami Malek had three GQ covers in three different editions, with three different photoshoots and three different interviews. None of the three editors-in-chief, one of them was me, had any idea that it was happening. It was a supreme waste of time and money, our time and Rami’s time.”

Since the changes, GQ has seen an 8% year-on-year increase in digital readership according to Baidawi.

Last month GQ announced it was planning on investing more in Web3, beginning with launching its own Discord community.

The move came at a trying time for the fledgling internet movement, as bitcoin hit its lowest price since December 2020 amid a wider crash in cryptocurrency and NFT prices.

Baidawi was not worried, however, telling Press Gazette the brand could be “curious, engaged and participatory” without “being blind to the fact that platforms are still emerging”. There are still early teething problems to work out, he added.

In 2021 Conde Nast posted a profit for the first time in years with $2bn of revenue.

Press Gazette is hosting the Future of Media Technology Conference. For more information, visit NSMG.live

Picture: Conde Nast

Email pged@pressgazette.co.uk to point out mistakes, provide story tips or send in a letter for publication on our "Letters Page" blog